Privacy Strategy Crushes Bitcoin: +13.66% vs +1.24% in Volatile Week

Privacy Strategy Crushes Bitcoin: +13.66% vs +1.24% in Volatile Week

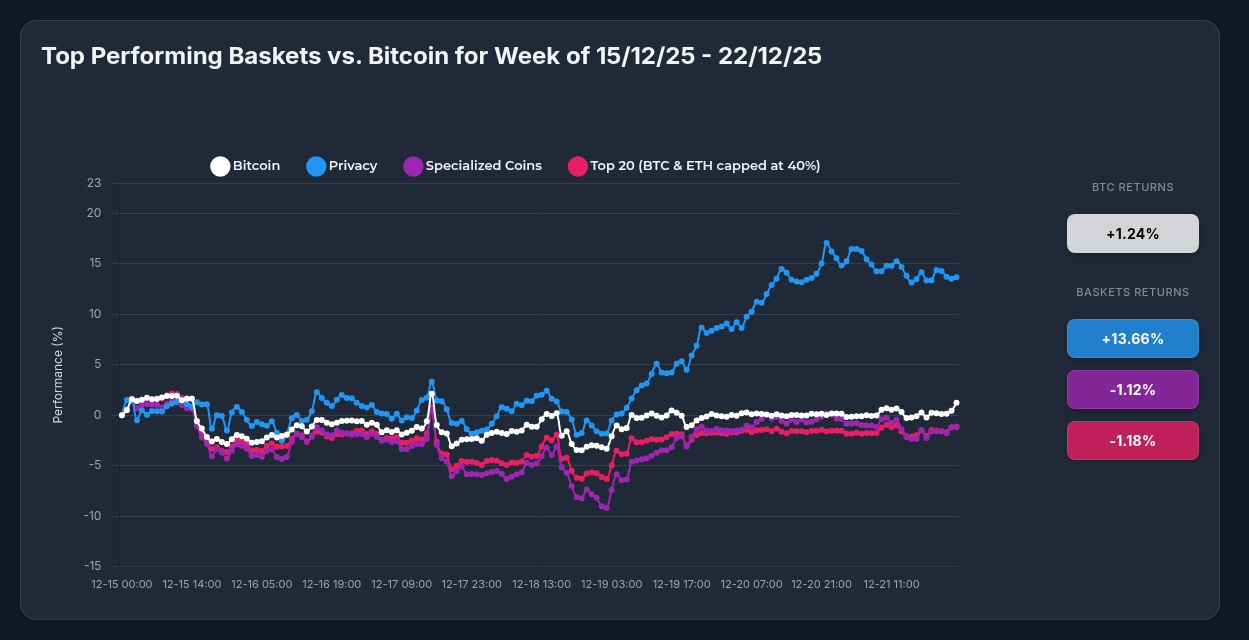

TL;DR: Optima's Privacy (OPPV) strategy delivered +13.66% returns versus Bitcoin's modest +1.24% gain during December 15-22, 2025. While BTC traded sideways in extreme fear, privacy tokens surged on institutional adoption catalysts. The strategy's diversified approach turned individual token volatility (-22.75% to +36.89%) into consistent double-digit outperformance.

Performance Scorecard: Privacy Dominates

| Asset | 7-Day Return | Status |

|---|---|---|

| Optima Privacy Strategy | +13.66% | Winner |

| Bitcoin (BTC) | +1.24% | Sideways |

| Specialized Coins Basket | -1.12% | Underperformer |

| Top 20 Basket | -1.18% | Underperformer |

The Privacy strategy didn't just beat Bitcoin—it delivered 11x the returns while broader crypto baskets slipped into negative territory. This performance gap highlights critical market divergence: while Bitcoin consolidated in a narrow $86,000-$89,000 range amid extreme fear, privacy tokens captured powerful sector-specific catalysts.

What Drove the Divergence?

Bitcoin: Sideways Consolidation in Extreme Fear

- Price Range: Trapped between $86K-$89K with minimal volatility

- Sentiment: Extreme Fear (Fear & Greed Index: 20-25/100)

- Volume: On-chain activity "completely disappeared"

- Catalysts: Waiting for breakout above $90K resistance or breakdown below $85K support

- Market Mood: Year-end consolidation with traders sidelined after $204M in recent liquidations

Privacy Strategy: Explosive Institutional Catalyst

- Canton Network: +36.89% on DTCC partnership to tokenize U.S. Treasuries

- Monero (XMR): +15.05% breaking 8-year resistance as "privacy reprices"

- Zcash (ZEC): +8.92% on institutional accumulation and regulatory-friendly positioning

- Sector Catalyst: Institutional blockchain privacy infrastructure gaining serious traction

- Technical Strength: Sustained upward momentum with superior recovery from mid-period -8% drawdown

The Major Catalysts Behind Privacy's Surge

1. Institutional Validation (Canton Network +36.89%)

The game-changer: DTCC announced plans to tokenize U.S. Treasury securities on Canton Network. This wasn't retail speculation—it was Wall Street choosing privacy-compliant blockchain infrastructure for multi-trillion-dollar assets. Canton Network's price initially spiked 58% before settling at +36.89%, signaling institutional adoption is real, not theoretical.

