Crypto Crash: The Hidden Forces You Didn’t See Coming | Optima Insights E1

Welcome to the inaugural episode of Optima Insights, where we delve into the current turmoil within the crypto market, exploring the macroeconomic forces and unexpected catalysts causing ripples across the financial landscape.

Here's the recap of the episode:

Initial Market Shock: The Role of International Trade

The crypto market was jolted recently, sending shockwaves reminiscent of the 2021 market volatility. On a fine Friday, the market saw massive liquidations that caught many investors by surprise. This drastic shift was partly ignited by macroeconomic tensions, spearheaded by the ongoing China-U.S. trade war. The catalyst was a new framework announced by China's Minister of Commerce. This framework imposed stringent regulations on rare earth mineral exports, indispensable in various high-tech industries, thus, triggering a significant market reaction once the implications became clear.

Deeper Dive: Macroeconomic and Market Reactions

Despite initial ignorance, the financial world awoke to the realization of serious market implications. The unresolved trade tensions led to a macro meltdown in U.S. markets, exemplified by significant drops in the S&P 500 and Nasdaq indices, affecting crypto assets as well. Contrary to the perception of crypto being immune to macro influences, this event highlighted their vulnerability to broader economic waves.

Crypto Market Volatility: A Case Study of Liquidation

Friday served as a stark reminder of crypto's volatility. Bitcoin, Ethereum, and other major crypto assets encountered sharp declines. Notably, Solana witnessed an astonishing 40% drop, a figure staggering for a top-five digital asset rather than a lesser-known altcoin. Such an intense move illustrated the sheer magnitude of market panic and response to external pressures.

Technical Turbulence: Behind-the-Scenes Factors

Beyond macroeconomic factors, technical issues compounded the market chaos. For instance, Binance, a crucial crypto trading platform, faced controversies related to its USDE trading mechanisms. Vulnerabilities in these mechanisms allowed for market manipulation, further exacerbating the turbulence. Additionally, strategic insider trading moves leveraged timing and trends to extract quick profits, intensifying overall market uncertainty.

Strategies for the Future: Proactive Market Participation

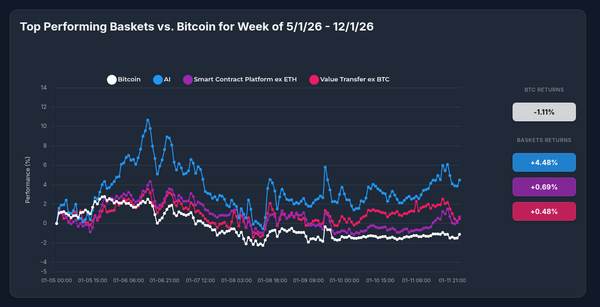

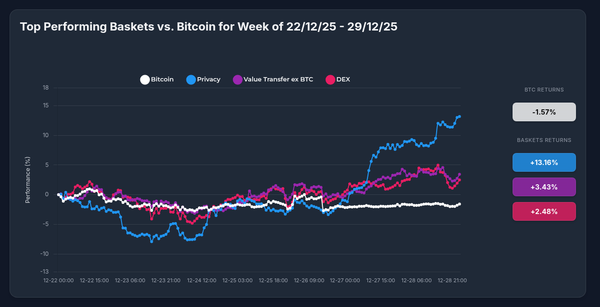

Taking stock of recent events, a more proactive investment strategy emerges as vital. In times of heightened volatility, traders and active managers can benefit from fluctuating markets. Optima advocates for a hands-on approach, recommending active management over passive holding in such erratic times. We stress the importance of adapting to data signals, market trends, and actively engaging with financial advisories to seize timely opportunities.

Long-Term Outlook: Catalysts for Recovery and Growth

Despite these shockwaves, opportunities persist for long-term investors. Market maturity and continued institutional interest indicate potential for recovery. Optima is poised to support this through innovative schemes like active strategies and thematic baskets tailored to evolving market demands and community feedback.

Optima's Commitment: Expanding Investment Opportunities

Responding to client feedback, Optima plans to launch diversified investment baskets, including a focus on privacy tokens. The goal is to provide a comprehensive suite of options accommodating both centralized and decentralized sectors, anticipating fluctuations and benefiting from inherent market opportunities.

Conclusion: Riding the Wave of Change

In summary, while recent crypto market turmoil is concerning, it also illuminates paths for savvy, proactive engagement. Holding positions offers long-term potential, but active management in volatile periods can unearth rewards. Optima remains committed to guiding investors through strategic insights and innovative solutions, ensuring readiness in the evolving financial ecosystem. Keep an eye on our upcoming launches for enhanced opportunities.