Introducing Optima Active Portfolios

We're launching Optima Active Portfolios — professionally managed crypto portfolios designed to outperform buy-and-hold while limiting drawdowns. EU-compliant. Global accessibility. Transparent fees. Your keys. Your choice.

Professional crypto portfolios, now in your wallet.

Today we're launching Optima Active Portfolios — actively managed, single-asset crypto portfolios designed to outperform buy-and-hold.

Each portfolio is represented by an Optima Portfolio Token (OPT) that you can hold in your own wallet or through the Optima app. One token. Professionally managed. Fully transparent.

We're launching with five Active Portfolios:

- Enhanced BTC Momentum (OPLBTC)

- Enhanced ETH Momentum (OPLETH)

- Enhanced XRP Momentum (OPLXRP)

- Enhanced SOL Momentum (OPLSOL)

- Enhanced NEAR Momentum (OPLNEAR)

Why Active Portfolios?

Most retail investors have two choices: hold and hope, or trade and lose.

Buy-and-hold works over long timeframes, but it means sitting through 30%+ drawdowns, hoping you don't panic sell at the bottom. Active trading can generate better returns, but it requires institutional-grade data, technology, and 24/7 attention. That's a full-time job.

Active Portfolios give you a third option: professional management without the complexity.

Our systems monitor markets continuously, adjusting positions based on momentum signals and risk conditions. When markets turn, we reduce exposure. When conditions improve, we scale back in. The goal is simple: capture upside while limiting drawdowns.

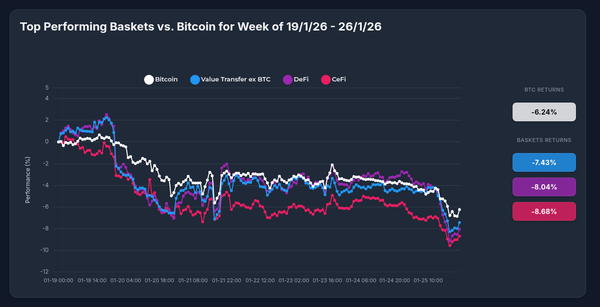

The Numbers: Enhanced BTC Momentum vs Buy-and-Hold

Let's look at the Enhanced BTC Momentum Portfolio (OPLBTC) performance.

Since Jan 1, 2025

Enhanced BTC Momentum Portfolio (OPLBTC)

- Total Return: 101.89%

- Sharpe Ratio: 2.53

- Annual Volatility: 25.41%

- Max Drawdown: -9.26%

BTC (Buy & Hold)

- Total Return: -18.37%

- Sharpe Ratio: -0.33

- Annual Volatility: 41.75%

- Annual Return: -16.57%

- Max Drawdown: -38.01%

Since Oct 1, 2025

Enhanced BTC Momentum Portfolio (OPLBTC)

- Total Return: 13.86%

- Sharpe Ratio: 1.80

- Annual Volatility: 20.63%

- Max Drawdown: -9.26%

BTC (Buy & Hold)

- Total Return: -34.01%

- Sharpe Ratio: -2.80

- Annual Volatility: 42.25%

- Max Drawdown: -38.01%

The key insight: It's not just about returns — it's about how you get there.

Since October, Enhanced BTC Momentum returned +13.86% while buy-and-hold fell -34.01%. Drawdowns of -9.25% vs -38.01% tell the deeper story, showing how disciplined risk management is built into the portfolio.

How It Works

- You buy the OPT token — through the Optima app or on supported DEXs in the near future

- We manage the underlying portfolio — adjusting positions based on market conditions

- The token price reflects performance — net of fees, in real-time

- You hold, transfer, or use as collateral — it's your token, your choice

No leverage. No complex derivatives. Just disciplined, data-driven position management on spot markets.

What You're Getting

Professional risk management. Our systems are designed to limit drawdowns. When momentum weakens or volatility spikes, we reduce exposure. This isn't about predicting the future — it's about responding to what's happening now.

Transparent performance. The OPT price reflects the portfolio's net value after fees. No hidden costs, no surprises. Check performance anytime in the Optima app with full analytics.

EU-compliant structure. Each OPT has an FMA-approved prospectus, ISIN, and symbol. This isn't a synthetic derivative or a leveraged bet — it's a real investment certificate, passported across the EU and accessible globally by retail or institutional investors.

Your keys, your choice. Hold your OPTs in the Optima app or withdraw to your own wallet. Use them as collateral on DeFi protocols. Transfer them freely. It's your investment.

The Fee Structure

We charge a daily assets under management fee, up to 0.0274%. No performance fees. No hidden costs.

The OPT prices you see already reflect net returns — what you see is what you get.

What Active Portfolios Are Not

Let's be clear about what we're offering — and what we're not.

This is not a guaranteed return. Crypto markets are volatile. Even with professional management, portfolios can decline. Our goal is to outperform buy-and-hold over time while limiting drawdowns — not to eliminate risk entirely.

This is not leverage trading. Active Portfolios trade only in spot markets. No margin, no perpetuals, no liquidation risk.

This is not a black box. You can see exactly how the portfolio is performing at any time. Full transparency on returns.

Getting Started

Active Portfolios are available now.

- Sign up

- Complete verification (required for EU compliance)

- Deposit funds

- Purchase your first OPT

The whole process takes about 10 minutes.

DeFi-Native by Design

Optima Portfolio Tokens aren't locked away. When held on-chain, they work like any other ERC-20 token:

- Transfer freely — Send to any wallet, no restrictions

- Trade on DEXs — Swap on decentralized exchanges

- Use as collateral — Borrow against your portfolio on lending protocols without triggering a taxable event

You get a professionally managed portfolio with DeFi composability. Hold in the Optima app for simplicity, or withdraw to your wallet and put your OPTs to work across the ecosystem.

Your portfolio. Your control.

The Bottom Line

Profitable crypto investing is a full-time job. Most retail investors don't have the data, technology, or time to compete with professionals.

Active Portfolios change that. Professionally managed. Simple and global access. Your keys.

Past performance does not guarantee future results. Crypto investments carry significant risk. Only invest what you can afford to lose.