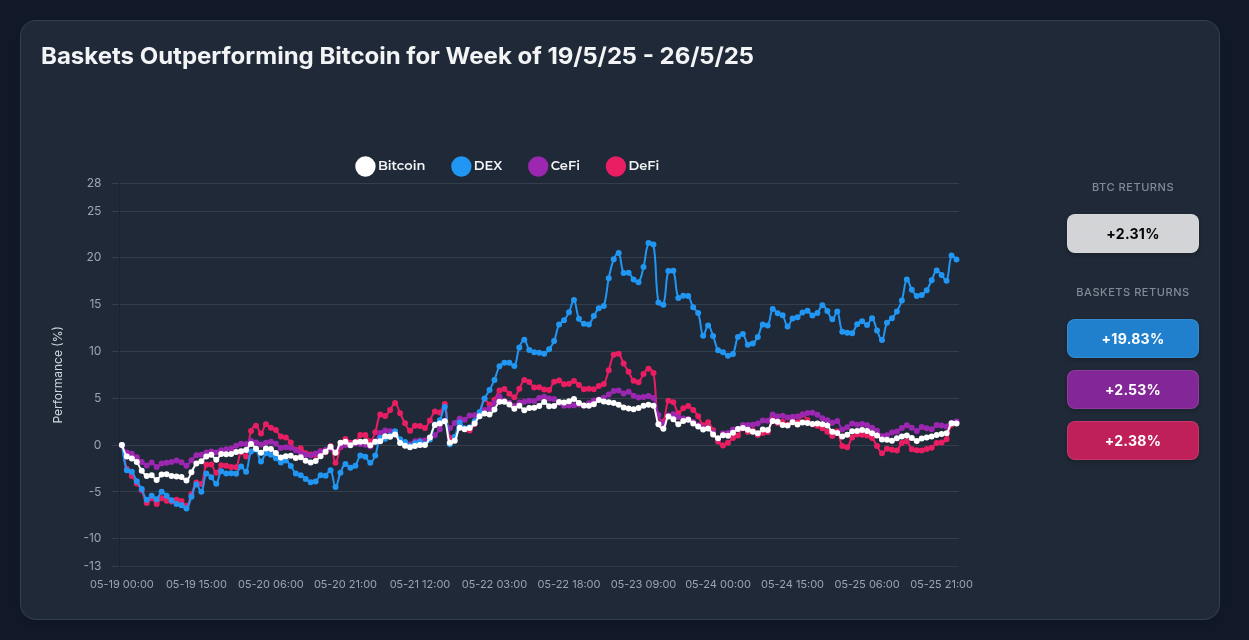

OPDEX Dominates the Market: Optima's DEX Strategy Outperforms Bitcoin by 17.52% in One Week

In a remarkable display of sector-specific strength, Optima Financial's DEX strategy (OPDEX) has delivered exceptional returns for investors, outpacing Bitcoin by a substantial margin during the week of May 19-26, 2025. This performance highlights the strategic advantage of targeted exposure to high-growth segments within the digital asset ecosystem.

Performance Breakdown: The Numbers Tell the Story

While Bitcoin posted a respectable gain of 2.31% during the analyzed period, OPDEX demonstrated exceptional alpha generation with a return of 19.83% - outperforming the market benchmark by an impressive 17.52 percentage points. Other Optima strategies also edged out Bitcoin's performance, with the CeFi Basket returning 2.53% and the DeFi Basket delivering 2.38%.

This stark contrast in performance underscores the potential benefits of professionally managed exposure to emerging sectors within the digital asset landscape.

What's Driving OPDEX's Exceptional Returns?

The strategy's stellar performance was primarily powered by two standout constituents:

Hyperliquid (HYPE): The Powerhouse

With an extraordinary 44.08% gain, Hyperliquid emerged as the dominant force behind the index's success. The token benefited from several key developments:

- Binance U.S. listing announcement generating significant market attention

- Over $1 billion in staking activity demonstrating strong community commitment

- Growing narrative as a potential "CEX disruptor" in the trading ecosystem

Curve DAO (CRV): The Steady Climber

Contributing a solid 10.16% gain, Curve DAO showed remarkable stability while maintaining positive momentum. Its growth was supported by:

- Expanded institutional presence through ETP listings

- Strong trading volumes on major exchanges

- Renewed interest in DeFi protocols as potential beneficiaries of Ethereum ETF developments

Market Catalysts: Understanding the Bigger Picture

The exceptional performance of the DEX sector isn't occurring in isolation. Several broader market forces have created a favorable environment:

- Institutional Adoption: Increased institutional interest in decentralized trading infrastructure, signaling growing mainstream acceptance

- DeFi Renaissance: Growing speculation about a potential "DeFi Summer" as the sector shows signs of resurgence

- Cross-Chain Integration: DEX tokens benefiting from expanded capabilities across Ethereum, Solana, and BNB Chain ecosystems

- Product Innovation: New features like Jupiter's lending protocol and Raydium's LaunchLab platform demonstrating continued evolution in the space

Meanwhile, Bitcoin continues its role as a stable store of value, showing steady but modest gains that reinforce its position as a market benchmark rather than a momentum play.

The Strategic Advantage: Why OPDEX Outperforms Individual Holdings

For investors seeking exposure to the growing DEX sector, Optima's OPDEX strategy offers several distinct advantages over holding individual tokens:

1. Superior Risk Management Through Diversification

Despite negative performance from some constituents (Raydium: -5.53%, DeXe: -3.29%), the index delivered substantial positive returns. This highlights the protective value of diversification in navigating volatile crypto markets.

2. Balanced Ecosystem Exposure

The index provides exposure across multiple blockchain ecosystems and DEX functionalities, creating a comprehensive position in the future of decentralized trading without requiring investors to make specific technology bets.

3. Reduced Concentration Risk

While Hyperliquid's exceptional performance drove significant alpha, the index structure protects investors from overexposure to single-token risks that could lead to outsized losses during sector-specific downturns.

4. Professional Portfolio Construction

Optima's strategic weighting methodology ensures optimal exposure to the DEX sector's growth without requiring complex individual token analysis, saving investors time and potentially avoiding costly mistakes.

Looking Forward: What's Next for DEX Platforms?

The technical picture reveals a pronounced rotation into decentralized exchange tokens, which significantly outperformed all other categories. This suggests strong institutional and retail interest in DEX infrastructure, possibly driven by increased trading volumes, protocol upgrades, and regulatory developments.

The strong finish across all assets indicates potential momentum continuation, with several technical indicators suggesting the possibility of sustained growth in the coming weeks.

For investors seeking to capitalize on emerging trends within the digital asset ecosystem while managing risk effectively, Optima's thematic strategies offer a compelling alternative to both broad market exposure and individual token selection.