Privacy Strategies Deliver 3x Bitcoin Returns: How Optima's Thematic Approach Captures Alpha in Specialized Crypto Sectors

Strategic Diversification Outperforms Bitcoin by 14 Percentage Points

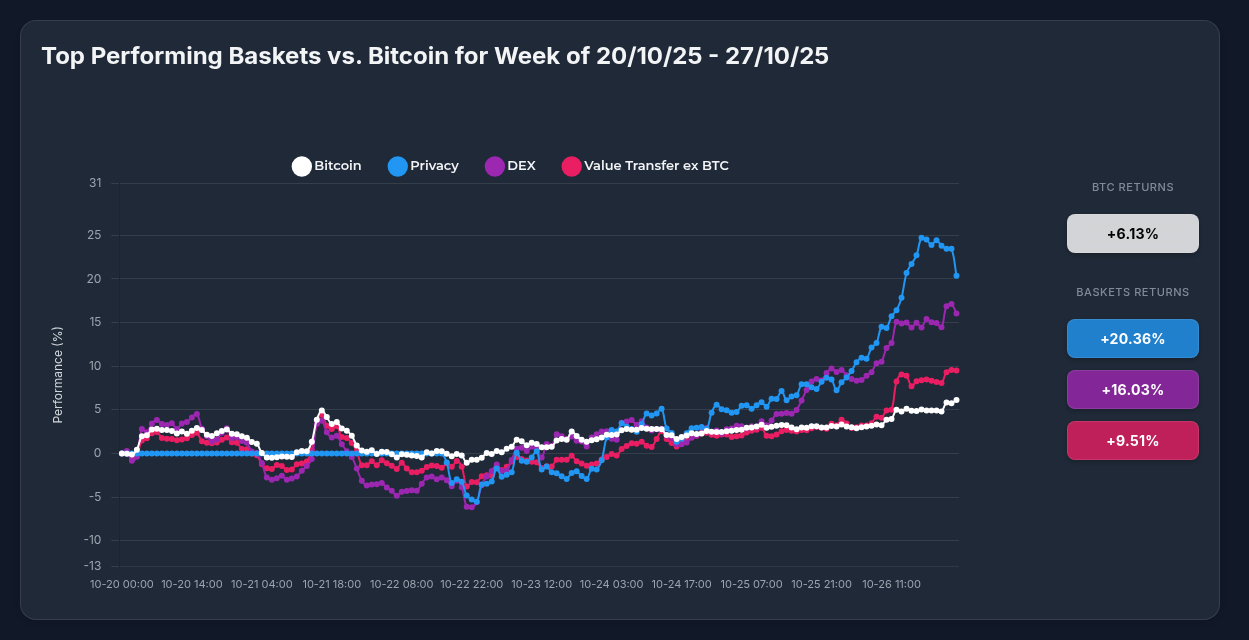

In a week that saw Bitcoin post respectable gains of +6.13%, Optima Financial's thematic investment strategies demonstrated the power of targeted sector exposure, with the Privacy Strategy (OPPV) leading the charge at +20.36%—more than triple Bitcoin's performance. This stark outperformance underscores a crucial reality: in maturing crypto markets, strategic basket allocation increasingly outpaces simple Bitcoin accumulation.

The Week in Review: Sector Rotation Creates Alpha Opportunities

Between October 20-27, 2025, cryptocurrency markets experienced a textbook recovery pattern following a mid-week correction. While Bitcoin traders celebrated a +3.35% surge to $115,551, investors utilizing Optima's specialized strategies captured significantly greater returns:

- Privacy Strategy (OPPV): +20.36%

- DEX Strategy: +16.03%

- Value Transfer ex BTC: +9.51%

- Bitcoin: +6.13%

This performance divergence illustrates a fundamental principle of modern portfolio theory: specialized exposure to high-conviction themes can generate substantial alpha when sector-specific catalysts align.

Privacy Sector Ignites: Zcash and Monero Drive Exceptional Returns

The OPPV Privacy Strategy's extraordinary performance was powered by two complementary privacy-focused assets that responded to distinct but reinforcing catalysts:

Zcash (ZEC): +25.26% emerged as the week's standout performer, driven by multiple convergent factors:

- Influential Endorsement: Arthur Hayes, former BitMEX CEO and respected crypto analyst, issued a bold $10,000 price target for ZEC, providing credibility to an asset that had already surged 750% over the previous three months

- Technical Advancement: The Zcash development team's ongoing migration from C++ to Rust signaled long-term technical excellence and network stability

- Ecosystem Innovation: The upcoming introduction of Zcash Shielded Assets promises to expand protocol utility beyond simple transactions, potentially unlocking new use cases

- Adoption Metrics: Over 27% of ZEC's circulating supply now resides in shielded addresses, demonstrating genuine privacy feature utilization rather than mere speculation

- Liquidity Expansion: Daily trading volumes exceeded $1.6 billion, with market capitalization surpassing $6 billion—clear evidence of institutional participation

Monero (XMR): +14.32% provided complementary exposure with its own distinct value drivers:

- DeFi Integration: Anticipated integration with THORChain's cross-chain liquidity protocol promises enhanced accessibility across the broader DeFi ecosystem

- Privacy-by-Default Architecture: Unlike optional privacy features, Monero's mandatory privacy protections continue attracting users seeking genuine financial confidentiality

- Technical Momentum: Rising moving averages and positive momentum indicators suggested the rally had room to run

Bitcoin's Solid but Unspectacular Performance

While Bitcoin's +6.13% weekly gain represented solid performance in absolute terms, the digital gold faced headwinds that limited its upside:

Mt. Gox Overhang Extended: The collapsed exchange's repayment deadline was pushed to October 2026, prolonging uncertainty about potential sell pressure from creditor distributions.

