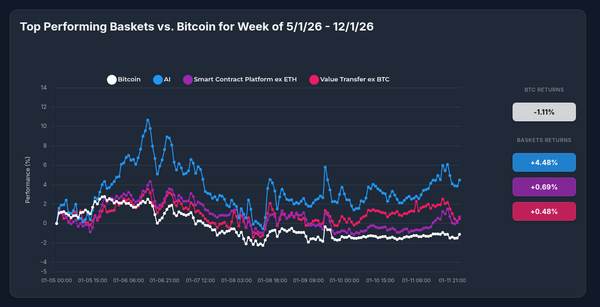

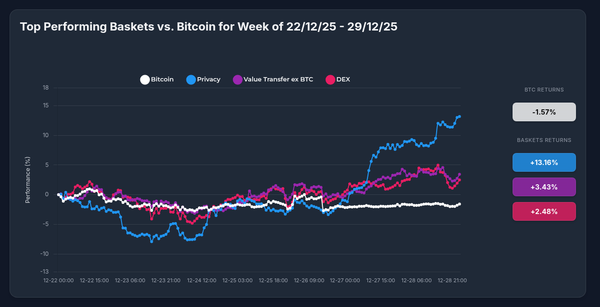

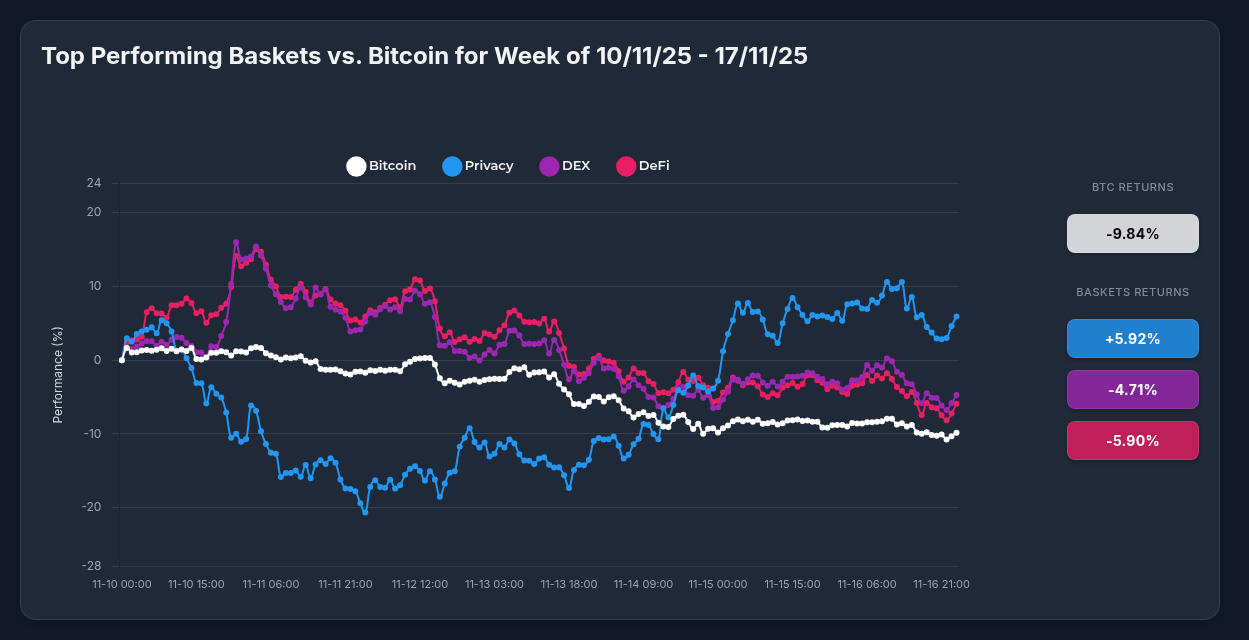

Privacy Strategy Outperforms Bitcoin by 15.76% During Market Correction

TL;DR

While Bitcoin plunged -9.84% during the week of November 10-17, Optima's Privacy Strategy (OPPV) delivered +5.92% returns—a stunning 15.76 percentage point outperformance. The diversified basket structure provided crucial downside protection during volatile conditions, demonstrating why strategic crypto exposure beats individual holdings during market turbulence.

Performance Scorecard: Strategy vs. Bitcoin

| Asset | 7-Day Return | vs. BTC |

|---|---|---|

| Privacy Strategy (OPPV) | +5.92% | +15.76% |

| DEX Strategy | -4.71% | +5.13% |

| DeFi Strategy | -5.90% | +3.94% |

| Bitcoin | -9.84% | — |

Even Optima's underperforming strategies beat Bitcoin during this correction period, showcasing the power of sector-specific diversification.

What Drove the Divergence?

