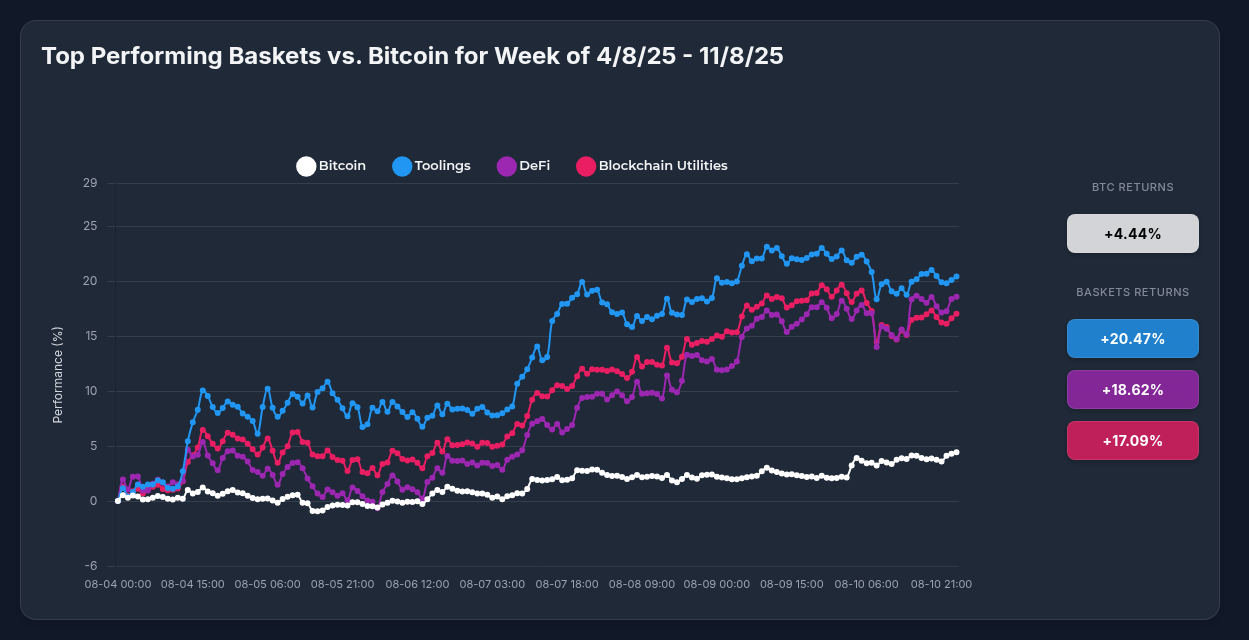

Optima's Toolings Strategy Outperforms Bitcoin by 16%: Why Strategic Diversification is Winning in the Bull Market

In an impressive demonstration of the power of strategic diversification, Optima Financial's Toolings strategy has delivered exceptional returns of +20.47% over the past week, outperforming Bitcoin's +4.44% by a substantial 16 percentage points. This performance highlights the growing value of professionally managed exposure to specialized blockchain infrastructure solutions in today's rapidly evolving crypto market.

Breaking Down the Performance Gap

While Bitcoin maintained its position as the stable cornerstone of the crypto market with a respectable +4.44% gain, Optima's strategic baskets delivered significantly stronger returns:

- Toolings Basket: +20.47% (Outperforming BTC by 16.03%)

- DeFi Basket: +18.62% (Outperforming BTC by 14.18%)

- Blockchain Utilities Basket: +17.09% (Outperforming BTC by 12.65%)

This performance differential isn't just impressive in isolation – it represents a consistent pattern. In late July, Optima's strategies similarly outpaced Bitcoin, with the Meme Basket delivering +28.91%, Specialized Coins +21.75%, and DeFi Basket +19.88% against Bitcoin's -1.72% during that period.

The Mantle Effect: Star Performer Driving Toolings Growth

The standout performance within the Toolings basket came from Mantle (MNT), which surged an extraordinary +44.97% during the period. This remarkable growth was supported by several fundamental catalysts:

- Strategic partnership with Bybit enhancing institutional access

- UR Global Money App integration bridging traditional and crypto finance

- Strong treasury position providing fundamental stability

- Increasing transaction volumes indicating growing adoption

- Expanding DeFi ecosystem creating additional utility

While Mantle's performance was exceptional, the basket's design prevented overconcentration, with other components providing balanced contributions: Ethereum Name Service (ENS) at +15.86%, VeChain (VET) at +8.97%, and Quant (QNT) at +2.75%.

Why Macro Factors Are Driving Both Bitcoin and Toolings—But Differently

The current market environment is uniquely favorable for both Bitcoin and specialized crypto sectors, but with different magnitudes of impact:

For Bitcoin:

- Continuing institutional adoption through ETFs (with $50B+ in Q1 2025 inflows)

- Growing corporate treasury adoption as a reserve asset

- Increasing mainstream financial acceptance

- Massive global liquidity expansion from fiscal policy

For Toolings and Specialized Strategies:

- All Bitcoin's tailwinds, plus:

- Accelerating enterprise blockchain adoption

- Higher beta characteristics in bull markets

- Strategic sector rotation as institutions seek specialized exposure

- Fundamental growth in usage of underlying protocols

This dynamic explains why Optima's strategies can significantly outperform during bullish periods while maintaining diversification benefits.

The Strategic Advantage of Basket Investing

The performance disparity between Optima's strategies and Bitcoin highlights several key advantages of professionally managed basket investing:

- Superior Risk-Adjusted Returns: Optima's Toolings strategy delivered 4.6x Bitcoin's return with carefully managed volatility through strategic diversification.

- Professional Selection and Weighting: The basket's components represent a carefully curated exposure to the blockchain infrastructure sector, selected and weighted by professionals.

- Reduced Single-Asset Risk: While Mantle's extraordinary performance drove significant gains, the basket approach protected investors from the potential volatility of a single-asset position.

- Sector-Wide Exposure: The positive performance across all components indicates sector-wide momentum that individual token selection might miss.

- Accessibility and Convenience: Investors gain sophisticated exposure without needing specialized knowledge or managing multiple positions across different platforms.

Looking Forward: Catalysts for Continued Outperformance

Several factors suggest Optima's strategies may continue to outperform Bitcoin in the coming quarters:

- Institutional Diversification: As 86% of institutions plan crypto exposure, many seek diversified positions beyond just Bitcoin

- Enterprise Adoption Acceleration: Growing integration of blockchain infrastructure into business processes

- Regulatory Clarity: Improved regulatory framework benefiting compliant, utility-focused projects

- Market Cycle Positioning: Mid-bull market typically sees rotation into higher beta assets

- Liquidity Environment: Unprecedented fiscal expansion creating favorable conditions for growth assets

Conclusion: The Strategic Advantage

Optima's remarkable outperformance versus Bitcoin demonstrates that while Bitcoin remains the foundational asset of the crypto ecosystem, strategic diversification through professionally managed baskets can deliver significantly enhanced returns with controlled risk.

As we progress through this bull market cycle, investors who rely solely on Bitcoin exposure may be leaving substantial returns on the table. Optima's EU-regulated, tokenized investment strategies provide an accessible way for both retail and institutional investors to capture the full potential of the digital asset ecosystem while benefiting from professional management and strategic diversification.

In a market environment characterized by massive liquidity expansion and growing institutional adoption, the data is clear: strategic diversification through Optima's specialized baskets is providing a significant edge over single-asset Bitcoin exposure.