Privacy Pays: How OPPV Strategy Beat Bitcoin by 14.7% in One Week

TL;DR

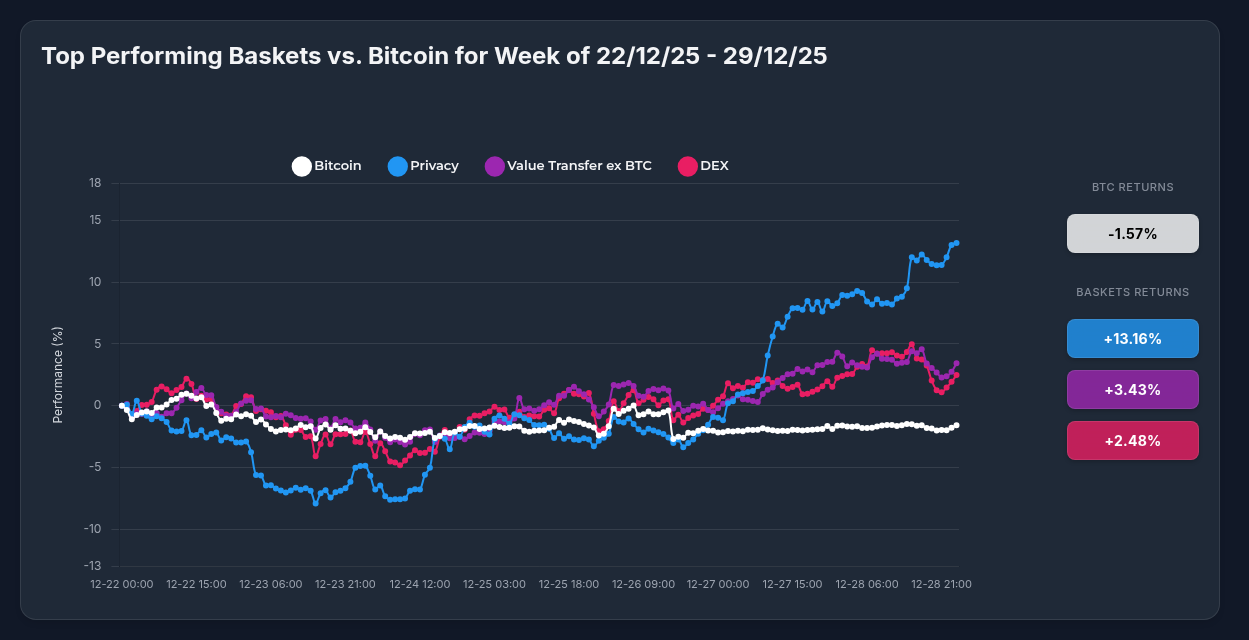

While Bitcoin struggled with -1.57% returns (Dec 22-29), Optima's Privacy Strategy delivered +13.16%, Value Transfer gained +3.43%, and DEX basket returned +2.48%. The standout performer: Canton Network's 44% surge powered the Privacy basket while index diversification cushioned individual token volatility.

The Performance Gap: Strategies vs. Bitcoin

The week of December 22-29, 2025 revealed a stark divergence between Bitcoin and Optima's strategic baskets:

- Privacy Strategy (OPPV): +13.16% - a 14.7% outperformance vs BTC

- Value Transfer ex BTC: +3.43% - a 5% outperformance

- DEX Basket: +2.48% - a 4% outperformance

- Bitcoin: -1.57% - volatile decline to -8% mid-period before recovery

This wasn't marginal outperformance - it was a complete decoupling event demonstrating the power of strategic sector allocation over single-asset exposure.

Main Drivers: Sector Rotation Trumps Market Beta

Privacy Infrastructure Awakening

The Privacy basket's explosive performance was driven by institutional appetite for compliance-friendly privacy solutions. While Bitcoin faced selling pressure and extreme fear (Fear & Greed Index: 16-24), privacy tokens benefited from narrative rotation toward:

- Enterprise-grade DeFi confidentiality (Canton Network: +44.20%)

- Proven privacy protocols gaining technical momentum (Zcash: +19.96%)

- Real-world payment utility (Dash: +10.7%)

Defensive Diversification

All three Optima baskets demonstrated defensive characteristics during Bitcoin's mid-period -8% drawdown. This suggests intelligent allocation reduces correlation during market stress - precisely when investors need protection most.

Momentum Acceleration

The critical decoupling occurred December 26-27, when baskets broke from Bitcoin's trajectory. This wasn't random - it reflected sector-specific catalysts overriding general market sentiment.