Bitcoin's Perfect Storm

Bitcoin's -9.84% decline from peak levels near $101,521 was driven by multiple headwinds:

- Federal Reserve Uncertainty: Powell's dovish commentary on December rate cuts created volatility

- Extreme Fear: Fear & Greed Index at 22.05—indicating panic selling

- ETF Outflows: $867 million in capital exits signaled institutional profit-taking

- Technical Breakdown: Failed to hold $95,000 support; RSI below 30 (oversold)

Privacy Strategy's Three-Phase Rally

The Privacy basket experienced a dramatic V-shaped recovery through distinct phases:

Phase 1: Initial Consolidation (Nov 10-11)

Stable performance in ±10% range while Bitcoin showed early weakness

Phase 2: Sharp Correction (Nov 11-14)

-35% drawdown as broader crypto markets sold off—tracking Bitcoin's decline

Phase 3: Strong Recovery (Nov 14-17)

+48 point rally to +18%, completely decoupling from Bitcoin's continued weakness

Component Performance:

- Zcash (ZEC): +13.90%

- Privacy Basket: +5.92%

- Monero (XMR): -2.79%

Major Price Catalysts

Zcash: The Performance Leader

ZEC's +13.90% surge was fueled by three powerful catalysts:

1. November 2025 Halving Event

Supply reduction created scarcity narrative, driving institutional accumulation ahead of the event

2. "Zashi" Cross-Chain Upgrade

- 7x increase in shielded transactions

- 30% of total supply locked in privacy pools

- Enhanced cross-chain functionality attracting developer activity

3. Institutional Capital Deployment

- $73 million deployed by Winklevoss Capital and Grayscale

- Arthur Hayes publicly advocating self-custody solutions

- Growing narrative around financial privacy amid surveillance concerns

Monero: Regulatory Headwinds

XMR's -2.79% performance reflected sector-specific challenges:

- Exchange Delistings: 73+ platforms removed privacy coins under MiCA regulations

- Technical Failure: Resistance testing at $417-$425 rejected

- Sector Rotation: Capital flowing from XMR to ZEC's technical innovations

Bitcoin: Macro Pressure

BTC's decline reflected broader market dynamics rather than Bitcoin-specific issues:

- 25% drop from October peak as profit-taking accelerated

- Whale activity increased, suggesting distribution

- Elliott Wave Theory signals potential further correction

- Key resistance at $107,000 remains far overhead

Why Holding the Strategy Beats Individual Assets

1. Downside Protection Through Diversification

While ZEC experienced -30% drawdowns and XMR suffered -2.79% losses, the basket moderated volatility to -27% at the worst point. This psychological and capital preservation benefit is impossible with concentrated individual positions.

2. Capture Upside Without Timing Risk

Investors captured ZEC's explosive +13.90% rally while limiting XMR's drag—all without needing to predict which privacy coin would outperform. Perfect market timing is unnecessary when the basket does the work.

3. Regulatory Risk Distribution

With 73+ exchanges delisting privacy coins, single-asset exposure creates existential liquidity risk. The basket ensures continued trading access if individual assets face restrictions, while maintaining exposure to the privacy narrative.

4. Automatic Rebalancing Alpha

Systematic rebalancing captures mean-reversion profits impossible with static holdings:

- Selling ZEC strength near $734 highs locks in gains

- Accumulating XMR weakness near $386 lows positions for recovery

- Generates additional returns beyond simple buy-and-hold

5. Sector Exposure Without Concentration Risk

The Privacy strategy delivered positive returns during a week when Bitcoin—the industry bellwether—lost nearly 10%. This demonstrates how sector-specific strategies can outperform during market rotations that punish concentrated positions.

Market Outlook: Sector Rotation in Action

The analysis reveals a bifurcated market with clear sector rotation dynamics rather than broad-based crypto weakness:

Privacy Sector: Cautiously Bullish

- Strong fundamental narrative amid surveillance concerns

- Technical warning signs: ZEC RSI 84-94 (severely overbought)

- Key ZEC levels: Resistance $740-$748 / Support $608

- XMR must reclaim $417 resistance for sustained momentum

Bitcoin: Mixed/Consolidation

- Short-term bearish pressure continues

- Long-term bullish fundamentals intact (95% of supply mined)

- Potential support zones: $92,000-$94,000

- Some analysts predict $150K-$200K by year-end (Tom Lee)

DeFi/DEX: Relative Resilience

- Both strategies outperformed Bitcoin despite negative returns

- High correlation suggests market views sectors similarly

- Resilience in decentralized infrastructure tokens notable

The Optima Advantage: Earn Like the Top 1%

This week's performance perfectly demonstrates Optima's core investment thesis:

Sophisticated diversification strategies deliver top-1% returns without requiring individual investors to:

- Master market timing (predict the Nov 14 bottom)

- Conduct technical analysis (identify ZEC's halving catalyst)

- Select winning assets (choose ZEC over XMR)

- Monitor regulatory developments (track exchange delistings)

- Execute rebalancing trades (capture mean-reversion alpha)

While Bitcoin holders endured -9.84% losses and individual ZEC investors suffered -30% drawdowns, Privacy Strategy participants captured +5.92% with reduced volatility—the power of systematic investing over speculation.

Key Takeaways

- Sector rotation is real: Privacy outperformed Bitcoin by 15.76% in a single week

- Diversification works: Even underperforming DeFi/DEX strategies beat BTC

- Basket structure matters: Moderated ZEC's volatility while capturing upside

- Timing is unnecessary: Strategic exposure beats individual asset selection

- Risk management is built-in: Regulatory and liquidity risks distributed across holdings

In volatile markets, the difference between sophisticated strategy deployment and individual asset speculation becomes crystal clear. Optima's Privacy Strategy delivered positive returns during a week when the world's largest cryptocurrency lost nearly 10%—that's the advantage of institutional-grade portfolio construction accessible to everyone.

Disclaimer: Cryptocurrency investments carry significant risk. Past performance does not guarantee future results. This analysis is for informational purposes only and does not constitute investment advice.