Selective Strength: How Solana's 7.33% Surge Drove the Optima Top 5 Index to Positive Returns Amid Market Rotation

Market Analysis

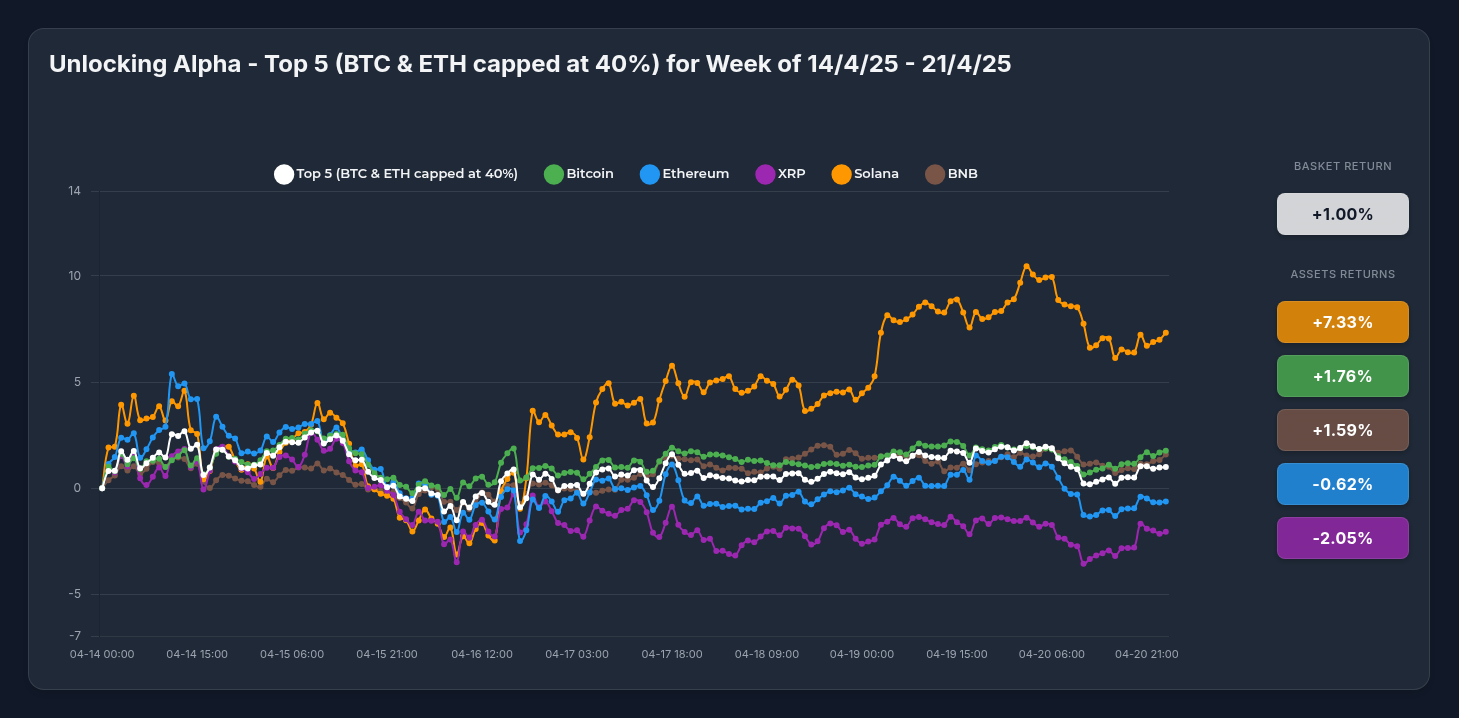

The Optima Top 5 Index concluded the past week (April 14-21, 2025) with a modest positive return of +1.00%, showcasing remarkable resilience amid significant constituent volatility. This performance was achieved despite mixed results from the underlying assets, highlighting the benefits of our diversified approach to crypto investing.

Component Performance

When examining the individual components, we observe a fascinating dynamic of outperformance and underperformance:

- Solana (+7.33%): The clear standout performer, delivering returns over 7x the index average

- Bitcoin (+1.76%): Moderate positive contribution, adding stability given its significant weighting

- BNB (+1.59%): Consistent positive performance, particularly in the latter half of the period

- Ethereum (-0.62%): Slight negative return, notable given its substantial weighting in the index

- XRP (-2.05%): Largest negative contributor, showing weakness throughout most of the period

Main Drivers of Price Development

The index's performance was driven by several key factors:

1. Solana's Exceptional Momentum

Solana's remarkable outperformance indicates increasing investor interest in alternative Layer 1 blockchains. Technical indicators showed a bullish MACD crossover without being overbought, suggesting sustainability in this rally. The growing ecosystem development in DeFi, AI, and staking sectors has fueled this momentum, with many traders actively recommending SOL over ETH based on relative strength indicators.

