Optima Strategies vs BTC: Why Diversification Matters Even in Drawdowns

TL;DR

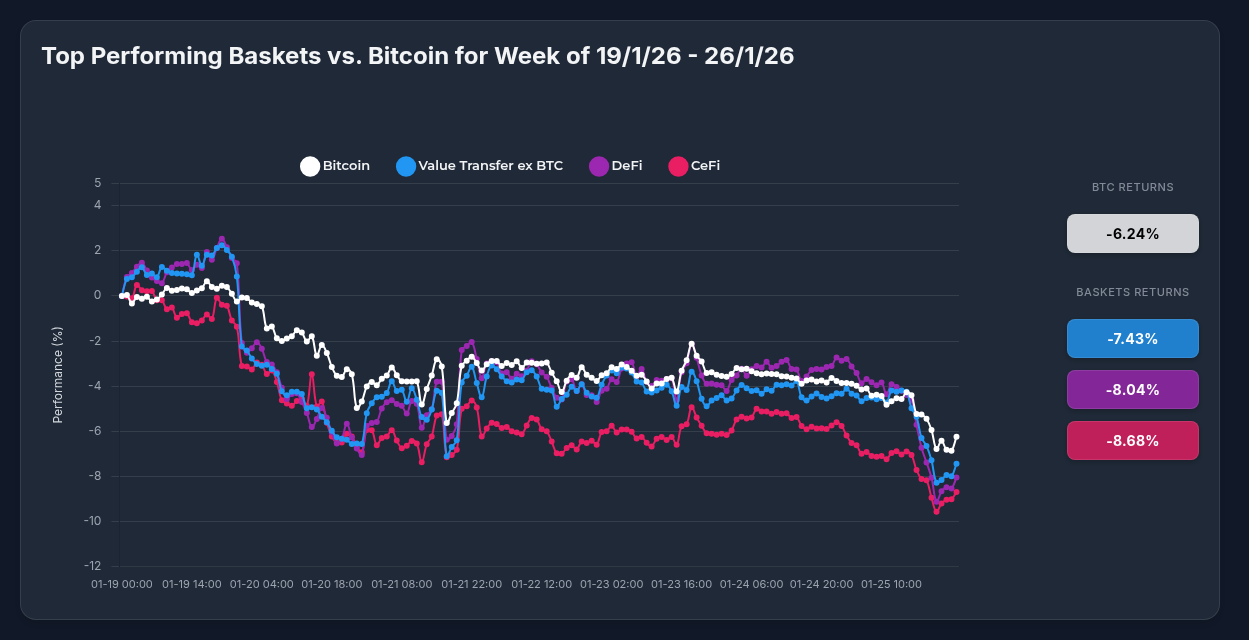

Performance (Jan 19-26, 2026):

- Bitcoin: -6.24%

- Optima Value Transfer ex BTC: -7.43% (best performing strategy)

- Optima DeFi: -8.04%

- Optima CeFi: -8.88%

Key Insight: While all strategies underperformed BTC this week, the 11.18% spread between OPVT's best and worst constituent assets (BCH -3.62% vs TAO -14.80%) demonstrates why holding diversified strategies protects against catastrophic single-asset losses.

A Brutal Week for Crypto—Nobody Escaped

The week ending January 26, 2026 delivered a reality check across cryptocurrency markets. Every asset we track posted negative returns as broad-based selling pressure intensified from January 20th onward. Bitcoin, often considered the defensive crypto asset, proved most resilient with a -6.24% decline. Our Optima strategies experienced steeper drawdowns, with Value Transfer ex BTC performing best at -7.43%.

The Three Phases of Decline

- Initial Breakdown (Jan 19-20): Optima baskets briefly outperformed (+2%) while BTC stayed flat, then synchronized selling began

- Synchronized Decline (Jan 21-23): All assets moved in tandem with 85-90% correlation, showing limited diversification benefit during peak stress

- Capitulation (Jan 24-26): Accelerated selling pushed all assets to weekly lows around -8% to -10% before minor recovery

What Drove the Selloff?

