Bank Credit Expansion Powers Crypto in January 2026

Why is institutional crypto adoption accelerating while Bitcoin ETFs experience volatile flows? The answer lies not in regulatory headlines, but in the monetary plumbing of the global economy.

TL;DR: US bank credit growth accelerated to 4.2% annually in January 2026, while China announced major stimulus measures on January 20. This credit expansion is creating the liquidity foundation for crypto's institutional adoption wave, even as regulatory uncertainty around the CLARITY Act temporarily disrupts ETF flows.

The Credit Signal: US Banks Accelerate Lending

US bank lending data for January 2026 reveals a crucial trend often missed in crypto market commentary: credit creation is accelerating across all major categories.

- Total lending: 4.2% annual growth (up from 3.7% in December)

- Business loans: 5% year-over-year (up from 3.9%)

- Consumer loans: 5.1% annually (up from 4%)

- Real estate loans: 2.4% growth (up from 2.2%)

This matters for crypto because bank lending creates new money. When banks extend loans, they're not lending out deposits—they're creating deposits through accounting entries. This expands the money supply available for all assets, including digital ones.

Major institutions including Bank of America (8% Q4 loan growth) and JPMorgan Chase (9% Q4 growth) are reporting robust lending activity. This isn't about interest rates—it's about profit expectations driving borrowing demand.

China's Stimulus Push: Liquidity on Demand

On January 20, 2026, China announced a coordinated stimulus effort that signals continued liquidity support:

- 500 billion yuan ($71.8B) loan-guarantee facility for private sector tech upgrades

- Rate cuts: 0.25 percentage point reduction (effective January 19)

- 1 trillion yuan re-lending quota for private firms

- Extended subsidies for consumer loans, equipment upgrades, and service sectors through 2026

Vice Finance Minister Liao Min confirmed on January 20 that high deficit levels (following 2025's record 4% ratio) will continue in 2026, enlarging the "fiscal spending plate."

While December 2025 credit data showed weakness (16.27 trillion yuan in new loans, the lowest since 2018), the January policy announcements indicate Beijing is committed to reflating. The IMF raised China's 2026 GDP forecast to 4.5%, citing stimulus rollout.

The Institutional Adoption Wave

This liquidity backdrop is fueling concrete institutional moves into crypto:

- Sovereign participation: Bhutan's sovereign wealth fund holds a $459 million Ethereum position (117,000 ETH)

- Corporate strategy shift: Ripple President Monica Long predicts 50% of Fortune 500 companies will adopt formal crypto strategies by year-end

- Product integration: Stablecoins gaining traction as global settlement foundations, integrated by Visa and Stripe

- Tokenization growth: Solana's real-world asset tokenization grew over 400% year-over-year

The institutional infrastructure is maturing rapidly. Banks and asset managers increasingly favor white-label solutions and purpose-built connectivity, with 61% of crypto owners planning to increase holdings.

Regulatory Headwinds: CLARITY Act Stalls

Not all news is positive. The CLARITY Act—a major US crypto market structure bill—hit significant roadblocks on January 15 when the Senate Banking Committee canceled its markup session. Coinbase withdrew support due to controversial amendments expanding SEC authority and DeFi oversight.

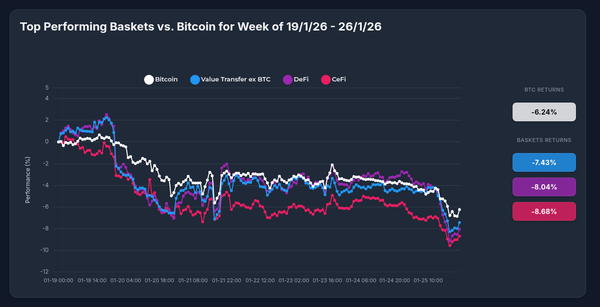

This regulatory uncertainty likely contributed to Bitcoin ETF outflows mid-month:

- January 13-15: $1.7 billion in inflows

- January 20: $479.61 million in outflows

- Key outflows: Grayscale GBTC ($160.84M), Fidelity FBTC ($152.13M), BlackRock IBIT ($56.87M)

Analysts attribute these flows to rebalancing and profit-taking rather than panic selling. Bitcoin traded in the $87,900-$91,320 range during this period, closing at $89,080 on January 21.

Europe: Cautious Stability

The eurozone presents a more neutral picture. The ECB's January 16 data showed base money declining €19.7 billion to €4,254.3 billion. Bank lending conditions remain cautious:

- Business loan demand: Increased slightly but remains weak (geopolitical uncertainty, trade tensions)

- Housing loan demand: Increased substantially

- Credit standards: Broadly unchanged for business loans; slightly tightened for housing and consumer credit

The EU's 2026 budget totals €192.77 billion in commitments, maintaining prior spending levels. Interest rates remain anchored near 2%, with no changes expected through 2026.

What This Means for Crypto Allocations

The liquidity data presents a clear framework for understanding crypto market dynamics in early 2026:

Bullish factors:

- US credit creation accelerating across all lending categories

- China committed to stimulus despite weak December data

- Institutional adoption accelerating (sovereign funds, Fortune 500 strategies)

- Expanding tokenization infrastructure

Neutral to bearish factors:

- CLARITY Act regulatory uncertainty

- Volatile ETF flows indicating short-term positioning shifts

- Eurozone credit conditions remain cautious

- US January fiscal deficit data not yet released (typical mid-February)

The key insight: Crypto follows liquidity, not headlines. While the CLARITY Act delay creates near-term noise, the underlying credit expansion in the US and stimulus commitment in China provide the monetary foundation for continued institutional adoption.

This isn't about predicting Bitcoin's next move—it's about recognizing that when banks create more credit and governments maintain deficit spending, the liquidity eventually flows into risk assets. Crypto, as the most globally accessible digital asset class, captures a growing share of that flow.

The Bottom Line

January 2026's crypto market tells two stories. The headline story features regulatory uncertainty and volatile ETF flows. The liquidity story reveals expanding bank credit in the US, aggressive stimulus in China, and institutions building long-term crypto infrastructure.

For investors making allocation decisions, the liquidity story matters more. Banks are creating money through loan expansion. China is reflating its economy. Sovereign funds and Fortune 500 companies are building crypto strategies.

The monetary plumbing is working. Everything else is noise.

Data as of January 21, 2026, 8:00 AM GMT. Bitcoin: $89,080 | Ethereum: $2,966