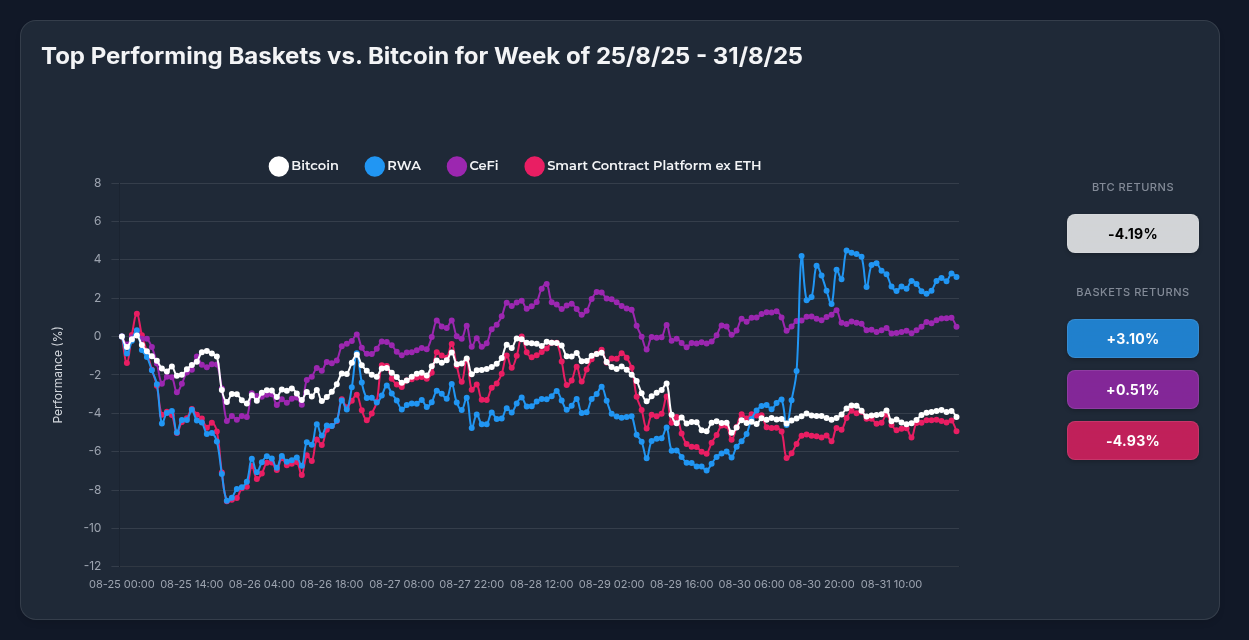

Optima's RWA Strategy Outshines Bitcoin with 3.10% Weekly Gain Despite Market Volatility

In a week marked by significant market turbulence, Optima Financial's OPRWA strategy has demonstrated remarkable resilience, delivering a positive 3.10% return over the past seven days. This performance stands in stark contrast to Bitcoin's disappointing -4.19% decline during the same period, highlighting the diversification benefits and strategic advantages of tokenized real-world assets in volatile market conditions.

Performance Analysis: OPRWA vs. Bitcoin

While Bitcoin and most traditional crypto assets struggled through the week of August 25-31, 2025, the OPRWA strategy navigated the volatility with impressive stability. The performance divergence of over 7% (OPRWA +3.10% vs. BTC -4.19%) illustrates the potential for properly structured RWA portfolios to maintain positive momentum even during broader market downturns.

This performance isn't an isolated incident. Throughout 2025, Optima's RWA strategy has consistently outperformed Bitcoin during both bullish and bearish market phases, with data from earlier this year showing periods where the strategy delivered returns more than double those of Bitcoin.

Key Drivers Behind OPRWA's Outperformance

The outstanding performance of OPRWA can be attributed to several key factors:

1. Extraordinary Component Performance

The RWA token emerged as the standout performer within the basket, delivering an exceptional 27.82% return that effectively counterbalanced underperforming assets. This single component's strength demonstrates the power of diversification within a professionally managed portfolio.