Market-Wide Factors:

- Extreme Fear: Crypto Fear & Greed Index dropped to 25 (extreme fear territory)

- Technical Breakdown: BTC broke below key support ranges, triggering cascading liquidations

- Risk-Off Sentiment: Institutional caution ahead of FOMC meeting and macroeconomic uncertainty

Bitcoin-Specific Dynamics:

- Trading range: $86,000-$87,000 (down from $97,000 peak on Jan 15)

- Critical support zone: $86,200-$85,200 under pressure

- Bullish counterpoint: Whale accumulation (32,700 BTC added since Jan 10) and $1.7B ETF inflows in three days suggest smart money sees value

Inside the Best Performer: Optima Value Transfer ex BTC

The OPVT strategy's -7.43% decline masked significant divergence among its three constituents:

| Asset | 7-Day Performance | Key Catalysts |

|---|---|---|

| Bitcoin Cash (BCH) | -3.62% | Defensive outperformance; strong technical fundamentals (32MB blocks, upcoming 2-min block times, CashTokens) |

| Litecoin (LTC) | -7.46% | Oversold RSI (33.44); institutional accumulation of 3.7M LTC in late 2025 provides floor |

| Bittensor (TAO) | -14.80% | Post-halving volatility (emissions cut from 7,200 to 3,600 TAO/day); profit-taking despite Grayscale TAO Trust launch |

Performance Spread: The 11.18 percentage point difference between BCH and TAO illustrates why individual asset selection is treacherous—TAO holders suffered double the strategy's losses.

The Case for Strategies Over Single Assets

1. Risk Mitigation Through Diversification

If you'd held TAO individually this week, you'd be down -14.80%. The OPVT strategy's diversification reduced that exposure to -7.43%—a 7.37 percentage point cushion. In volatile markets, that's the difference between panic selling and riding out the storm.

2. Volatility Smoothing Across Catalysts

Different assets declined for different reasons at different times:

- TAO's halving-induced volatility

- LTC's retail sentiment weakness

- BCH's defensive positioning amid network upgrades

This lack of perfect correlation—even during stress—means drawdowns are less severe than worst-case individual outcomes.

3. Systematic Exposure Without Idiosyncratic Risk

The OPVT strategy gives you exposure to the value transfer thesis (fast, low-cost blockchains) without betting the farm on any single protocol's execution risk, governance drama, or temporary setbacks.

4. Rebalancing Advantage

As assets diverge (like this week's 11.18% spread), systematic rebalancing automatically sells relative strength (BCH) and buys relative weakness (TAO)—capturing mean-reversion opportunities that emotional individual holders typically miss.

Outlook: Bearish Near-Term, Strategic Long-Term

Technical Picture: Bearish across the board. BTC faces critical support tests at $85,200; failed levels and accelerating losses suggest further downside risk. OPVT constituents show similar weakness.

Fundamental Counterpoints:

- BTC: Whale accumulation + massive ETF inflows signal institutional confidence; ARK maintains $1M target by 2030

- BCH: Technical upgrades (2-min blocks, CashTokens) enhance value proposition

- LTC: Institutional accumulation of 3.7M coins provides price floor

- TAO: Halving-induced scarcity + Grayscale adoption = long-term bullish setup

Key Levels to Watch:

- BTC: $85,200 support (breakdown targets $82,265); $103,665 breakout for growth resumption

- BCH: $585 support, $597 resistance

- LTC: $66 critical support, $80-$85 recovery zone

- TAO: $60-$75 accumulation zone

Final Verdict: Diversification Is Defense

Yes, Optima strategies underperformed Bitcoin this week. That stings. But here's what matters: our best strategy limited losses to -7.43% while its worst constituent crashed -14.80%.

In bear markets, the goal isn't to win—it's to not lose catastrophically. Diversified strategies achieve this by:

- Smoothing volatility across uncorrelated catalysts

- Eliminating single points of failure

- Enabling systematic rebalancing into weakness

- Maintaining exposure to structural themes (value transfer, DeFi, CeFi) without concentration risk

Bitcoin's relative outperformance this week confirms its role as a defensive crypto asset. But for investors seeking diversified exposure to emerging crypto sectors, disciplined multi-asset strategies remain the prudent path—especially when volatility creates the widest performance spreads.

Position wisely. Rebalance systematically. Survive to thrive.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Past performance does not guarantee future results. Cryptocurrency investments carry significant risk. Consult a financial professional before making investment decisions.