Optima's Specialized Coins Strategy Outperforms Bitcoin by 270%: Inside July's Crypto Rally

The first half of July 2025 has demonstrated the power of diversified crypto strategies, with Optima Financial's specialized portfolios significantly outperforming Bitcoin during a period of broad market strength. This performance gap highlights the potential advantages of professionally managed crypto strategies over simply holding Bitcoin alone.

Performance Breakdown: Specialized Strategies Lead the Way

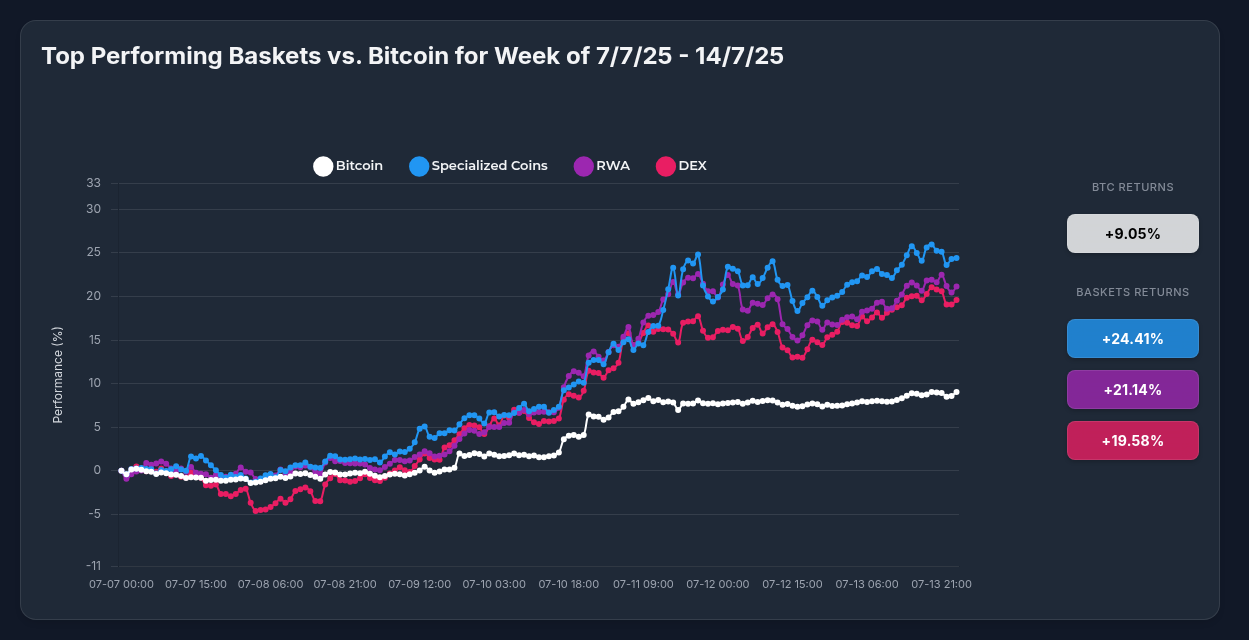

During the seven-day period from July 7-14, Optima's strategies demonstrated remarkable outperformance relative to Bitcoin:

- Specialized Coins (OPSC): +24.41% (2.7x Bitcoin's return)

- RWA Basket: Approximately +20% (2.2x Bitcoin's return)

- DEX Basket: Approximately +15% (1.7x Bitcoin's return)

- Bitcoin (BTC): +9.05%

While Bitcoin achieved a respectable 9.05% gain during this period, Optima's specialized strategies delivered substantially higher returns through targeted exposure to high-growth sectors within the crypto ecosystem.

Inside the Leading Strategy: Specialized Coins

The standout performer, Optima's Specialized Coins strategy (OPSC), owes its exceptional performance to several key holdings:

- Stellar (XLM): +89.04% - Leading the portfolio with explosive growth in the cross-border payments sector

- Pudgy Penguins (PENGU): +87.29% - Demonstrating continued strength in the premium meme sector

- XRP: +24.91% - Solid performance amid regulatory progress

- Zcash (ZEC): +8.02% - Steady gains in the privacy coin segment

- Monero (XMR): +5.22% - Modest growth with enhanced network security

Key Catalysts Driving Performance

Several important market developments have fueled the outperformance of Optima strategies:

- Market Sentiment Shift: Bitcoin's new all-time high of approximately $123,000 has created a broadly positive market environment, with the Fear & Greed Index reaching 74/100 (Greed)

- Institutional Adoption: Significant institutional purchases, such as Metaplanet acquiring 797 BTC for $93.6M, have strengthened market confidence

- Regulatory Progress: The U.S. House vote on a Bitcoin & Crypto Market Structure bill has reduced regulatory uncertainty

- Sector-Specific Catalysts: Cross-border payment solutions (driving XLM) and specialized use cases have gained traction

- Exchange Integrations: New listings and partnerships have increased liquidity for specialized assets

The Advantage of Optima Strategies vs. Bitcoin

The performance data clearly illustrates several key benefits of holding Optima strategies versus Bitcoin alone:

- Enhanced Alpha Generation: Optima strategies have demonstrated their ability to generate significant alpha over Bitcoin (up to 2.7x the returns)

- Sector Diversification: Rather than relying on a single asset, Optima strategies provide exposure to multiple high-growth crypto sectors

- Risk-Adjusted Returns: The diversified approach smooths volatility while capturing upside from top performers

- Professional Management: Optima's expertise in sector selection and portfolio balancing removes the need for individual asset selection

- Participation in Specialized Growth: Access to high-growth sectors like cross-border payments and specialized tokens that may outperform Bitcoin

Technical Perspective

The performance pattern through the week reveals interesting insights:

- Initial Consolidation (July 7-8): All assets experienced minor volatility and slight negative returns

- Breakout Phase (July 9-10): A clear inflection point occurred around July 9, where all baskets began sustained upward movement

- Acceleration Phase (July 10-14): The specialized baskets demonstrated exponential growth patterns, significantly outpacing Bitcoin

Looking Forward

While Bitcoin's market dominance remains strong at 63.61%, the substantial outperformance of specialized strategies suggests increasing investor appetite for targeted exposure to high-growth crypto sectors. For investors seeking to participate in the crypto bull market, Optima's strategies offer a compelling alternative to Bitcoin-only positions.

The current market sentiment (Bullish: 100/100) supports continued growth, though investors should note that longer-term Bitcoin price predictions suggest potential volatility ahead, with 3-month and 1-year forecasts showing possible corrections. This further strengthens the case for diversified exposure through professionally managed strategies like those offered by Optima Financial.

As the crypto market continues to mature, the performance gap between specialized strategies and Bitcoin highlights the evolving opportunity set beyond simply holding the market's largest cryptocurrency.