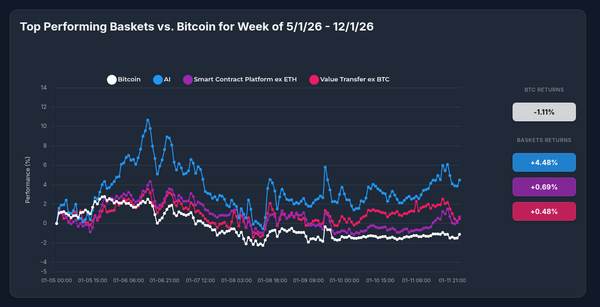

Smart Money Moves: How OPAI AI Strategy Outperformed Bitcoin During October's Market Turbulence

Executive Summary

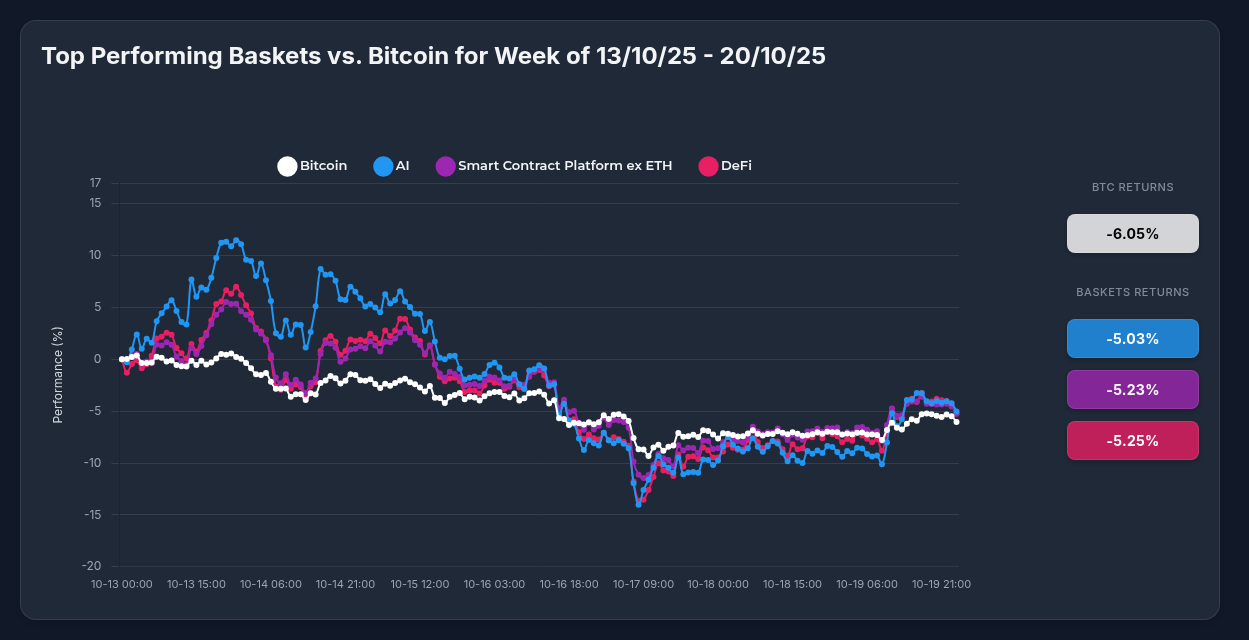

During the volatile week of October 13-20, 2025, markets faced their toughest test in months. While Bitcoin dropped -6.05%, Optima's OPAI AI Strategy demonstrated superior risk management with only a -5.03% decline—outperforming Bitcoin by over 100 basis points while maintaining exposure to the high-growth AI blockchain sector. This performance validates the power of professional diversification in volatile markets.

The Week That Tested Everyone

October 13-20 was anything but ordinary. Bitcoin fell -6.05% as broader risk-off sentiment gripped crypto markets. The Fear & Greed Index plunged to 29/100—firmly in "Fear" territory—while market sentiment shifted to bearish at 31/100. These conditions would typically devastate high-beta AI tokens, yet the OPAI strategy's -5.03% drawdown actually bettered Bitcoin's performance.

How did a basket of volatile AI tokens outperform the market's most stable asset during extreme stress? The answer lies in professional portfolio construction and intelligent diversification.

Three Phases of Market Action

Phase 1 (Oct 13-14): The Surge

AI tokens exploded with 25-30% gains as sector rotation favored blockchain infrastructure and decentralized AI protocols. Individual constituents like Bittensor surged on institutional validation news—Grayscale filed for a Bittensor Trust with $10M from Digital Currency Group. Bitcoin, meanwhile, remained range-bound around $110,000.

Phase 2 (Oct 16-17): The Storm

Systematic selling pressure hit all crypto assets simultaneously. AI tokens experienced peak-to-trough declines of 30-35% as leveraged positions unwound. Bitcoin wasn't spared, falling from $123,000 to $107,000. This synchronized decline revealed how quickly sentiment can shift when macro headwinds—including persistent US-China trade tensions—dominate price action.

