Optima's CeFi Strategy Outperforms Bitcoin by 6.72%: Why Diversification Wins in Volatile Markets

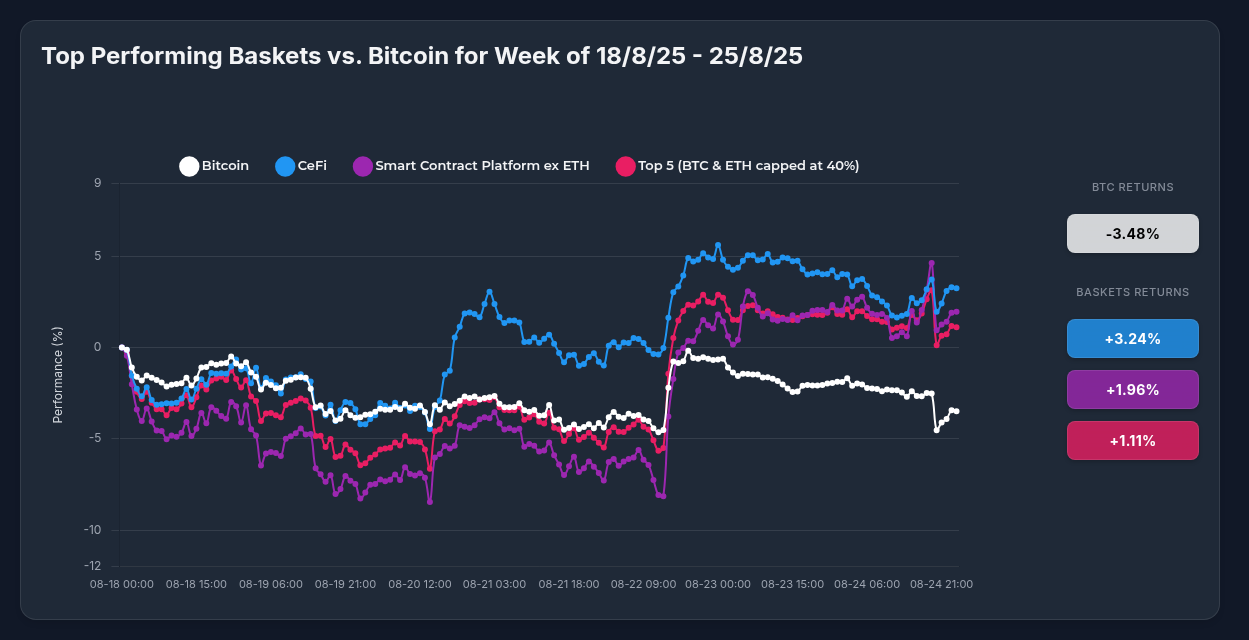

In a week marked by significant market volatility, Optima Financial's CeFi strategy has demonstrated remarkable resilience, delivering a positive 3.24% return while Bitcoin declined by 3.48% – representing a substantial 6.72% outperformance. This divergence highlights the powerful benefits of strategic diversification in cryptocurrency markets, particularly during periods of sector rotation and heightened uncertainty.

Market Dynamics: Bitcoin's Struggle vs. Optima's Rise

The week of August 18-25, 2025 presented a challenging environment for cryptocurrency investors. Bitcoin, which had recently touched an all-time high of $124,290 on August 13, experienced significant downward pressure, falling to approximately $111,749 by week's end. This 3.48% weekly decline occurred amid broader market volatility, with Bitcoin failing to participate in the recovery seen across other digital assets.

By contrast, all three top-performing Optima strategies delivered positive returns:

- CeFi basket: +3.24% (strongest performer)

- Smart Contract Platform ex ETH: +1.98%

- Top 5 (BTC & ETH capped at 40%): +1.11%

This performance bifurcation tells a compelling story about market dynamics and the advantages of professionally managed crypto exposure.

