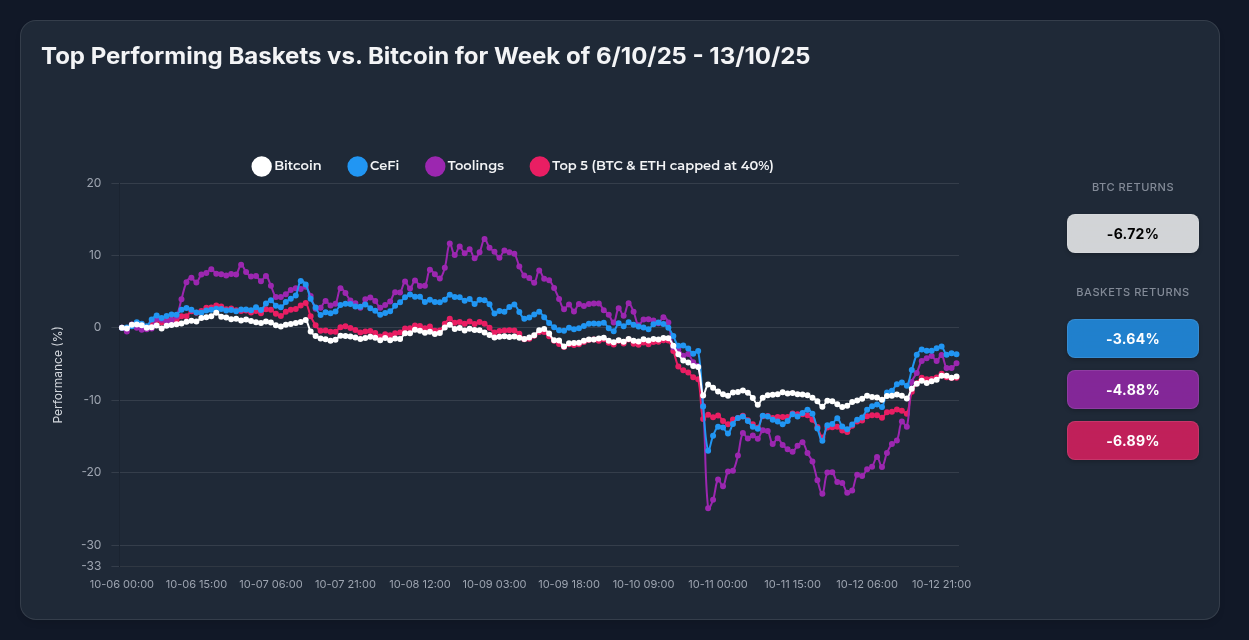

Optima's CeFi Strategy Outperforms Bitcoin During October Market Turbulence

In the volatile cryptocurrency landscape of October 2025, diversified investment approaches have proven their worth. Optima Financial's CeFi strategy demonstrated remarkable resilience during a week of extreme market volatility, significantly outperforming Bitcoin's standalone performance.

Market Context: A Week of Extraordinary Volatility

The cryptocurrency market experienced a significant correction between October 6-13, 2025, with Bitcoin falling from its all-time high of approximately $126,198 on October 6 to around $115,153 by October 13 - representing a decline of nearly 9%. This correction was part of a broader market downturn triggered by several macro factors:

- The ongoing U.S. government shutdown (13 days and counting)

- Escalating geopolitical tensions, particularly around potential new tariffs

- A massive market liquidation event that saw $7 billion wiped out in a single hour

- Isolated stablecoin depegging incidents that further rattled market confidence

Optima's CeFi Strategy: Weathering the Storm

While Bitcoin experienced a significant drawdown of approximately -12%, Optima's CeFi strategy demonstrated superior resilience with a decline of just -3.64% over the same period - outperforming Bitcoin by 8.36 percentage points.

The CeFi strategy's performance showcased a distinctive V-shaped pattern:

- Initial stability (October 6-7): Relatively flat performance while Bitcoin began its descent

- Sharp decline phase (October 8-10): A drawdown reaching approximately -15%, followed by

- Strong recovery phase (October 11-13): A substantial bounce-back that significantly reduced losses

Divergent Asset Performance: The Power of Diversification

The key to the CeFi strategy's outperformance lies in its diversified approach. The basket includes several major centralized finance tokens with dramatically different performance profiles during the turbulent week:

- BNB: +11.44% (The star performer)

- Gate Token (GT): -1.55% (Minimal impact)

- Bitget Token (BGB): Moderate performance

- OKB: -16.18% (Significant decline)

- Cronos (CRO): -17.51% (Largest decline)

- NEXO: Moderate decline

This performance disparity highlights the fundamental benefit of Optima's strategy - BNB's exceptional 11.44% gain significantly offset the losses from other components, creating a net result far superior to holding Bitcoin alone.

Catalysts Behind Individual Asset Movements

BNB's Remarkable Resilience

BNB's standout performance can be attributed to several factors:

- Reaching a new all-time high around $1,370-$1,375

- Binance's proactive response to market chaos, including a $283 million user compensation plan

- Continued ecosystem expansion and strong fundamental metrics

Challenges for Underperforming Assets

The weaker performers faced specific headwinds:

- Cronos (CRO): Delays in potential ETF approval due to the U.S. government shutdown

- OKB: Despite implementing a token burn strategy that reduced supply by 52%, market sentiment remained negative

The Strategic Advantage: Why Optima's Approach Outperforms

The performance difference between Optima's CeFi strategy and Bitcoin illustrates several key benefits of Optima's approach:

1. Superior Risk Mitigation Through Diversification

By spreading investment across multiple CeFi tokens, the strategy dramatically reduced the impact of any single underperforming asset. While Cronos and OKB experienced significant declines (-17.51% and -16.18% respectively), BNB's strong performance (+11.44%) substantially offset these losses.

2. Reduced Volatility

The strategy's daily fluctuation averaged approximately -0.52% per day, significantly lower than Bitcoin's more dramatic movements. This reduced volatility makes the CeFi strategy more suitable for investors seeking steadier performance.

3. Sector-Specific Advantages

While Bitcoin represents the overall crypto market, Optima's focused CeFi strategy capitalizes on the specific dynamics of centralized exchanges and financial platforms. This sector-specific approach enables investors to benefit from the unique growth drivers in the CeFi space.

4. Professional Selection and Management

Optima's expertise in selecting representative assets ensures investors gain exposure to quality tokens with strong fundamentals and utility, without requiring specialized knowledge of each individual asset.

Looking Forward: Opportunity Amid Volatility

The recent market turbulence creates both challenges and opportunities:

- Current market positioning suggests a neutral to slightly bearish short-term outlook

- Key support level at -15% (recent lows) appears to be holding

- A breakout above +5% would signal confirmed recovery

For investors seeking exposure to the cryptocurrency space while managing risk, Optima's diversified strategies offer a compelling alternative to direct Bitcoin investment. The recent performance demonstrates how strategic diversification can provide meaningful protection during market downturns while maintaining significant upside potential.

As cryptocurrency markets continue to evolve and mature, the value proposition of professionally managed, diversified strategies becomes increasingly clear. Optima's approach not only mitigates risk but potentially delivers superior risk-adjusted returns compared to single-asset holdings.