Major Catalysts: What Moved the Markets

Bitcoin's Week of Volatility

BTC experienced turbulence despite closing near $89,555:

- Whale redistribution creating selling pressure

- Extreme fear in retail markets

- Consolidation in $85K-$90K range after October's $126K all-time high

- Institutional uncertainty regarding 2026 outlook

Privacy Sector Tailwinds

Canton Network's 65% Swing: From -20% to +45% represented genuine institutional accumulation of enterprise privacy infrastructure. This wasn't retail speculation - it was smart money positioning for regulated DeFi.

Zcash Technical Breakout: Ascending triangle pattern completion with volume confirmation. Traders targeting $600-$767 zones, with social sentiment strongly bullish on privacy as a 2026 theme.

Dash Platform 2.0: Adoption in cross-border payments and emerging markets driving consistent gains.

Broader Market Context

While Bitcoin traded at extreme fear levels, Optima strategies captured rotation into:

- Value transfer protocols benefiting from Layer 1 maturation

- DEX infrastructure amid continued centralized exchange outflows

- Privacy solutions as digital rights awareness grows

The Index Advantage: Why Strategies Beat Individual Holdings

1. You Can't Pick Winners - But You Can Own Them All

Who predicted Canton Network would surge 44% while Monero declined 3.93%? Individual token selection is nearly impossible. The OPPV basket captured Canton's explosive gains while limiting Monero's downside - delivering +13.16% overall despite 40% of components declining.

2. Volatility Dampening Without Upside Sacrifice

Canton's 65% total swing (from -20% to +45%) would destroy most individual holders' conviction. The index approach provided:

- Exposure to the full 44% upside

- Diversification limiting the -20% drawdown impact

- Emotional stability to stay invested through volatility

3. Sector Exposure vs. Token Gambling

Privacy is a thematic investment spanning multiple technical approaches:

- Enterprise infrastructure (Canton)

- Shielded transactions (Zcash)

- Payment privacy (Dash, Monero)

- Cross-chain privacy (Beldex)

Different approaches will dominate different use cases. The index ensures you participate in the entire privacy revolution, not just one implementation.

4. Automatic Risk Management

Compare outcomes:

- Bitcoin holder: -1.57% return

- Individual Monero holder: -3.93% loss

- Individual Canton holder: +44.20% (if you timed entry perfectly and held through -20%)

- OPPV Strategy holder: +13.16% with none of the stress

5. Professional Rebalancing and Active Management

As market dynamics shift, Optima strategies adjust composition to maintain optimal exposure. Individual investors often hold losers too long (loss aversion) or sell winners too early (fear of reversal). Strategic baskets remove these psychological pitfalls.

The Real Question: Can You Afford NOT to Diversify?

This week's performance demonstrates a fundamental truth: concentrated positions feel great when you're right and devastating when you're wrong.

Bitcoin holders experienced volatility without reward (-1.57%). Canton Network holders who bought the exact bottom and held through -20% drawdowns earned 44% - but how many actually did that?

Optima strategy holders simply earned strong returns across all three baskets without requiring perfect timing, steel nerves, or 24/7 market monitoring.

Technical Outlook: Strategies Position for Continued Outperformance

Bullish Factors:

- Privacy narrative gaining institutional traction

- Sustained momentum with volume confirmation

- Bitcoin consolidation creating sector rotation opportunities

- Extreme fear in BTC creating value elsewhere

Risk Monitors:

- Potential mean reversion after Canton's rapid advance

- Regulatory developments in privacy sector

- Bitcoin support levels at $84K-$82K could trigger broader correlation

Conclusion: The 1% Earn With Strategy, Not Luck

This week encapsulates Optima's core mission: making investments easier, allowing everyone to earn like the top 1%.

The top 1% don't gamble on individual tokens. They don't hold Bitcoin through -8% drawdowns hoping for recovery. They deploy capital strategically across opportunities, manage risk through diversification, and capture sector rotations systematically.

That's exactly what OPPV (+13.16%), Value Transfer (+3.43%), and DEX strategies (+2.48%) delivered this week - while Bitcoin holders earned nothing.

The question isn't whether strategic baskets can outperform. This week proved they did. The question is: are you still investing like the 99%, or are you ready to earn like the 1%?

Cryptocurrency investments involve significant risk. Past performance does not guarantee future results. This analysis is for informational purposes and does not constitute financial advice. Always conduct your own research.