OPDEX Strategy Outperforms Bitcoin by 6.64% During Market Turmoil

TL;DR

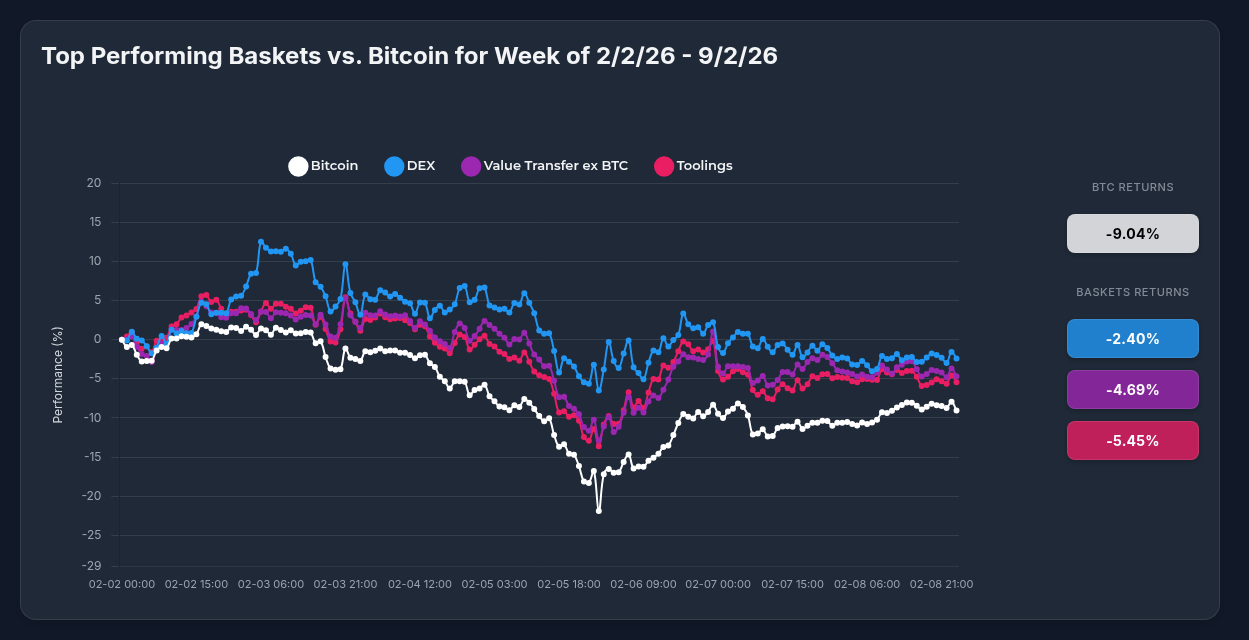

During the volatile week ending February 9, 2026, Optima's DEX strategy (OPDEX) declined just -2.40% while Bitcoin plummeted -9.04%—a 6.64 percentage point outperformance. The strategy's diversification across six leading DEX tokens cushioned volatility, with individual assets ranging from Lighter's +6.77% gain to PancakeSwap's -9.97% loss.

Performance Snapshot: Defense Wins in Bearish Markets

The past week tested crypto investors' resolve. Bitcoin dropped from near-breakeven levels to approximately -22% before recovering to close at -9.04%. Meanwhile, Optima's three flagship strategies demonstrated their value proposition:

- DEX Basket (OPDEX): -2.40% (outperformed BTC by 6.64%)

- Value Transfer ex BTC: -4.69% (outperformed BTC by 4.35%)

- Toolings: -5.45% (outperformed BTC by 3.59%)

In a market where minimizing losses is the primary objective, all three strategies delivered superior risk-adjusted returns.

What Drove the Divergence?

Bitcoin's Headwinds: The flagship cryptocurrency faced multiple pressures. The Fear & Greed Index plunged to 11 (Extreme Fear), while over $770 million in positions were liquidated in 24 hours. ETF outflows accelerated as institutional investors rotated toward risk-off positions. Bitcoin briefly touched $60,000 before stabilizing around $70,380.