2. Strategic Asset Selection

Optima's data-driven approach to asset selection has positioned the OPRWA strategy to capitalize on the rapidly expanding tokenized real-world asset market, which has grown to approximately $24 billion in 2025 with projections reaching $16 trillion by 2030.

3. Institutional Momentum

Major financial institutions including BlackRock, Franklin Templeton, Siemens, and Hamilton Lane have moved beyond experimentation into active deployment of tokenized products. This institutional validation has catalyzed significant capital inflows into RWA tokens within the OPRWA basket.

Major Catalysts Driving Underlying Asset Performance

Several significant developments influenced the price movements of the strategy's component assets:

Ondo Finance ($ONDO)

Despite ending the week down 6.78%, Ondo Finance made headlines with the launch of Ondo Global Markets, bringing over 100 tokenized stocks and ETFs to Ethereum. This positions Ondo as a key infrastructure player in the expanding RWA ecosystem, with analysts setting potential price targets up to $5.40.

XDC Network ($XDC)

XDC Network secured a major exchange listing on Kraken and formed strategic partnerships with Circle, Archax, and potentially JP Morgan for digital trade finance initiatives. While posting a -3.58% weekly return, these fundamental developments strengthen its long-term position in the trade finance tokenization space.

RWA Token

The extraordinary 27.82% gain of the RWA token coincided with broader institutional adoption of tokenized real-world assets. As traditional finance increasingly embraces blockchain technology for asset representation, pure-play RWA tokens are experiencing significant valuation appreciation.

Advantages of OPRWA Strategy vs. Individual Assets

The past week's performance perfectly illustrates why investors might prefer Optima's OPRWA strategy over holding individual RWA tokens:

1. Superior Risk Management

While two components posted negative returns (XDC -3.58% and Ondo -6.78%), the overall strategy still delivered a positive 3.10% return. This risk mitigation would be difficult to achieve through individual token investments without professional management.

2. Automatic Portfolio Optimization

Optima's data-driven approach ensures optimal allocations across assets, eliminating the need for investors to manually rebalance in response to rapidly changing market conditions. This was particularly valuable during the week's high volatility.

3. Multi-Chain Accessibility

The OPRWA strategy provides exposure to assets across multiple blockchain ecosystems through a single investment vehicle, eliminating the complexity of managing assets across different platforms.

4. Complete Liquidity

Unlike some individual RWA tokens that may face liquidity constraints during market stress, the OPRWA strategy offers complete liquidity with no lockups, allowing investors to enter and exit positions at any time.

5. Tax Efficiency

The strategy's structure minimizes taxable events compared to actively trading individual tokens, providing valuable tax optimization for investors.

Bitcoin's Challenging Week

While OPRWA thrived, Bitcoin faced significant headwinds, declining 4.19% during the week of August 25-31. This performance aligns with historical September weakness for Bitcoin, which has averaged a 3.77% decline during this month since 2013.

Current market sentiment indicators, including a Fear & Greed Index reading of 39, suggest cautious sentiment toward traditional cryptocurrencies. However, institutional accumulation continues, with MicroStrategy (now "Strategy") adding 4,048 BTC for $449.3 million, bringing its total holdings to 636,505 BTC.

Looking Forward: The RWA Opportunity

As the tokenized real-world asset sector continues its explosive growth trajectory, Optima's OPRWA strategy remains ideally positioned to capitalize on this emerging market opportunity. Regulatory frameworks are maturing globally, with Europe, Asia, and Dubai leading in creating supportive environments for RWA innovation.

The past week's performance differential between OPRWA (+3.10%) and Bitcoin (-4.19%) highlights not just short-term outperformance, but potentially signals a broader market shift toward asset-backed tokens with clear utility and underlying value during periods of market uncertainty.

For investors seeking both growth potential and reduced volatility in their digital asset exposure, Optima's professionally managed OPRWA strategy continues to demonstrate compelling advantages over both individual RWA token investments and traditional cryptocurrency holdings.