2. Privacy Repricing Narrative (Monero +15.05%)

Monero broke an 8-year descending channel versus Bitcoin, triggering technical and fundamental reevaluation. Growing concerns about CBDCs, surveillance, and digital identity tracking are driving demand for financial privacy solutions. The market is fundamentally repricing privacy as a premium feature, not a niche use case.

3. Regulatory Clarity (Zcash +8.92%)

Whale activity on Binance Futures ($877K and $864K positions) shows smart money accumulating privacy tokens with compliant frameworks. Zcash balances cryptographic privacy with regulatory pathways—exactly what institutions need.

4. Technology Bifurcation (Dash -6.87%, Starknet -22.75%)

Not all privacy tokens won. Legacy solutions without institutional use cases or competitive technology got brutally punished. The sector is separating innovation leaders from obsolete protocols.

Bitcoin's Struggle: Why the Consolidation?

While privacy tokens rallied on specific catalysts, Bitcoin faced headwinds:

- Macro Uncertainty: Bank of Japan's 30-year high rate hike and Fed policy signals created caution

- Low Participation: On-chain volumes disappeared, signaling sidelined traders

- Technical Limbo: Stuck between $85K support and $90K resistance with no clear catalyst

- Year-End Doldrums: Reduced leverage and wait-and-see positioning typical of holiday periods

- Post-Liquidation Trauma: $204M in recent liquidations left traders gun-shy

Bitcoin's modest +1.24% gain reflects market stability but zero momentum. The technical setup is neutral: bullish above $90K, bearish below $85K, dead money in between.

Strategy vs. Individual Holdings: The Diversification Advantage

Risk Management Through Volatility

Individual privacy token holders faced extreme outcomes: Canton Network investors made +36.89% while Starknet holders lost -22.75%. That's a 60-percentage-point spread. The Privacy strategy absorbed both extremes and delivered smooth +13.66% returns—proving diversification works even in volatile niches.

Capturing Innovation Without Concentration Risk

If you held only Monero and Zcash (the "safe" privacy plays), you'd have missed Canton Network's 36.89% explosion. If you held only Starknet (the "innovative" Layer 2 privacy solution), you'd be down -22.75%. The strategy ensured exposure to the breakout winner while limiting damage from losers.

Automatic Sector Rotation

The privacy token space is bifurcating rapidly:

- Institutional Infrastructure: Canton Network leading with enterprise adoption

- Established Protocols: Monero/Zcash delivering steady gains on repricing narrative

- Legacy Solutions: Dash/Starknet struggling with obsolescence and competition

Index holders benefit from exposure across all three categories without needing to time rotations or pick individual winners. The strategy automatically captures wherever value emerges.

Execution Simplicity vs. Multi-Token Complexity

Managing five privacy tokens across multiple exchanges, each with different liquidity profiles and custody requirements, creates friction and error risk. The OPPV strategy provides single-transaction exposure to the entire privacy thesis with professional rebalancing.

Professional Rebalancing During Extremes

When Canton Network surged 36.89%, individual holders face agonizing decisions: Take profits and miss further upside? Hold and risk reversal? How much to trim? The strategy maintains strategic allocations, capturing gains while preserving diversified exposure to the privacy opportunity set.

Bitcoin vs. Privacy: Different Games, Different Winners

This week perfectly illustrates why diversification across strategies matters:

Bitcoin's Strengths (Not Exhibited This Week):

- Store of value stability during macro uncertainty

- Liquidity and institutional infrastructure maturity

- Broad market leadership when risk appetite returns

Privacy Strategy's Strengths (On Full Display):

- Sector-specific catalyst capture (institutional adoption)

- Narrative momentum (privacy repricing thesis)

- Diversified exposure to innovation while mitigating single-token risk

Bitcoin is the market's foundation—stable, liquid, waiting for macro catalysts. Privacy tokens are the alpha generators—volatile, catalyst-driven, requiring diversification. Holding both provides stability AND opportunity.

Technical Outlook: What's Next?

Privacy Strategy: Cautiously bullish with 20-25% upside potential if Canton Network maintains institutional momentum. Key resistance at 18-20% for the basket. Mid-period drawdown to -8% followed by aggressive recovery demonstrates strong underlying support. Watch for regulatory developments as privacy tokens remain policy-sensitive.

Bitcoin: Neutral-to-slightly-positive. Must break $90K resistance for continuation or defend $85K support to avoid deeper correction. Extreme fear (20/100) historically signals buying opportunities, but low volume suggests waiting for catalyst. Potential scenarios: Bullish above $95K targeting $106K, bearish below $84K retesting $80K.

The Bottom Line

This week proved that portfolio diversification isn't about holding "safe" assets—it's about capturing opportunity wherever it emerges. While Bitcoin consolidated in fear, privacy tokens rallied on institutional catalysts. The Privacy strategy's +13.66% return versus Bitcoin's +1.24% demonstrates the power of sector-specific exposure managed through diversified strategies.

Individual token holders faced binary outcomes ranging from -22.75% to +36.89%. Strategy holders captured the sector's upside while smoothing volatility. That's the Optima difference: making sophisticated investing accessible, turning market complexity into consistent performance.

The takeaway? Don't choose between Bitcoin's stability and sector alpha. Build a portfolio that captures both. That's how you earn like the top 1%.