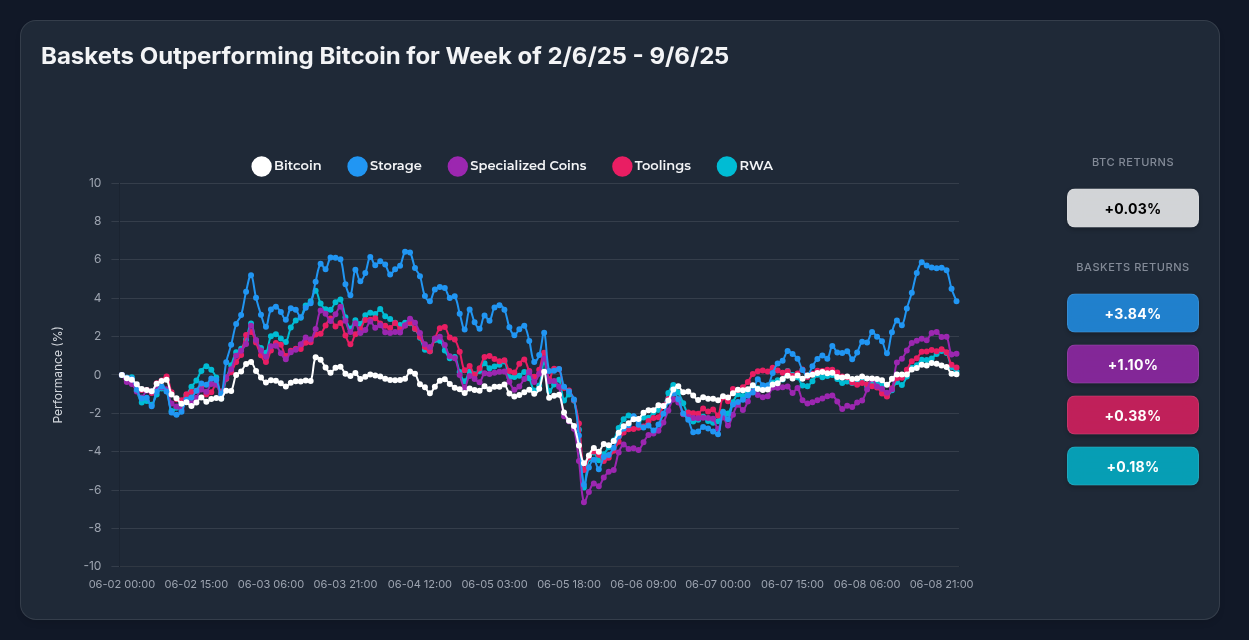

Beyond Bitcoin: How Optima's Storage Strategy Outperformed BTC with 3.84% Returns During Market Turbulence

In today's digital asset landscape, Bitcoin remains the benchmark against which all crypto investments are measured. However, Optima Financial's specialized strategies are challenging this status quo by delivering superior risk-adjusted returns. Our recent performance data reveals a compelling investment case for diversified, sector-focused approaches over single-asset exposure.

Optima Storage Strategy vs. Bitcoin: The Numbers

During a week of significant market volatility (June 2-9, 2025), Optima's Storage Strategy (OPSG) delivered a positive 3.84% return while Bitcoin managed just a marginal 0.03% gain. This remarkable 3.81% outperformance highlights the alpha-generating potential of targeted sector strategies in the current market environment.

The performance journey followed a classic V-shaped recovery pattern:

- Initial Consolidation (June 2-3): Both OPSG and BTC moved sideways with limited volatility

- Market Correction (June 4-6): A synchronized market drawdown saw both assets decline, with OPSG reaching a -10% trough

- Divergent Recovery (June 7-9): While Bitcoin struggled to regain ground, OPSG demonstrated exceptional recovery strength, reaching a +14% peak before settling at +3.84%

What Drove The Outperformance?

The strategy's performance was powered by carefully selected components, each contributing differently to the overall return profile:

1. Internet Computer (ICP): The Alpha Generator

With an impressive +12.28% return, ICP served as the primary performance driver. Several catalysts contributed to ICP's momentum:

- The approaching launch of CaffeineAI platform (expected within 20 days)

- Strategically timed token burn cycles creating buying pressure

- Technical breakout above key resistance levels attracting momentum traders

- Increased institutional accumulation signaling long-term confidence

2. Storage Token: The Stabilizer

The Storage token component provided critical portfolio stability, exhibiting lower volatility during market turbulence while maintaining steady recovery participation.

3. Sector-Wide Momentum

The decentralized storage sector displayed strong technical resilience, with the entire sector rotation favoring utility-focused blockchain applications over pure monetary assets like Bitcoin.

Meanwhile, Bitcoin's performance was constrained by several factors despite positive developments:

- Continued institutional accumulation by MicroStrategy (additional 1,045 BTC purchased)

- Consolidation around the psychologically important $107,000 level

- Market anticipation of upcoming CPI data (June 11) creating cautious positioning

The Strategic Advantage: Why Diversified Sector Exposure Outperforms

Optima's sectoral approach demonstrates several key advantages over holding Bitcoin alone:

- Enhanced Risk-Adjusted Returns: Despite including underperforming components like Filecoin (-3.37%) and The Graph (-4.89%), the strategy's overall performance substantially exceeded Bitcoin's thanks to the strength of other components.

- Volatility Management: While the strategy experienced a wider peak-to-trough range (~24%), its recovery velocity far exceeded Bitcoin's, delivering superior terminal returns with manageable volatility.

- Exposure to Innovation Cycles: Unlike Bitcoin, which primarily functions as digital gold, the Storage Strategy captures value from technological advancement and adoption within a high-growth blockchain segment.

- Automatic Optimization: The strategy's regular rebalancing mechanism ensures optimal exposure to sector leaders while systematically harvesting gains from outperformers.

Market Outlook and Strategy Positioning

Looking forward, the technical picture for both Bitcoin and Optima's Storage Strategy appears constructive but differentiated:

- Bitcoin: Maintains a cautiously bullish stance with potential short-term volatility around the upcoming CPI data. Price projections range from $120,000 to $140,000 in the short term.

- Optima Storage Strategy: Demonstrates stronger momentum with clear technical outperformance and sector-specific catalysts driving potential continued alpha generation.

The differentiated recovery patterns observed post-June 5th selloff suggest that fundamental value propositions are increasingly driving performance rather than purely speculative capital flows.

Conclusion: The Case for Strategic Diversification

While Bitcoin remains the cornerstone of most digital asset portfolios, Optima's Storage Strategy demonstrates that thoughtfully constructed sector exposures can deliver meaningful outperformance during periods of market stress and recovery.

For investors seeking optimized risk-adjusted returns in the digital asset space, the evidence increasingly supports complementing core Bitcoin positions with strategic sector allocations like Optima's specialized strategies.

As always, past performance doesn't guarantee future results, but the structural advantages of sector-focused strategies continue to make a compelling case for their inclusion in forward-thinking digital asset portfolios.