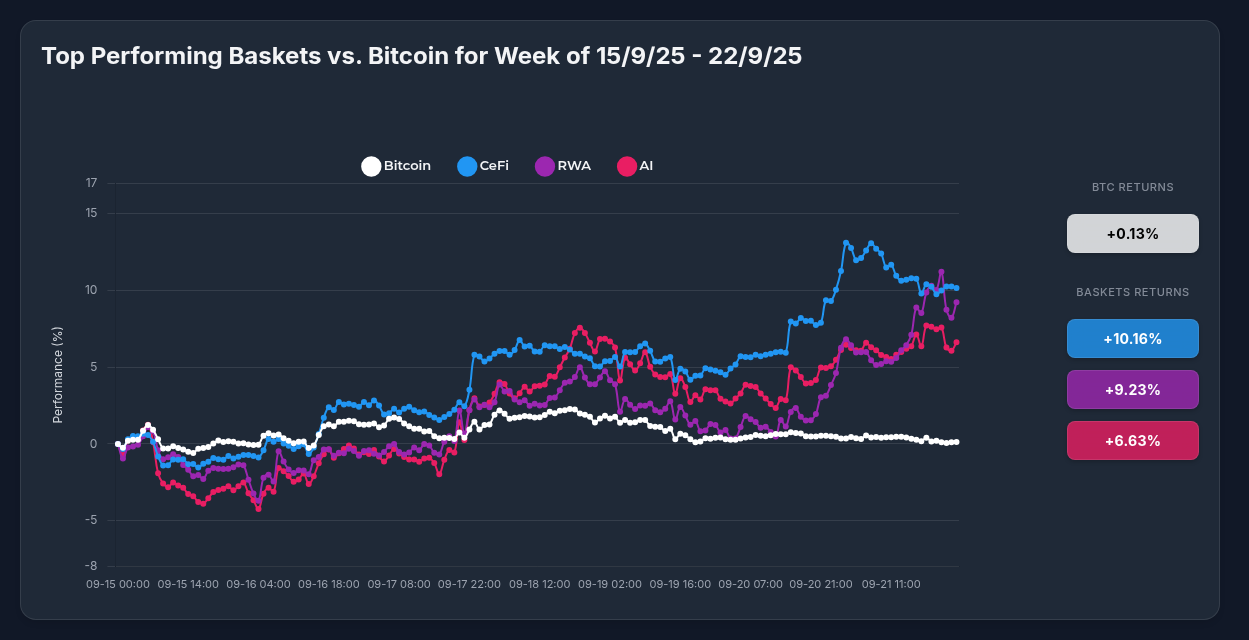

CeFi Strategy Outshines Bitcoin with 10.16% Surge: Optima's Diversified Approach Delivers Superior Returns

In a week where Bitcoin struggled to maintain momentum, Optima's CeFi strategy demonstrated remarkable strength, posting an impressive 10.16% gain from September 15-22, 2025. This significant outperformance highlights the growing value of specialized, professionally managed investment strategies in the evolving digital asset landscape.

Performance Comparison: Optima vs. Bitcoin

The contrast between Optima's CeFi strategy and Bitcoin couldn't be more striking during the analyzed period:

- CeFi Strategy: +10.16%

- RWA Strategy: +9.23%

- AI Strategy: +6.63%

- Bitcoin: +0.13%

While Bitcoin essentially traded sideways with minimal movement, all three Optima strategies delivered substantial returns, with the CeFi basket leading the charge. This performance gap illuminates the value of strategic diversification and sector-specific exposure in the current market environment.

Anatomy of CeFi's Outperformance

The CeFi strategy's impressive returns were primarily driven by BNB's exceptional 13.13% rally, supported by Bitget Token's solid 5.95% gain. This strong performance occurred despite two components actually posting negative returns:

- BNB: +13.13%

- Bitget Token: +5.95%

- KuCoin: -2.22%

- Cronos: -7.91%

This divergent performance within the basket underscores a fundamental strength of Optima's approach: the ability to capture sector-wide momentum while mitigating individual token volatility.

Market Catalysts Driving Performance

CeFi Strategy Catalysts

Several key developments propelled the CeFi strategy's strong performance:

- Regulatory Progress: Improved regulatory clarity for major centralized exchanges, particularly Binance's enhanced compliance status and potential relief from U.S. oversight

- Deflationary Tokenomics: Systematic supply reduction through token burns across multiple platforms, including BNB's auto-burn mechanism and significant token burns by Bitget, KuCoin, and OKB

- Ecosystem Expansion: Strategic partnerships and infrastructure improvements enhancing utility, including Bitget's Morph Chain partnership and Cronos' Cross-Bridge Mainnet Beta Release

Bitcoin's Performance Catalysts

During the same period, Bitcoin faced mixed signals:

- Institutional Dynamics: Despite positive developments like Deutsche Bank's bullish outlook and Strive Inc.'s acquisition positioning as a Bitcoin treasury company, ETF outflows and profit-taking limited price appreciation

- Technical Pressures: A significant $1.6B liquidation event created selling pressure, offsetting the generally positive market sentiment

- Rotation to Thematic Investments: Capital appears to be rotating from Bitcoin toward specialized thematic exposures, including centralized finance platforms with strong fundamentals

Benefits of Optima's Strategy Approach vs. Individual Assets

The week's performance highlights several compelling advantages of Optima's strategy-based approach:

1. Superior Risk-Adjusted Returns

While Bitcoin showed minimal movement (+0.13%), the CeFi strategy delivered 78 times greater returns at +10.16%. This outperformance came with manageable volatility, demonstrating superior risk-adjusted returns.

2. Effective Diversification

The CeFi strategy maintained strong positive performance despite two components posting negative returns. This diversification benefit protected investors from the full impact of individual token volatility while capturing the sector's upside.

3. Sector Rotation Capture

By holding a basket of centralized finance tokens, investors benefited from the emerging trend of capital rotation from Bitcoin toward specialized thematic exposures, particularly regulated CeFi platforms.

4. Professional Management

Optima's strategic approach provides expertly curated exposure to complex digital asset sectors, eliminating the need for investors to research, select, and manage individual tokens.

Market Outlook

The technical analysis indicates a continued bullish outlook for Optima's strategies, particularly the CeFi basket. Several factors support this positive perspective:

- Strong momentum across all three Optima baskets, suggesting sustained buying interest

- Clear sector rotation from Bitcoin into specialized crypto themes

- Growing institutional adoption of centralized finance platforms with regulatory clarity

- Expanding tokenized real-world asset (RWA) market, now exceeding $30 billion with 400% growth over three years

For investors seeking exposure to digital assets, Optima's strategies offer a compelling alternative to direct Bitcoin investment, combining the growth potential of emerging crypto sectors with the risk management benefits of professional curation and diversification.

Disclaimer: Past performance is not indicative of future results. This analysis is for informational purposes only and should not be considered investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.