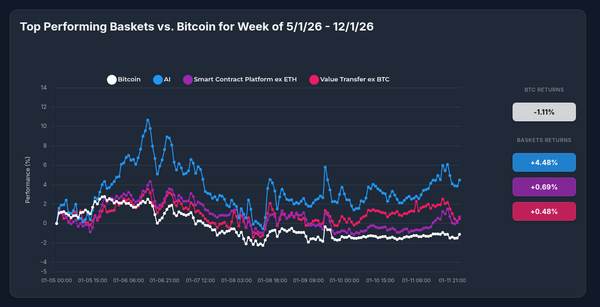

Optima's Value Transfer Strategy Outperforms Bitcoin: +2.27% vs -0.27% in Volatile Week

TL;DR

While Bitcoin stumbled to -0.27% last week, Optima's Value Transfer ex BTC strategy delivered +2.27%—a 254 basis point advantage. Bitcoin Cash's 10.37% surge powered the basket, while diversification cushioned Bittensor's decline. The data proves a critical point: smart diversification beats concentration, even when you're concentrating on the king.

The Performance Gap: Strategy vs. Single Asset

From December 1-7, the market delivered a masterclass in why basket strategies exist:

- Value Transfer ex BTC: +2.27%

- Bitcoin: -0.27%

- Top 5 Capped Basket: +0.90%

- Top 20 Capped Basket: +0.96%

All assets endured synchronized selling pressure early in the week (Dec 1-2), with drawdowns reaching -8% to -9%. But recovery patterns diverged sharply. While Bitcoin failed to sustain gains above 2-3%, the Value Transfer strategy demonstrated superior momentum, reaching peaks around +6-7% before consolidating.

What Drove the Outperformance?

Bitcoin Cash: The MVP

BCH's exceptional +10.37% weekly gain wasn't luck—it was catalyzed by:

- mF International's $500M institutional treasury purchase

- 35% spike in active addresses

- $50B+ annual transaction volume

- Nearly 40% YTD gains, making it 2025's top Layer-1 performer

Litecoin: The Steady Hand

LTC contributed +1.84%, supported by:

- LitecoinVM upgrade bringing EVM compatibility

- 1-second block times and sub-cent fees

- New DeFi capabilities unlocking dormant capital

Bittensor: The Temporary Drag

TAO's -5.01% decline created short-term headwinds, but fundamental catalysts remain intact:

- December 2025 halving event approaching

- 128 active subnets competing for emissions

- AI ecosystem offering 100-400% APY opportunities

Why Bitcoin Lagged

Bitcoin's -0.27% performance reflects a critical market shift. Current sentiment sits at extreme fear (20/100 on Fear & Greed Index) despite:

- Price: $91,528.88 (+2.49% in 24h at time of analysis)

- YTD Performance: +74%

- Strong institutional flows via ETFs

The data suggests rotation away from pure store-of-value narratives toward utility-focused cryptocurrencies. Bitcoin's correlation breakdown with diversified baskets during the recovery phase (Dec 2-4) signals changing market dynamics.

Major Price Catalysts Across Assets

Bitcoin Cash: Institutional validation through treasury allocations + technical breakout above $600 = bullish momentum confirmation

Litecoin: LitecoinVM transforming the network from payment rail to DeFi platform = potential capital reactivation

Bittensor: Halving event + subnet expansion = maturing decentralized AI infrastructure (volatility expected)

Bitcoin: Anticipated Fed rate cuts (Dec 10) + corporate treasury adoption ($7.1B+ holdings) = macro tailwinds, but short-term technical weakness

The Diversification Advantage: Why Baskets Beat Single Assets

1. Asymmetric Risk Management

TAO's -5.01% loss was more than offset by BCH's +10.37% gain. This non-correlated recovery pattern is impossible to achieve with single-asset holdings.

2. Multi-Narrative Exposure

One position captures three distinct crypto themes:

- Peer-to-peer payments (BCH)

- DeFi infrastructure (LTC)

- Decentralized AI (TAO)

3. Performance Without Concentration Risk

BCH's dominance this week could easily reverse next week. The basket approach captures upside without betting the farm on timing one asset correctly.

4. Systematic Rebalancing

No emotional decisions. No FOMO. No panic selling. Just exposure to value transfer protocols with built-in risk management.

5. Downside Protection

When Bitcoin dropped -0.27%, diversified exposure limited losses while maintaining upside optionality.

Technical Outlook: Neutral to Mildly Bullish

The seven-day period reveals three distinct phases:

- Decline (Dec 1-2): Synchronized selling, -8% to -9% drawdowns

- Recovery (Dec 2-4): Value Transfer basket led with +6-7% peaks

- Consolidation (Dec 4-8): Gradual drift with increased divergence

Key Technical Levels:

- Support established: -10% to -12% zone (tested and held)

- Bitcoin resistance: Struggling above $91,500

- BCH momentum: Continuation above $600 critical for basket performance

The data shows no clear directional bias, suggesting defensive positioning. However, Value Transfer's resilience during consolidation indicates relative strength.

The Bottom Line: Why This Matters

This week's performance validates a fundamental investment principle: diversification isn't about eliminating risk—it's about optimizing it.

Bitcoin holders endured a week of sideways pain for -0.27%. Value Transfer strategy holders captured +2.27% by spreading exposure across complementary blockchain ecosystems.

The correlation breakdown between Bitcoin and utility tokens signals a maturing market where narratives matter. As institutional capital flows toward practical blockchain applications (payments, DeFi, AI), concentrated Bitcoin exposure leaves returns on the table.

Optima's Value Transfer ex BTC strategy offers what traditional crypto portfolios can't: balanced exposure to secular trends without binary risk.

The top 1% don't put all their chips on one number. Neither should you.