DEX Sector Resilience: While Bitcoin traded as a macro risk asset, the decentralized exchange sector benefited from structural tailwinds:

- Institutional Validation: Bitwise's Uniswap ETF filing signals growing recognition of DeFi infrastructure

- Tokenomics Innovation: Fee-sharing mechanisms (Uniswap's UNIfication) and aggressive token burns (PancakeSwap) create sustainable value capture

- Platform Dominance: Jupiter processes 80% of Solana's DEX volume ($700M+ daily); Hyperliquid's fair launch model attracts community support

Inside OPDEX: Winners and Losers

The strategy's -2.40% aggregate decline masks significant internal divergence:

Top Performers:

- Lighter ($LIT): +6.77% | First green weekly candle signals potential trend reversal; low volatility suggests accumulation

- Hyperliquid ($HYPE): +5.67% | Despite 25% intraday swings, closed positive on fair launch credibility and #15 market cap ranking ($7.71B)

Underperformers:

- PancakeSwap ($CAKE): -9.97% | Token burns ($5M in January) failed to offset 33% decline from recent highs

- Curve DAO ($CRV): -9.83% | Founder liquidation concerns (918.83K tokens in December) continue weighing on sentiment

Steady Contributors:

- Uniswap ($UNI): Moderate performance bolstered by ETF filing and fee-switch proposal

- Jupiter ($JUP): $35M ParaFi investment and final 200M token airdrop support stability

Why Diversification Matters

The 16.74% spread between OPDEX's best (Lighter) and worst (PancakeSwap) performers illustrates the value of systematic allocation:

1. Volatility Dampening

Hyperliquid's 25% intraday swings would devastate concentrated portfolios. OPDEX's -2.40% decline demonstrates effective risk management.

2. Eliminate Timing Risk

Predicting that Lighter would outperform while PancakeSwap would lag requires perfect foresight. OPDEX captures both outcomes proportionally.

3. Ecosystem Exposure

Six tokens across Ethereum, Solana, BSC, and emerging chains ensure participation in whichever ecosystem accelerates next.

4. Professional Rebalancing

Automatic weight optimization captures opportunities without constant monitoring or emotional decision-making.

5. Reduced Idiosyncratic Risk

Founder liquidations, governance disputes, and technical failures affect individual tokens. Diversification isolates these risks.

Strategic Implications: Alpha Generation in Bear Markets

The technical analysis reveals critical insights for investors:

Correlation Breakdown: During the February 4-6 correction, all assets initially moved together. However, the recovery phase (Feb 7-9) showed differentiated performance—DEX tokens demonstrated relative strength while Bitcoin remained range-bound.

Defensive Characteristics: OPDEX's 74% downside capture (declined 2.40% vs BTC's 9.04%) proves its defensive value. In bull markets, concentrated bets may outperform; in corrections, diversification preserves capital.

Alpha Opportunity: The 6.64 percentage point outperformance in a single week annualizes to significant value creation. Even in neutral markets, sector-specific fundamentals drive returns independent of Bitcoin's trajectory.

Market Catalysts: What's Driving DEX Tokens?

Regulatory Clarity: Institutional ETF filings suggest regulators are warming to DeFi infrastructure as critical market infrastructure rather than speculative assets.

Revenue Models Maturing: The shift from governance tokens to fee-sharing mechanisms aligns holder incentives with protocol success. Uniswap's UNIfication and PancakeSwap's burns are early examples.

Multi-Chain Competition: Ethereum, Solana, and emerging L1s compete for DEX liquidity. OPDEX's cross-chain exposure captures this fragmentation as opportunity rather than risk.

Retail vs Institutional Divergence: While retail sentiment (Google Trends at 12-month highs) drives Bitcoin volatility, institutional capital flows toward DeFi infrastructure with clearer revenue models.

Outlook: Cautiously Bullish on Sector Rotation

Short-Term (1-4 weeks):

Expect continued Bitcoin range-trading between $65,000-$75,000 as macro uncertainty persists. DEX tokens may consolidate recent gains but should maintain relative strength.

Medium-Term (1-3 months):

Institutional validation (ETF approvals, strategic investments) could drive sector rotation from Bitcoin into DeFi infrastructure. OPDEX positioned to capture this flow.

Key Risks:

Broader crypto selloff could overwhelm sector fundamentals. Regulatory crackdowns on DeFi remain tail risk. Individual protocol failures (smart contract exploits, team departures) could impact constituent tokens.

The Bottom Line

Optima's DEX strategy delivered exactly what sophisticated investors demand: superior risk-adjusted returns through systematic diversification. While Bitcoin investors endured -9.04% losses, OPDEX holders limited damage to -2.40%—a 6.64% alpha generation in a single week.

The strategy's internal mechanics reveal why diversification works: Lighter's +6.77% gain partially offset PancakeSwap's -9.97% loss without requiring predictive genius. Professional rebalancing, ecosystem exposure, and volatility dampening create an experience impossible to replicate through individual token holdings.

As crypto markets mature, the gap between systematic strategies and ad-hoc portfolios will widen. OPDEX proves that earning like the top 1% doesn't require perfect market timing—just disciplined allocation to quality assets with structural tailwinds.

Risk Rating: Moderate-High | Suitable for: Investors seeking DeFi exposure with managed volatility