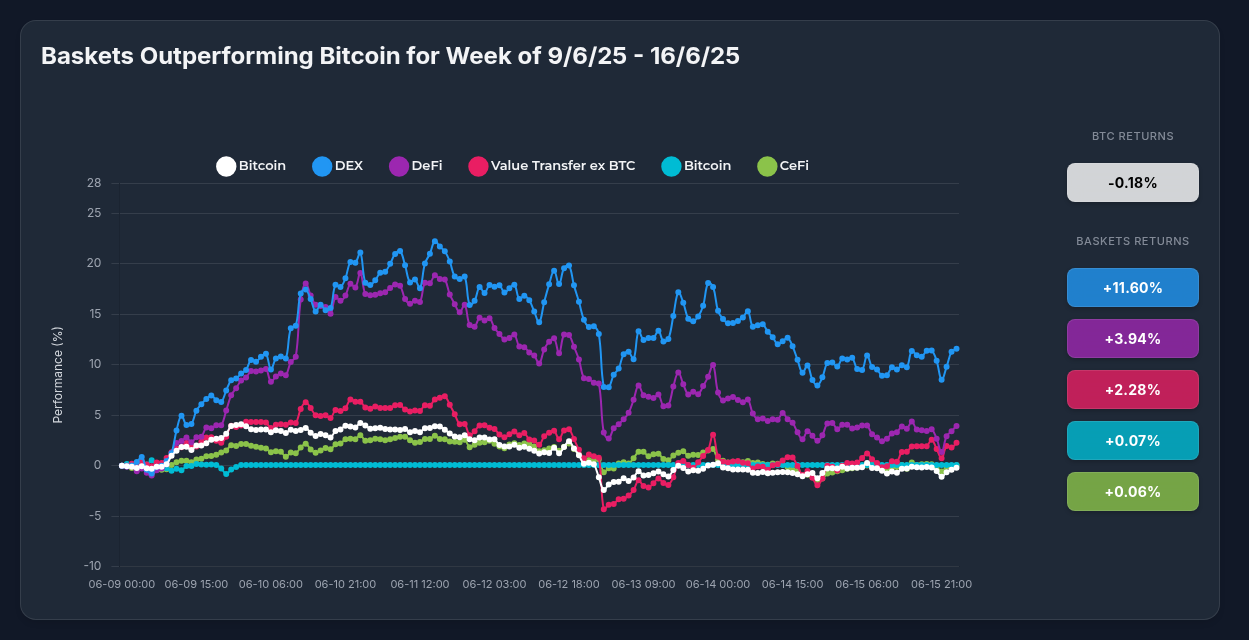

Optima DEX Strategy Outperforms Bitcoin by 11.78%: A Case for Strategic Diversification

In today's dynamic crypto landscape, strategic diversification has proven to be not just beneficial but essential. The latest performance metrics from Optima Financial showcase this reality in striking clarity, with the DEX Strategy basket delivering impressive returns against the backdrop of a stagnant Bitcoin.

Performance Overview: Optima Strategies vs. Bitcoin

From June 9th to June 16th, 2025, we observed a clear divergence in performance between Optima's curated strategies and the market benchmark:

- DEX Basket: +11.60%

- DeFi Basket: +3.94%

- Value Transfer ex BTC Basket: +2.28%

- Bitcoin Basket: +0.07%

- CeFi Basket: +0.06%

- Bitcoin (BTC): -0.18%

Most notably, all Optima strategies successfully outperformed Bitcoin during this period, with the DEX Strategy emerging as the clear frontrunner with a remarkable 11.78% outperformance relative to BTC.

What's Driving These Returns?

Several key factors contributed to the outperformance of Optima strategies, particularly in the decentralized finance sector:

1. Sector Rotation

We're witnessing a significant rotation from centralized to decentralized finance alternatives. This shift in capital flow has particularly benefited the DEX and DeFi baskets, which saw the strongest performances. Investor preference appears to be moving toward utility-driven crypto assets over traditional store-of-value narratives.

2. Asset-Specific Catalysts

Looking deeper into the DEX strategy's components, we find several significant developments driving performance:

- Hyperliquid (+17.29%): The standout performer benefited from the introduction of the $USDhl stablecoin with $HYPE rewards, ecosystem expansion with multiple point-earning opportunities, and significant daily revenue growth.

- Uniswap (+13.63%): Regulatory optimism with hints of an 'innovation exemption' for DeFi projects, technical breakout through a long-term descending resistance, and Binance's announcement of perpetual contracts all contributed to UNI's strong performance.

3. Market Sentiment Shifts

While Bitcoin's sentiment remained cautiously bullish (54% according to Oriole Insights), the sentiment around DEX tokens was notably more optimistic. This divergence in market perception created opportunities for outperformance in the alternative sectors that Optima's strategies have effectively captured.

Why Hold Optima Strategies vs. Individual Assets?

The recent performance of the DEX Strategy perfectly illustrates the advantages of Optima's basket approach:

1. Superior Risk-Adjusted Returns

While individual tokens like Hyperliquid (+17.29%) and Uniswap (+13.63%) outperformed the overall basket, they also exhibited higher volatility. The DEX Strategy delivered solid returns with reduced drawdowns, creating a smoother investment experience while still capturing 11.60% gains.

2. Built-In Diversification

Despite underperformance from Jupiter (-6.46%) and Curve DAO (-7.66%), the DEX basket still achieved impressive returns. This inherent diversification protected investors from the potential downside of selecting the wrong individual token.

3. Reduced Monitoring and Research Requirements

Rather than tracking multiple projects, developments, and price movements across different tokens, Optima's strategies allow investors to gain broad exposure through a single investment vehicle. This simplification is particularly valuable in the rapidly evolving crypto landscape.

4. Professional Rebalancing

The strategies benefit from professional management that adjusts weights based on changing market conditions, rather than requiring investors to manually rebalance individual holdings—a significant advantage during periods of high volatility.

Market Outlook

Technical analysis suggests a continued bullish outlook for Optima's strategies, particularly those focused on decentralized finance infrastructure. The sustained outperformance against a declining Bitcoin benchmark demonstrates strong relative strength and indicates investor preference for utility-focused crypto assets.

For Bitcoin, while the current price hovers around $107,074 with a Fear & Greed Index of 61/100 (indicating "Greed"), the sideways price action during our analysis period suggests potential consolidation before the next major move.

Conclusion

The impressive outperformance of Optima's strategies, particularly the DEX basket, highlights the value of professionally managed, diversified exposure to crypto sectors beyond Bitcoin. As the market continues to mature and evolve, these strategic approaches offer both enhanced returns and reduced volatility—precisely what sophisticated investors seek in the digital asset space.

For those looking to optimize their crypto exposure without the complexity of managing multiple positions, Optima's strategies offer a compelling solution that has demonstrably outperformed in the current market environment.