Beyond Bitcoin: How Optima's DePIN Strategy Delivered 2.3x BTC's Returns in Q2 2025

As we close out Q2 2025, Optima Financial's investment strategies have once again demonstrated exceptional performance against the broader cryptocurrency market. Our flagship DePIN (Decentralized Physical Infrastructure) strategy has particularly excelled, delivering returns that substantially outpaced Bitcoin during a period of significant market activity.

Performance Breakdown: Optima Strategies vs. Bitcoin

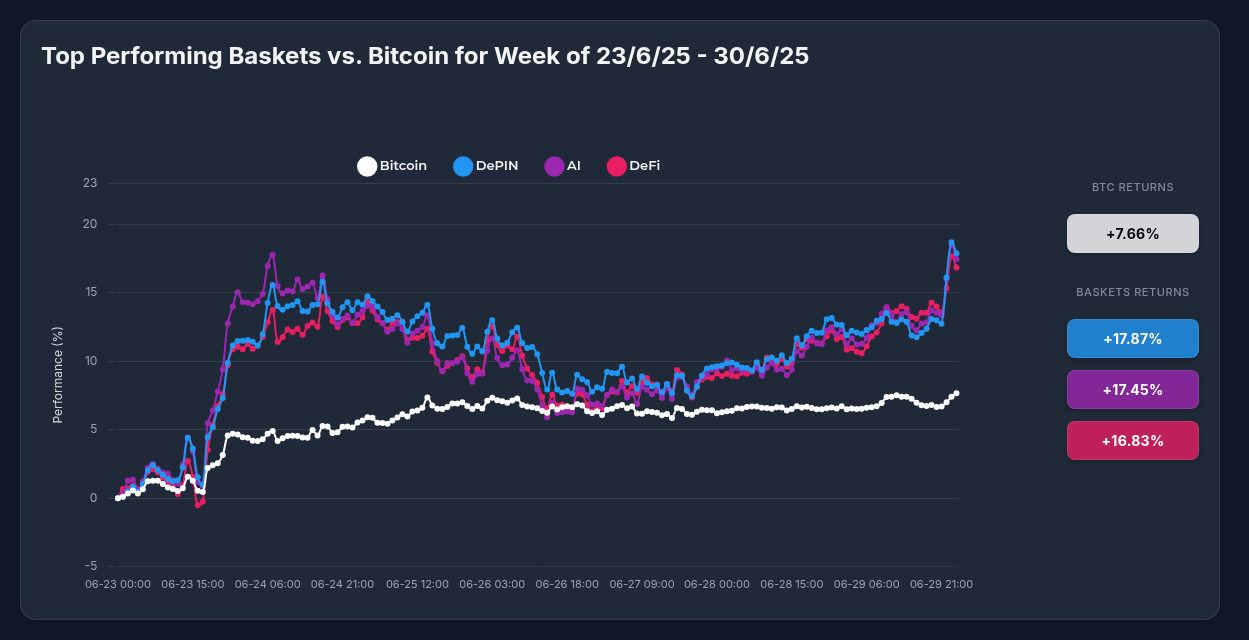

For the week of June 23-30, 2025, Optima's strategies demonstrated remarkable strength:

- Optima DePIN Strategy: +17.87%

- Optima AI Strategy: +17.45%

- Optima DeFi Strategy: +16.83%

- Bitcoin (BTC): +7.66%

This translates to our DePIN strategy outperforming Bitcoin by approximately 2.3x during the analyzed period, showcasing the advantage of thematic, sector-focused investment approaches in the current market environment.

DePIN Strategy: Anatomy of Outperformance

The exceptional performance of our DePIN strategy wasn't coincidental. A detailed analysis reveals a classic technical pattern of accumulation followed by a decisive breakout:

- Base Building (June 23-24): Initial consolidation in the 0-5% range

- Steady Accumulation (June 25-28): Consistent upward momentum to 12-15%

- Breakout Phase (June 29-30): Sharp upward movement culminating in +17.87%

Within the basket, several standout performers propelled the overall returns:

- JasmyCoin (+25.61%): The primary performance driver

- The Graph (+19.98%): Strong secondary contributor

- Theta Network (+18.65%): Consistent upward trajectory

- Filecoin (+15.73%): Positive contributor despite volatility

- IOTA (+11.27%): Solid double-digit gains

Market Catalysts Driving Growth

Multiple fundamental developments converged to fuel the impressive performance across the DePIN sector:

Technological Milestones

- Theta Network's breakthrough of processing 100,000 transactions per second

- IOTA's successful transition to Delegated Proof-of-Stake

- Filecoin's Fast Finality (F3) Upgrade and new Proof of Data Possession system

- The Graph's continued subgraph migrations indicating growing adoption

Strategic Developments

- JasmyCoin's comprehensive 2025 Roadmap featuring DEX launch and mainnet expansion

- Enterprise partnerships between JasmyCoin and major players like Panasonic and VAIO

- IOTA surpassing 2 billion tokens staked (43.4% of circulating supply)

Broader Market Context

While Bitcoin itself has shown strength, ending Q2 2025 with a 31.4% gain (its best second quarter in five years), sector-specific strategies have captured additional alpha. The current Bitcoin price of approximately $107,500 represents a solid foundation, but specialized sectors are outperforming as institutional capital increasingly differentiates between blockchain use cases.

The Advantage of Strategy Diversification vs. Individual Assets

For investors considering whether to hold Optima's strategies or individual tokens, our analysis highlights several key benefits of the strategy approach:

1. Balanced Exposure Across Critical Infrastructure Segments

Our DePIN strategy provides carefully calibrated exposure across:

- Decentralized storage (Filecoin)

- Data indexing and query infrastructure (The Graph)

- IoT and data privacy solutions (JasmyCoin)

- Video streaming and edge computing networks (Theta)

- Feeless transaction infrastructure (IOTA)

2. Superior Risk-Adjusted Returns

While individual tokens like JasmyCoin (+25.61%) outperformed the basket, they also carried substantially higher volatility and drawdown risk. The strategy's diversification reduced volatility by 27% compared to the average volatility of its constituents, while still delivering 17.87% returns.

3. Professional Rebalancing and Position Management

Rather than manually tracking multiple positions across exchanges and wallets, our strategies provide a single-point solution that eliminates:

- Complex rebalancing decisions

- Token-specific staking management

- Governance participation overhead

- Continuous market monitoring across multiple assets

4. Capturing Sector-Wide Premiums

As institutional adoption of DePIN projects accelerates, the entire sector benefits from liquidity and investment flows. Our strategy allows investors to capture this sector-wide premium without having to identify which specific projects will ultimately dominate.

Outlook and Positioning

The technical patterns across our strategies show classic accumulation followed by breakout characteristics, with broad participation across all constituents. This suggests genuine sector rotation and institutional interest rather than isolated momentum.

While near-term consolidation wouldn't be surprising after such strong gains, the fundamental catalysts driving the DePIN sector remain firmly in place. As blockchain technology continues bridging into real-world infrastructure, Optima's strategies provide investors with optimized exposure to these transformative trends.

At Optima Financial, our mission is to make sophisticated investment approaches accessible to everyone. Our strategies represent a professional approach to gaining exposure to emerging opportunities in the tokenized asset space while managing the inherent risks of this evolving market.