Optima's CeFi Strategy Outperforms Bitcoin by 9.93% in One Week: The Power of Strategic Diversification

In the ever-evolving landscape of digital assets, the performance gap between strategic token baskets and standalone cryptocurrencies continues to widen. This past week provided a striking example as Optima's CeFi strategy delivered impressive results while Bitcoin struggled to maintain momentum.

Performance Analysis: Optima Strategies vs. Bitcoin

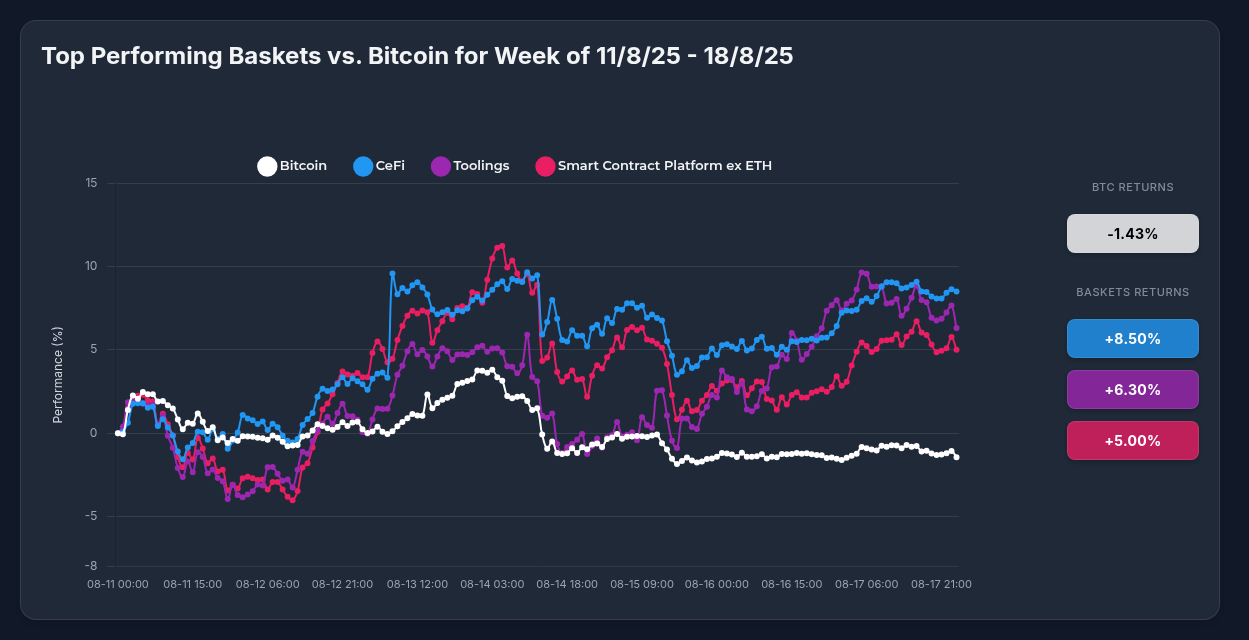

The week of August 11-18, 2025 revealed a remarkable divergence between Bitcoin and Optima's top-performing strategies:

- Bitcoin: -1.43%

- Optima CeFi Basket: +8.50% (outperforming BTC by 9.93%)

- Optima Toolings Basket: +6.30% (outperforming BTC by 7.73%)

- Optima Smart Contract Platform ex ETH: +5.00% (outperforming BTC by 6.43%)

This performance disparity demonstrates the value proposition of Optima's thematic investment approach, particularly in market conditions where Bitcoin experiences consolidation or correction phases.

Anatomy of Success: Inside the CeFi Strategy

The standout performer, Optima's CeFi strategy, showcases how strategic diversification can capture extraordinary opportunities while mitigating individual asset risk. The basket's composition reveals both concentration effects and balanced exposure:

Key Performance Drivers

The extraordinary performance of OKB (+156.66%) served as the primary catalyst for the CeFi basket's success. This remarkable gain was driven by:

- Supply Reduction: OKX's strategic burn of 65.26 million tokens, creating significant scarcity by reducing total supply to just 21 million tokens

- Technological Advancement: The implementation of "PP Upgrade" technology enhanced OKX's X Layer network infrastructure, dramatically improving performance metrics to 5,000 TPS with near-zero fees

Additional positive contributors included:

- KuCoin Token (KCS): +11.14%, supported by its new loyalty program and airdrop events

- Binance Coin (BNB): +6.47%, bolstered by upcoming token listings and institutional adoption

The basket also contained assets with more modest performance, including NEXO (-2.29%) and Cronos (-8.25%), highlighting how diversification successfully mitigated downside exposure.

Market Catalysts Driving Performance

Several market-wide catalysts influenced the performance divergence between Optima strategies and Bitcoin:

1. Token Economic Innovations

Strategic supply management through token burns and deflationary mechanisms has become a powerful price driver for CeFi tokens, creating value through scarcity while Bitcoin's fixed emission schedule remains unchanged.

2. Technological Differentiation

CeFi platforms are rapidly enhancing their technological foundations, with OKX's X Layer and BNB Chain's multichain integration demonstrating how infrastructure improvements directly translate to token value appreciation.

3. Regulatory Evolution

While Bitcoin has long benefited from regulatory clarity as a commodity, the extension of similar classifications to major exchange tokens (particularly BNB) has reduced uncertainty for institutional investors exploring beyond Bitcoin.

4. Market Rotation Dynamics

The data suggests a classic market rotation from Bitcoin into altcoins, as evidenced by Bitcoin's declining market dominance (around 59-60%) despite its recent all-time high near $124,000.

The Diversification Advantage

Optima's strategy baskets demonstrate several key advantages over holding individual assets like Bitcoin:

1. Capturing Black Swan Opportunities

The CeFi basket's incorporation of OKB allowed investors to benefit from its extraordinary 156.66% gain without having to predict which specific token would outperform. This eliminated the need for perfect timing or specialized knowledge.

2. Enhanced Risk-Adjusted Returns

Despite including assets with negative performance, the CeFi basket delivered strong positive returns, demonstrating how proper diversification can enhance risk-adjusted performance metrics.

3. Reduced Volatility

The basket's 8.50% return represents significantly less volatility than OKB's 156.66% surge, providing a more stable growth trajectory preferred by many sophisticated investors.

4. Sector-Specific Exposure

While Bitcoin serves as a digital gold and inflation hedge, Optima's thematic baskets provide targeted exposure to specific growth sectors within the digital asset ecosystem.

Looking Forward: Strategic Implications

The performance disparity between Optima strategies and Bitcoin highlights the evolving maturity of the digital asset market. As the ecosystem diversifies, Bitcoin's role appears to be consolidating as a reserve asset while thematic investments capture sector-specific growth opportunities.

For investors seeking to "earn like the top 1%," the data suggests that a balanced approach incorporating both Bitcoin for stability and strategically diversified baskets for outperformance potential may offer the optimal risk-reward profile.

Optima's performance this week demonstrates that properly constructed thematic baskets can deliver significant alpha compared to single-asset holdings, particularly during periods of market rotation and sector-specific catalysts.