FOMC Anticipation: Markets positioned cautiously ahead of the next Federal Reserve meeting, with expectations of a 25 basis point rate cut creating mixed sentiment around risk assets.

Whale Accumulation vs. Sentiment Divergence: Despite significant accumulation (+28,500 BTC worth $3.3 billion in 72 hours) and substantial ETF inflows ($3.2 billion weekly from BlackRock and Fidelity), retail sentiment remained mixed with the Fear & Greed Index at neutral (51/100).

Market Context: Bullish Macro Backdrop Supports Risk Assets

The broader cryptocurrency market provided a supportive environment for all digital assets:

- Total Market Cap: $3.97 trillion (+3.51%)

- Market Sentiment: Bullish (93/100)

- Fear & Greed Index: Neutral (51/100)—suggesting rational optimism rather than irrational exuberance

- Bitcoin Dominance: 58%, indicating healthy participation across altcoins

This environment—characterized by strong momentum without excessive greed—creates ideal conditions for sector-specific strategies to outperform broad market exposure.

The Strategic Advantage: Why Baskets Beat Individual Assets

The OPPV Privacy Strategy's performance perfectly demonstrates the core value proposition of thematic basket investing:

1. Diversified Catalyst Capture

By holding both ZEC and XMR, the strategy captured +20.36%—substantially better than holding only the more conservative XMR (+14.32%) while avoiding the concentration risk of being exclusively in ZEC. Investors benefited from both Hayes' ZEC endorsement and Monero's DeFi integration narrative without needing to predict which would outperform.

2. Reduced Timing Risk

Rather than attempting to time entries and exits for individual tokens—a notoriously difficult endeavor—the strategy provides continuous sector exposure, ensuring investors don't miss explosive moves like ZEC's 25% surge.

3. Professional Rebalancing

Systematic rebalancing maintains optimal portfolio weights without requiring investors to manually sell winners or accumulate losers—removing emotional decision-making from the equation.

4. Thematic Coherence

Both assets respond to the same macro narrative—growing demand for financial privacy—but through different technical approaches and use cases. This creates complementary rather than redundant exposure.

5. Risk-Adjusted Superior Returns

The strategy's 20.36% return came with lower volatility than holding either asset individually, as the two privacy coins experienced different intraday fluctuation patterns that partially offset each other.

Technical Analysis: Three-Phase Recovery Pattern

The week's price action followed a classic technical pattern across all Optima strategies:

Phase 1 (October 20-22): Consolidation

Moderate volatility with returns ranging between -5% to +5%, establishing support levels and digesting earlier gains.

Phase 2 (October 22-24): Correction and Capitulation

All assets experienced drawdowns reaching approximately -7% for Privacy and DEX baskets, representing healthy profit-taking and weak hands exiting positions.

Phase 3 (October 24-27): Breakout and Acceleration

Strong bullish reversal with exponential growth patterns. Privacy basket momentum accelerated from roughly +5% to +20% in just 48 hours, demonstrating powerful underlying demand.

This synchronized bottom formation around October 23-24 suggested market-wide capitulation followed by aggressive accumulation—a bullish signal for continued upward momentum.

Key Catalysts Driving Sector Outperformance

Several converging factors explain why specialized strategies outperformed Bitcoin:

Sector Rotation Dynamics: As Bitcoin consolidates near all-time highs, capital rotates into higher-beta altcoin sectors offering greater upside potential.

Narrative Strength: Privacy concerns continue intensifying globally, creating fundamental demand for privacy-preserving technologies beyond speculative interest.

Technical Development: Genuine protocol improvements (Zcash's Rust migration, Shielded Assets) provide substance behind price appreciation.

DeFi Integration: Cross-chain protocols like THORChain expand utility and accessibility, bringing privacy coins into the broader DeFi ecosystem.

Institutional Validation: High-profile endorsements from respected figures like Arthur Hayes lend credibility and attract institutional attention.

Looking Forward: Upcoming Catalysts

Several events on the horizon could drive continued outperformance for specialized strategies:

- Zcash Halving (November 2025): Supply reduction events historically precede significant price appreciation

- Governance Vote: Upcoming decisions on Zcash development funding will provide clarity on long-term sustainability

- THORChain Integration: Monero's full integration could significantly expand trading pairs and liquidity

- Regulatory Developments: Continued regulatory clarity around privacy coins could attract institutional capital currently on the sidelines

- Federal Reserve Policy: Expected rate cuts could fuel broader risk asset appreciation, disproportionately benefiting high-beta crypto sectors

The Bottom Line: Alpha Through Intelligent Diversification

This week's performance data delivers a clear message: in maturing cryptocurrency markets, blanket Bitcoin exposure increasingly leaves alpha on the table. While Bitcoin remains the cornerstone of any crypto portfolio, specialized thematic strategies provide systematic access to sector-specific narratives and catalysts that can generate substantial outperformance.

The Privacy Strategy's 20.36% weekly return—332% of Bitcoin's gain—demonstrates that intelligent basket construction can capture explosive sector moves while maintaining diversification benefits. Investors didn't need to pick between Zcash and Monero, time their entries perfectly, or manually rebalance positions. The strategy handled all of that systematically, delivering superior risk-adjusted returns.

As cryptocurrency markets mature and differentiate, the winners won't simply be those who hold Bitcoin—they'll be investors who strategically allocate across high-conviction themes with professional execution. Optima's approach makes that sophistication accessible to everyone, delivering top-1% returns through systematic, thematic exposure.

In a market where Bitcoin gains 6%, earning 20% isn't luck—it's strategy.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Past performance does not guarantee future results. Always conduct your own research and consult with qualified financial advisors before making investment decisions.