Anatomy of a Winning Strategy: Inside the CeFi Basket

The standout performer, Optima's CeFi strategy, showcases how strategic diversification can capture exceptional opportunities while mitigating downside risks. The strategy's 3.24% gain masks dramatic differences between individual components, with returns ranging from an extraordinary +68.38% (OKB) to a modest -4.28% (NEXO).

Key contributors to performance included:

- OKB: +68.38%, driven by a historic token burn that destroyed approximately 65 million tokens (valued at over $7 billion), slashing supply by 52% and capping maximum supply at 21 million tokens

- Cronos (CRO): +3.93%, buoyed by expectations of a stablecoin launch in late Q3 2025

- BNB: +2.23%, benefiting from Binance's ecosystem growth with over 5,800 decentralized applications and $13.4 billion in Total Value Locked

This 72.66 percentage point spread between best and worst performers underscores why diversification matters in volatile markets.

Market Catalysts: What Drove Price Movements?

Several key catalysts influenced market dynamics during this period:

- Bitcoin Whale Activity: A significant whale moved 24,000 BTC (worth ~$2.7B), reportedly selling BTC to buy ETH. This single move contributed to Bitcoin's decline to ~$112K and erased approximately $45B in market value.

- OKX's Deflationary Move: The extraordinary OKB token burn on August 13 created an immediate supply shock, triggering significant buying pressure as investors recognized the potential long-term value proposition.

- Jackson Hole Uncertainty: The Federal Reserve symposium and broader economic headwinds contributed to market volatility, with Bitcoin particularly sensitive to macroeconomic sentiment.

- Technical Recovery Patterns: After initial declines reaching approximately -8% to -10% at the trough around August 21st, most assets except Bitcoin demonstrated strong recovery patterns.

These catalysts highlight the complex interplay of tokenomics, macroeconomic factors, and market technicals that drive cryptocurrency returns.

The Diversification Advantage: Why Optima Strategies Outperformed

The performance disparity between Optima's strategies and Bitcoin demonstrates several key advantages of professional diversification:

- Risk Management Through Diversification: While OKB's extraordinary performance is appealing, concentrating in a single asset would have exposed investors to significant volatility. The index approach captured upside while mitigating single-token risk.

- Reduced Correlation During Market Stress: When Bitcoin experienced selling pressure, Optima's strategies demonstrated lower correlation, providing valuable portfolio protection.

- Capture of Sector-Specific Opportunities: The CeFi basket's ability to benefit from exchange token innovations (particularly OKB's supply shock) demonstrates how targeted exposure can capture alpha.

- Automatic Rebalancing: As market conditions shifted dramatically, the strategies maintained balanced exposure without requiring active trading decisions, reducing transaction costs and emotional biases.

- Smoother Performance Curve: The positive returns across all Optima strategies demonstrate how diversification can deliver steady growth even when major assets like Bitcoin experience significant volatility.

Technical Outlook: Divergence Suggests Sector Rotation

From a technical perspective, the divergence between Bitcoin and Optima's strategies suggests a potential sector rotation within cryptocurrency markets. The ability of all three baskets to not only recover from significant mid-week declines but achieve positive returns demonstrates underlying strength and suggests these diversified crypto strategies are providing effective risk management.

The CeFi basket's +3.24% return represents a 6.72% outperformance versus Bitcoin's -3.48%, indicating strong relative momentum. This technical picture presents a cautiously optimistic outlook for the Optima baskets with a neutral-to-bearish view on Bitcoin.

Conclusion: The Case for Strategic Diversification

The week's performance data makes a compelling case for strategic diversification in cryptocurrency investing. While Bitcoin remains a cornerstone digital asset with strong long-term fundamentals, its recent underperformance highlights the risks of concentrated exposure.

Optima's strategies – particularly the CeFi basket – demonstrate how professionally managed, diversified exposure can navigate volatile market conditions while capturing emerging opportunities. By balancing risk and return across carefully selected assets, these strategies provide a more resilient approach to cryptocurrency investing.

For investors seeking to participate in the digital asset revolution while managing volatility, Optima's diversified strategies offer a sophisticated alternative to single-asset exposure – a proposition validated by this week's substantial outperformance versus Bitcoin.