Navigating Volatility: How Optima's CeFi Strategy Weathered the Recent Market Storm Compared to Bitcoin

In the ever-evolving landscape of digital assets, strategic diversification remains a cornerstone of risk management. This past week (June 16-23, 2025) provided a compelling case study as Optima's CeFi strategy navigated a challenging market environment alongside Bitcoin, offering valuable insights for investors seeking both performance and protection.

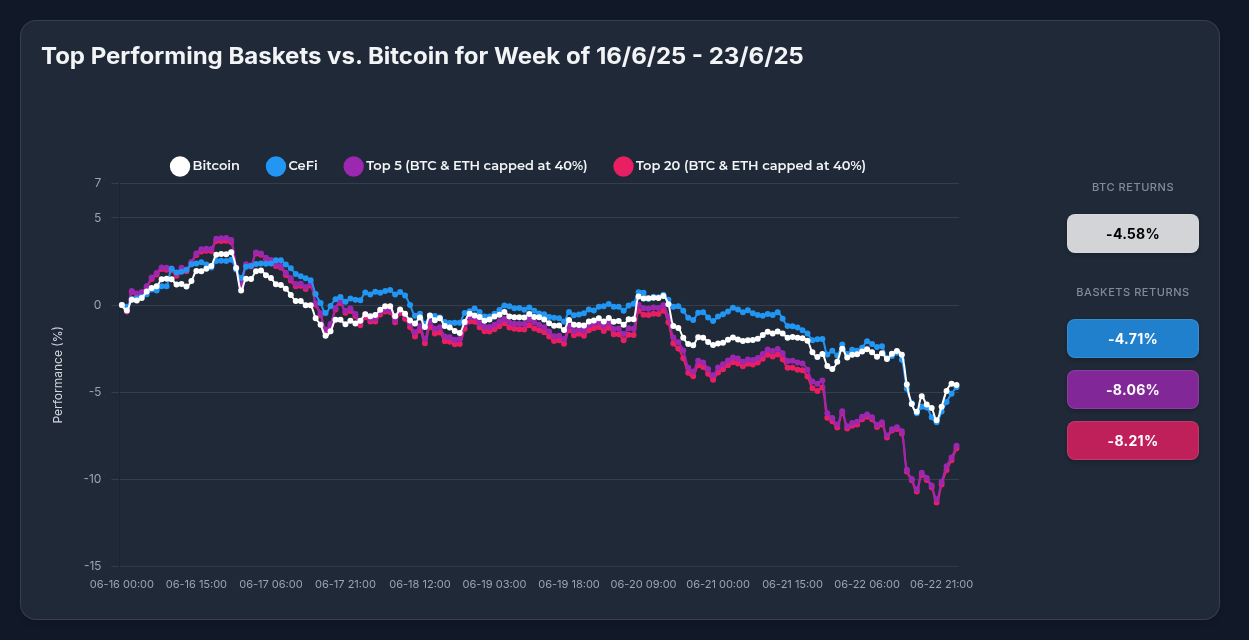

Performance Snapshot: CeFi Strategy vs. Bitcoin

The week saw Bitcoin post a modest decline of -4.58%, while Optima's CeFi strategy experienced a comparable -4.71% return. This near-identical headline performance masks the significant divergence and opportunity beneath the surface.

While Bitcoin moved as a single asset, the CeFi strategy's constituent tokens demonstrated remarkable dispersion:

- WhiteBIT Coin (WBT): +21.34%

- OKB: -3.65%

- BNB: -4.98%

- Cronos (CRO): -12.11%

- Tokenize Xchange (TKX): -16.40%

This 37.74% performance spread between best and worst performers illustrates both the risks and opportunities in the exchange token ecosystem—and highlights the value of Optima's index approach.

Market Drivers: Understanding the Week's Performance

The week of June 16-23 exhibited a distinct two-phase pattern: initial outperformance by the CeFi basket followed by synchronized decline across all assets. Several key factors influenced this market dynamic:

- Sector-Wide Pressure: 80% of the CeFi strategy's constituent tokens posted negative returns, reflecting systemic challenges for centralized finance platforms.

