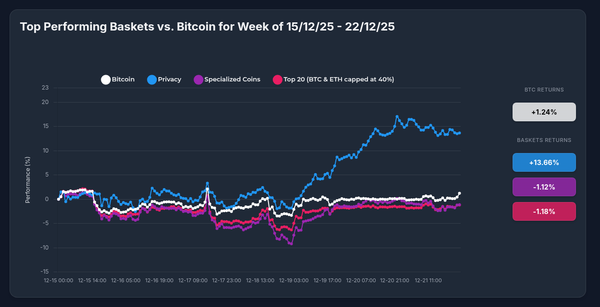

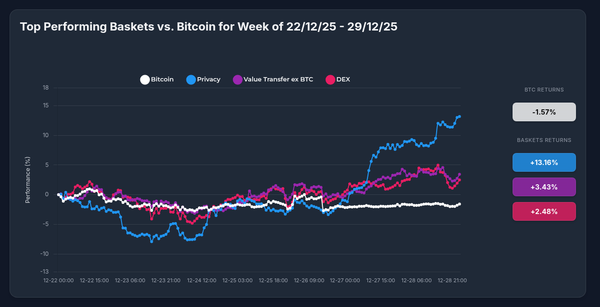

Privacy Pays: How OPPV Strategy Beat Bitcoin by 14.7% in One Week

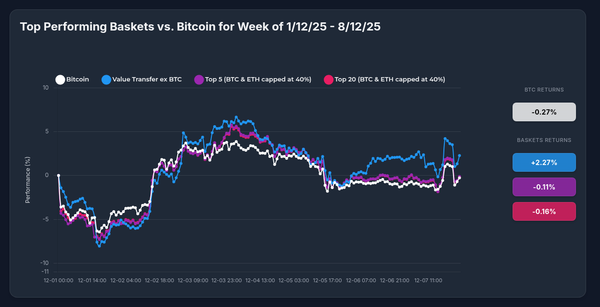

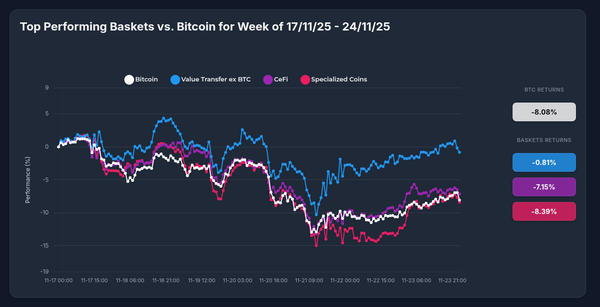

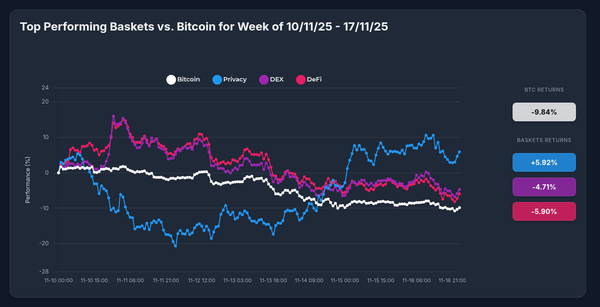

TL;DR While Bitcoin struggled with -1.57% returns (Dec 22-29), Optima's Privacy Strategy delivered +13.16%, Value Transfer gained +3.43%, and DEX basket returned +2.48%. The standout performer: Canton Network's 44% surge powered the Privacy basket while index diversification cushioned individual token volatility.