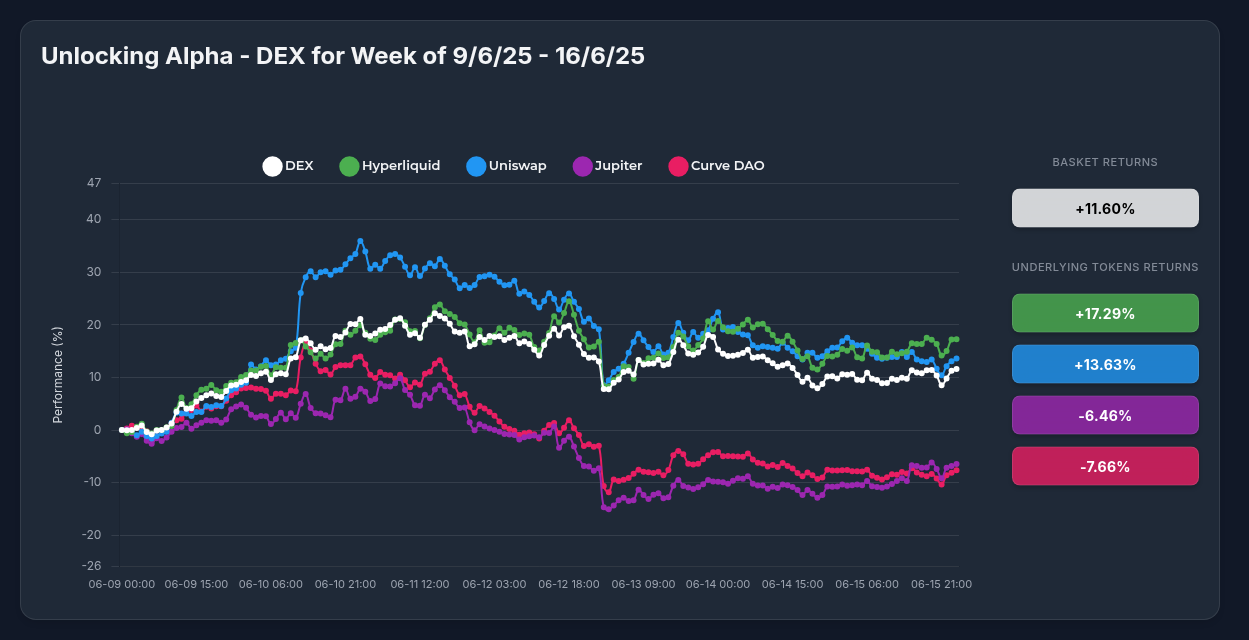

DEX Strategy Outperforms with 11.60% Weekly Gain: Hyperliquid and Uniswap Lead the Charge

The DEX strategy has delivered impressive returns for investors, posting a robust 11.60% gain over the past week (June 9-16, 2025). This performance highlights the growing strength of decentralized exchange tokens in the current market landscape and demonstrates the benefits of a diversified approach to this dynamic sector.

Weekly Performance Breakdown

The DEX strategy showed remarkable resilience over the 7-day period, characterized by three distinct phases:

- Early Period Surge (June 9-11): Most tokens in the basket exhibited strong positive momentum, with Uniswap reaching impressive gains of around 35%.

- Mid-Period Correction (June 11-13): A healthy pullback occurred across most assets, with Uniswap retracing from 35% to approximately 8% gains.

- Stabilization Phase (June 13-16): The majority of tokens found support levels and began consolidating, with the overall basket maintaining positive territory.

Key Performance Drivers

The strategy's performance was driven by a mix of strong performers offsetting weaker components:

Top Performers:

- Hyperliquid (+17.29%): The standout contributor showed consistent upward momentum with minimal drawdowns.

- Uniswap (+13.63%): Despite experiencing the highest volatility, Uniswap delivered strong returns and demonstrated its market leadership.

- DEX (+11.60%): The basket's namesake token performed steadily with moderate volatility.

Underperformers:

- Jupiter (-6.46%): Showed consistent bearish sentiment with failed recovery attempts.

- Curve DAO (-7.66%): The weakest performer, consistently trading in negative territory.

Catalysts Behind the Movements

Several significant developments drove the performance of the underlying assets:

Hyperliquid (HYPE)

Hyperliquid's exceptional performance was fueled by significant ecosystem expansion, including:

- Introduction of $USDhl stablecoin with $HYPE rewards

- Multiple point-earning opportunities across the ecosystem (HyperBeat, HypurrFi, Hyperliquid, and HyperEVM points)

- Significant daily revenue growth

- Strong bullish sentiment from traders comparing its potential to early Solana

Uniswap (UNI)

Uniswap's strong performance was driven by both technical and fundamental factors:

- Regulatory optimism with SEC Chair Paul Atkins hinting at an 'innovation exemption' for DeFi projects

- Technical breakout through a long-term descending resistance

- Binance's announcement of perpetual contracts for UNI (launched June 16)

- A remarkable 160% increase in trading volume

Negative Catalysts for Underperformers

Despite the overall positive trajectory of the DEX basket, some components faced challenges:

- Jupiter (JUP): Despite the launch of Jupiter Lend and $1 billion in TVL, the token struggled to maintain positive momentum.

- Curve DAO (CRV): Despite being listed in "Top DeFi Coins to Watch in 2025" and some positive short-term moves, CRV experienced bearish pressure throughout most of the period.

Benefits of the DEX Strategy vs. Individual Holdings

The performance of the DEX strategy over the past week perfectly illustrates why a basket approach offers significant advantages:

1. Superior Risk-Adjusted Returns

While individual tokens like Hyperliquid and Uniswap outperformed the basket, they also experienced higher volatility. The DEX strategy delivered solid returns with reduced drawdowns, creating a smoother investment experience.

2. Built-In Diversification

The strategy's inclusion of five different DEX tokens mitigated the negative impact of underperformers. Despite Jupiter and Curve DAO losing 6.46% and 7.66% respectively, the overall basket still achieved an 11.60% gain. This diversification protected investors from making the wrong bet on a single DEX token.

3. Reduced Monitoring Requirements

Rather than tracking multiple DEX projects, their developments, and price movements, the strategy allows investors to gain broad exposure to the sector through a single investment vehicle.

4. Sector-Wide Exposure

The DEX strategy provides exposure to various aspects of the decentralized exchange ecosystem, from liquidity protocols (Curve) to aggregators (Jupiter) and established AMMs (Uniswap).

5. Professional Rebalancing

The strategy benefits from professional management that can adjust weights based on changing market conditions, rather than requiring investors to manually rebalance individual holdings.

Outlook

With a strong 11.60% weekly performance and 60% of components showing positive returns, the DEX strategy presents a bullish technical outlook. The recent stabilization suggests a consolidation phase before potentially continuing its upward trajectory.

For investors seeking exposure to the growing DEX sector without the risk and complexity of selecting individual tokens, the DEX strategy continues to demonstrate its value as an effective investment vehicle.