- Flight-to-Quality: Bitcoin's relatively moderate decline suggests investors sought refuge in the market's dominant asset as uncertainty increased.

- Technical Breakdown: The sharp deterioration after June 20th, with assets falling 6-8% in three days, indicates potential technical breakdowns across the crypto ecosystem.

- Geopolitical Uncertainty: Middle East tensions created market uncertainty, with Bitcoin viewed as a potential hedge during geopolitical instability.

Catalysts Behind Individual Token Movements

WhiteBIT Coin (WBT) - The Standout Performer (+21.34%)

WBT's remarkable outperformance was primarily driven by its high-profile Juventus partnership announcement, significantly boosting brand visibility. The token reached an all-time high of $52.27 before experiencing a modest correction, yet maintained substantial gains throughout the week.

BNB (-4.98%)

BNB's moderate decline came despite positive developments, including significant institutional interest with reports of hedge fund executives raising $100M to invest in the token. The upcoming Maxwell Hard Fork scheduled for June 30 failed to generate sufficient bullish momentum to offset broader market pressure.

Bitcoin (-4.58%)

Bitcoin's performance reflected a neutral market sentiment (Fear & Greed Index: 47/100) and continued institutional accumulation, with MicroStrategy purchasing an additional 245 BTC for approximately $26 million. Key support levels around $92,000-$93,000 remained intact, while resistance at $102,000 proved challenging.

The Strategic Advantage: Why Hold Optima's Strategy vs. Individual Assets

This week's performance vividly illustrates the benefits of holding Optima's CeFi strategy versus individual assets:

- Superior Downside Protection: While the index declined 4.71%, this significantly outperformed the worst-performing constituents (TKX -16.40%, CRO -12.11%). Investors exclusively holding these tokens would have suffered losses more than three times greater than the index.

- Volatility Dampening: The 37.74% performance spread between best and worst performers highlights the extreme volatility in individual assets. The index effectively smooths this volatility through diversification.

- Exposure to Outperformers: The index captured significant upside from WBT's outstanding 21.34% gain, which would have been missed by investors solely holding Bitcoin.

- Reduced Monitoring Burden: The rapidly changing landscape of exchange tokens creates a substantial monitoring burden for individual token holders. The index approach streamlines this process.

- Insulation from Asset-Specific Risks: As demonstrated by community backlash affecting CRO, exchange tokens face unique risks. The index provides insulation against these asset-specific challenges.

Bitcoin vs. CeFi Strategy: Strategic Considerations

While Bitcoin performed marginally better than the CeFi strategy this week (-4.58% vs. -4.71%), the comparison highlights important considerations:

- Correlation Benefits: In times of market stress, Bitcoin's status as the dominant digital asset can provide relative stability, as demonstrated by its slight outperformance during the downturn.

- Growth Potential: The CeFi strategy's exposure to high-growth exchange tokens offers potentially greater upside in bullish environments, as evidenced by WBT's 21.34% gain.

- Sector Diversification: Holding both Bitcoin and the CeFi strategy provides complementary exposure across the digital asset ecosystem, balancing Bitcoin's store-of-value characteristics with the growth potential of exchange tokens.

Looking Forward

As we navigate the remainder of 2025, several factors warrant attention for both Bitcoin and the CeFi strategy:

- Bitcoin appears poised for potential growth, with analyst predictions suggesting possible targets of $109,254 (1-month), $136,888 (3-month), and $120,474 (1-year).

- Exchange tokens continue to demonstrate both significant opportunity (as with WBT) and risk (as with TKX), underscoring the value of Optima's index approach.

- The current market positioning appears oversold, potentially offering contrarian opportunities for risk-tolerant investors in both Bitcoin and the CeFi strategy.

For investors seeking balanced exposure to the digital asset ecosystem, Optima's CeFi strategy offers an elegant complement to Bitcoin holdings—capturing diversified upside potential while providing meaningful downside protection in volatile market conditions.