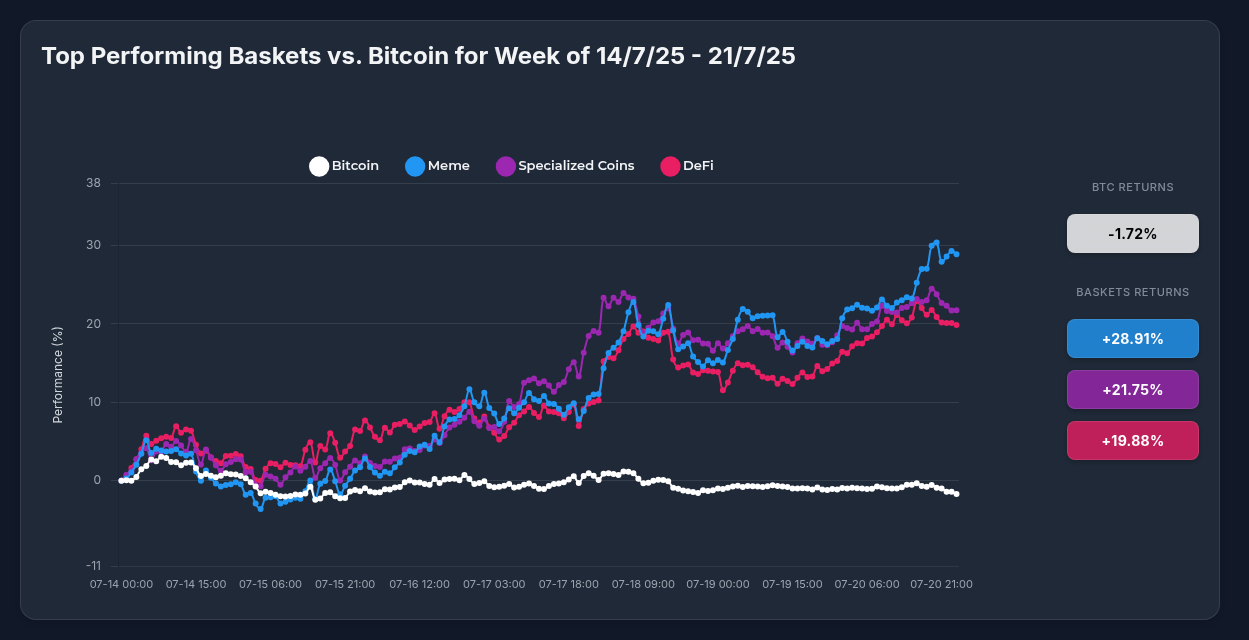

Optima Strategies Outshine Bitcoin: How Diversified Crypto Baskets Delivered 30% Returns While BTC Declined

In a striking display of strategic diversification, Optima Financial's crypto baskets have significantly outperformed Bitcoin during the past week (July 14-21, 2025). While Bitcoin struggled with a -1.72% return, Optima's specialized strategies delivered impressive gains, with the Meme basket leading at an exceptional +28.91% return.

The Numbers Tell the Story

The performance divergence between Optima's strategies and Bitcoin couldn't be more clear:

- Optima Meme Basket (OPMM): +28.91%

- Optima Specialized Coins: +21.75%

- Optima DeFi Basket: +19.88%

- Bitcoin (BTC): -1.72%

This stark contrast demonstrates the potential benefits of strategically diversified crypto exposure over single-asset concentration, even when that asset is the market leader.

Behind the Meme Basket's Success

Diving deeper into Optima's top-performing strategy, the Meme basket's exceptional returns were driven by several standout performers:

- FLOKI: +41.25%

- Dogecoin: +37.72%

- Fartcoin: +11.07%

- Pudgy Penguins: +3.82%

The basket's performance evolved through three distinct phases: an initial consolidation (July 14-16), a decisive breakout (July 16-17), and sustained momentum (July 17-21) that ultimately delivered nearly 30% returns.

Key Catalysts Driving Outperformance

Several significant market developments fueled the exceptional returns of Optima's strategies:

1. Institutional Recognition

Major exchanges like Binance removed "Seed" tags from several meme tokens, signaling growing institutional confidence in previously niche segments. This legitimization attracted fresh capital while Bitcoin experienced typical post-halving consolidation.

2. Ecosystem Development

Many tokens within Optima's baskets achieved significant milestones:

- FLOKI successfully launched its Valhalla play-to-earn metaverse game

- FLOKI achieved MiCA-compliance in the European Union

- DeFi protocols implemented substantial protocol upgrades

- Community-driven events bolstered engagement across multiple networks

3. Market Rotation Dynamics

The market displayed classic sector rotation behavior, with Bitcoin's dominance declining from 66% to 61.75%. This shift unlocked capital flows into alternative crypto sectors, precisely those captured by Optima's carefully curated baskets.

Why Optima's Approach Outperforms Individual Holdings

While individual tokens like FLOKI (+41.25%) posted impressive returns, Optima's basket approach offers several distinct advantages:

1. Optimal Risk Management

The Meme basket's +28.91% return came without the concentration risk of holding a single token. Had FLOKI underperformed, other components would have provided balance - a key consideration in the notoriously volatile meme token space.

2. Professional Curation

Not all tokens are created equal. Optima's selection process filters out weaker projects and focuses on those with stronger fundamentals, community backing, and growth potential. This expertise is particularly valuable in emerging sectors where quality assessment requires specialized knowledge.

3. Convenience and Efficiency

Managing multiple wallets, tracking various communities, and timing entries/exits across numerous tokens requires significant time and expertise. Optima's strategies handle this complexity for investors, allowing them to gain diversified exposure through a single, managed position.

4. Capturing Sector Momentum

While Bitcoin consolidated, Optima's strategies capitalized on distinct momentum shifts between different crypto sectors. The well-timed capture of the July 16-17 breakout demonstrates the value of active management in this rapidly evolving space.

Looking Ahead

As cryptocurrency markets continue maturing, the performance gap between strategic diversification and single-asset concentration may become increasingly pronounced. Bitcoin remains the foundational digital asset, but Optima's results demonstrate that thoughtfully curated exposure to emerging crypto sectors can significantly enhance portfolio performance.

For investors seeking both the stability of established crypto assets and the growth potential of emerging sectors, Optima's basket approach offers a compelling solution that has proven its value during periods of market divergence.

The lesson is clear: in crypto as in traditional markets, strategic diversification can deliver superior risk-adjusted returns - especially when guided by expert curation and sector-specific insight.