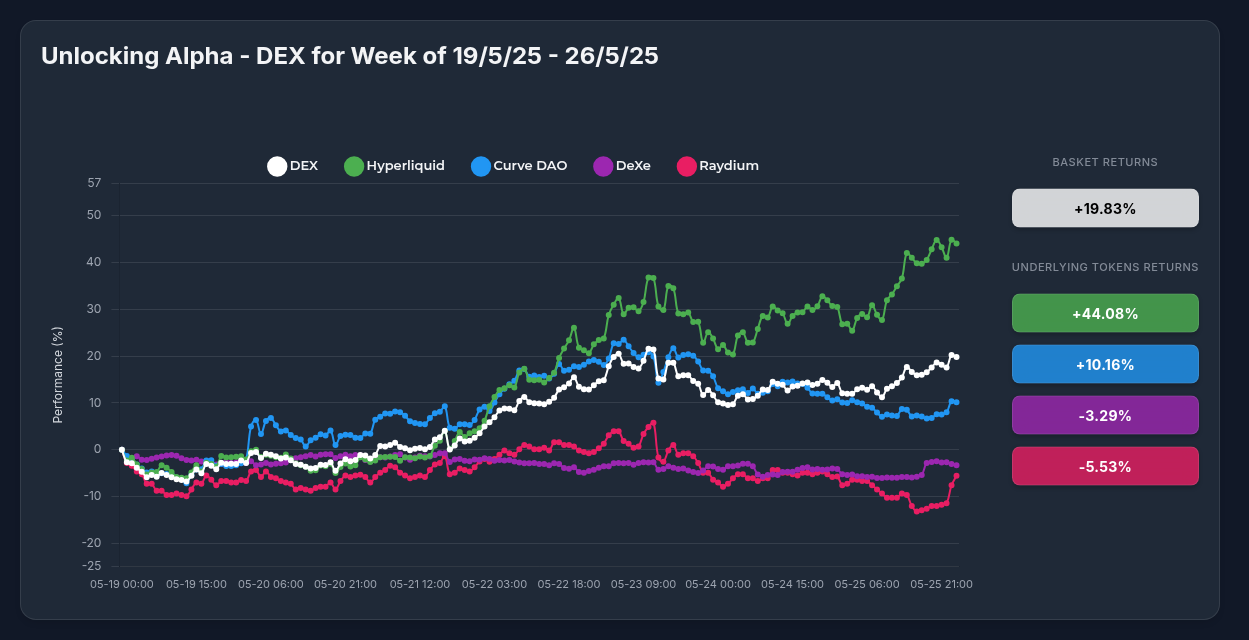

DEX Dominance: How Optima's OPDEX Strategy Surged 19.83% in One Week

In a testament to the growing strength of decentralized exchange infrastructure, Optima Financial's OPDEX strategy delivered an impressive 19.83% return over the past seven days. This performance highlights both the resilience and potential of decentralized trading platforms as crucial components of the evolving digital asset landscape.

A Week of Momentum: The OPDEX Journey

The OPDEX strategy's performance can be broken down into three distinct phases:

- Initial Consolidation (May 19-20): The week began with modest gains as the market established a foundation for growth.

- Acceleration Phase (May 21-23): Significant momentum built as institutional interest in DEX infrastructure increased.

- Explosive Growth (May 24-26): The strategy reached peak performance, cementing its strong weekly returns.

Star Performers Driving the Surge

The index's stellar performance was primarily powered by two standout constituents:

Hyperliquid (HYPE): The Powerhouse

With an extraordinary 44.08% gain, Hyperliquid emerged as the dominant force behind the index's success. The token benefited from several key developments:

- Binance U.S. listing announcement generating significant market attention

- Over $1 billion in staking activity demonstrating strong community commitment

- Growing narrative as a potential "CEX disruptor" in the trading ecosystem

Curve DAO (CRV): The Steady Climber

Contributing a solid 10.16% gain, Curve DAO showed remarkable stability while maintaining positive momentum. Its growth was supported by:

- Expanded institutional presence through ETP listings

- Strong trading volumes on major exchanges

- Renewed interest in DeFi protocols as potential beneficiaries of Ethereum ETF developments

Sector-Wide Catalysts

Beyond token-specific developments, broader market forces have created a favorable environment for DEX platforms:

- Institutional Adoption: Increased institutional interest in decentralized trading infrastructure

- DeFi Renaissance: Growing speculation about a potential "DeFi Summer" as the sector shows signs of resurgence

- Cross-Chain Integration: DEX tokens benefiting from expanded capabilities across Ethereum, Solana, and BNB Chain ecosystems

- Product Innovation: New features like Jupiter's lending protocol and Raydium's LaunchLab platform demonstrating continued evolution

Why OPDEX Outperforms Individual Holdings

The OPDEX strategy's performance demonstrates several key advantages over holding individual DEX tokens:

1. Superior Risk Management

Despite negative performance from Raydium (-5.53%) and DeXe (-3.29%), the index delivered substantial positive returns. This highlights the protective value of diversification in navigating volatile crypto markets.

2. Ecosystem-Wide Exposure

The index provides balanced exposure across multiple blockchain ecosystems and DEX functionalities, creating a comprehensive position in the future of decentralized trading.

3. Reduced Concentration Risk

While Hyperliquid's exceptional performance drove significant alpha, the index structure protects investors from overexposure to single-token risks.

4. Professional Portfolio Construction

Optima's strategic weighting methodology ensures optimal exposure to the DEX sector's growth without requiring complex individual token analysis.

Looking Forward

The OPDEX strategy's recent performance suggests strong momentum for decentralized exchange infrastructure. With continued innovation across constituent platforms and growing institutional interest, the sector appears well-positioned for sustained growth.

As the broader crypto market evolves, DEX platforms continue to demonstrate their fundamental importance to the ecosystem. By providing a professionally managed approach to this sector, Optima's OPDEX strategy offers investors an efficient way to participate in the ongoing transformation of digital asset trading infrastructure.