2. Bitcoin's Institutional Support

Bitcoin's positive contribution was primarily driven by continued institutional interest. Notably, Metaplanet increased its Bitcoin holdings to 4,855 BTC, while MicroStrategy now holds 538,200 BTC valued at $36.47B. This institutional accumulation, combined with Bitcoin's relative strength during stock market weakness, suggests a potential decoupling from traditional markets that has supported its price around the $87K level.

3. BNB's Fundamental Strength

BNB's positive performance was bolstered by its recent quarterly token burn of 1.57 million tokens (valued over $916 million), which reduced supply and enhanced value proposition. Additionally, the $100 million incentive program to support BNB Chain-native tokens and strong ecosystem metrics ($8.148 billion TVL) provided fundamental strength to its price movement.

4. Market Rotation Dynamics

The divergent performance between assets suggests we're experiencing a selective rather than broad market rally. This "stock-picker's market" for cryptocurrencies has benefited the index through its balanced methodology and exposure to the strongest performers.

Major Catalysts Behind Price Movements

1. Regulatory Developments

XRP's performance was influenced by the SEC dropping its appeal against Ripple on March 19, 2025, with a reduced $50 million penalty. While this regulatory clarity should theoretically provide a positive catalyst, the market appears to have already priced in this development, leading to a 'sell the news' dynamic.

2. Technological Advancements

Ethereum's slight negative performance comes despite mentions of potential RISC-V integration and technological transformation. This suggests the market may be rotating from ETH to alternative Layer 1 solutions like Solana, which are perceived to offer faster growth potential in the current cycle.

3. Macroeconomic Factors

Bitcoin's resilience amid stock market volatility points to its maturing profile as a potential store of value with "gold-like appeal." This perception shift has supported BTC while creating divergence with other digital assets.

4. Ecosystem Expansions

Both Solana and BNB benefited from visible ecosystem growth and development activity. Solana's growing traction in DeFi, AI, and staking sectors, combined with BNB's strategic initiatives including the $100 million incentive program, drove investor interest in these assets.

Benefits of Holding the Index vs. Individual Assets

The past week's performance perfectly illustrates the advantages of the Optima Top 5 Index approach:

1. Built-in Risk Diversification

Despite two major components (ETH and XRP) delivering negative returns (-0.62% and -2.05% respectively), the index maintained a positive return of +1.00%. This demonstrates how diversification mitigates the impact of underperforming assets in your portfolio.

2. Reduced Volatility with Enhanced Returns

The index maintained a relatively stable trajectory despite significant constituent volatility. This stability provides peace of mind while still capturing upside potential during periods of selective market strength.

3. Optimized Weighting Methodology

Our proprietary weighting approach, including the 40% cap on BTC and ETH, proved beneficial given Ethereum's negative contribution. This methodology ensured adequate exposure to outperformers like Solana without overconcentration in any single asset.

4. Passive Exposure to High-Performing Assets

Without actively trading or timing market entries, index holders automatically gained exposure to Solana's impressive 7.33% gain while being protected from overexposure to underperforming assets.

5. Elimination of Emotional Decision-Making

Rather than making difficult decisions about which assets to buy, sell, or hold during volatile periods, the index provides a systematic approach that removes emotion from the investment process.

Outlook and Conclusion

The Optima Top 5 Index demonstrates a cautiously bullish posture with significant internal rotation. The divergent performance suggests we're in a selective market environment rather than a broad directional trend. In such conditions, a diversified index approach proves particularly valuable.

Investors should monitor whether Solana's outperformance continues or reverts to mean, and whether Ethereum can reverse its negative trend, as these factors will likely determine the index's near-term direction. However, the beauty of the Optima Top 5 Index is that you don't need to make these predictions yourself – our balanced approach ensures you're positioned to benefit regardless of which assets lead the next leg of the market cycle.

For investors seeking exposure to the digital asset class with reduced volatility and professional management, the Optima Top 5 Index continues to demonstrate its value as an intelligent investment vehicle.