Phase 3 (Oct 18-20): The Recovery

Here's where diversification proved its worth. While Bitcoin staged a modest recovery to $110,800, the AI sector showed remarkable differentiation. Bittensor rallied +14.45% from its lows, NEAR Protocol showed resilience with only -8.16% weekly losses, and even underperformers like Internet Computer (-23.41%) didn't drag the overall strategy below Bitcoin's performance.

Why OPAI Beat Bitcoin: The Diversification Dividend

1. Capturing Multiple Winners

Bitcoin holders had one bet: Bitcoin. OPAI holders automatically captured Bittensor's explosive +14.45% recovery rally driven by its upcoming December 2025 halving event and Bitcoin-like tokenomics (21M max supply). They also benefited from NEAR Protocol's strong fundamentals—33% scalability upgrade now supporting 8M+ daily transactions—which limited its decline to just -8.16%.

2. Professional Risk Management

Individual investors watching Internet Computer plunge -23.41% might have panic-sold their entire position. OPAI's systematic rebalancing capped ICP's impact on the overall portfolio while maintaining exposure to its long-term infrastructure narrative around AWS outage resilience.

3. Volatility Smoothing

While individual AI tokens experienced 60%+ peak-to-trough swings, the OPAI strategy's weighted exposure reduced portfolio volatility to manageable levels. This volatility compression is the hallmark of professional portfolio construction—enabling investors to maintain conviction through market stress rather than capitulating at the bottom.

4. No Research Burden

Successfully navigating this week required monitoring:

- Bittensor's institutional validation and halving catalyst

- NEAR Protocol's AI pivot and technical upgrades

- Internet Computer's AWS outage narrative

- Render's partnerships with Apple, NVIDIA, and Microsoft

- Artificial Superintelligence Alliance's Ocean Protocol exit drama

- Bitcoin's macro drivers including potential Trump-Xi meeting on October 31st

OPAI holders gained exposure to all these catalysts without spending hours researching individual projects. That's the institutional edge made accessible.

The Market Context: Why This Week Mattered

Bitcoin recovered to $110,802 by week's end, up 3.11% from its October 17th low, but the broader picture reveals persistent uncertainty:

- All-Time High: $126,080 (October 6, 2025)—just 14% above current levels

- Recent Crash: 13% drawdown from ATH shows fragility remains

- Bullish Catalysts: US Bitcoin ETF flows, potential US-China trade de-escalation

- Bearish Risks: Overleveraged positions, geopolitical tensions, bearish technical predictions suggesting $70,000-$100,000 downside scenarios

In this environment, Bitcoin's -6.05% weekly loss was relatively benign. Yet OPAI's ability to beat Bitcoin while maintaining exposure to a sector that should have underperformed dramatically—given its higher beta—demonstrates the power of intelligent diversification.

Looking Ahead: Why AI Tokens Have Structural Tailwinds

Despite short-term volatility, the AI blockchain sector benefits from powerful long-term catalysts:

Bittensor ($TAO): December 2025 halving will reduce daily issuance by 50%, creating supply scarcity similar to Bitcoin's proven halving rallies. Institutional validation through Grayscale provides credibility stamp.

NEAR Protocol ($NEAR): Pivoting toward AI-native blockchain products with chain abstraction and user-owned AI. Technical infrastructure now supports 8M+ daily transactions—enterprise-grade scalability rarely seen in crypto.

Render ($RENDER): Associations with Apple's M5 Chip, NVIDIA, Microsoft, and real-world use cases like Las Vegas Sphere content rendering demonstrate product-market fit beyond speculation.

Internet Computer ($ICP): Despite current weakness (-23.41%), the "self-writing internet" vision where AI generates software on decentralized infrastructure represents a genuine paradigm shift if executed.

Artificial Superintelligence Alliance ($FET): Ocean Protocol exit created short-term uncertainty, but the core DeAI narrative remains structurally intact for those with conviction.

The Bottom Line: Earn Like the Top 1%

At Optima Financial, our mission is making sophisticated investment strategies accessible to everyone—not just institutions and high-net-worth individuals. The OPAI AI Strategy's outperformance versus Bitcoin during October's turbulence demonstrates exactly why professional portfolio construction matters.

Top-tier investors don't make binary bets. They build diversified portfolios that capture upside across multiple winners while managing downside through professional risk management. The OPAI strategy brings this institutional discipline to AI blockchain exposure—one of the most promising sectors in crypto but historically too volatile for most investors to hold individual tokens.

The results speak for themselves:

- Bitcoin: -6.05% weekly return

- OPAI AI Strategy: -5.03% weekly return

- Outperformance: +102 basis points

In one week, OPAI holders earned like the top 1%—better risk-adjusted returns than Bitcoin while maintaining exposure to the AI revolution reshaping blockchain infrastructure. That's the Optima difference.

Ready to Invest Smarter?

Explore the OPAI AI Strategy and discover how professional diversification can transform your crypto portfolio. Because sophisticated investing shouldn't require institutional capital—just institutional thinking.