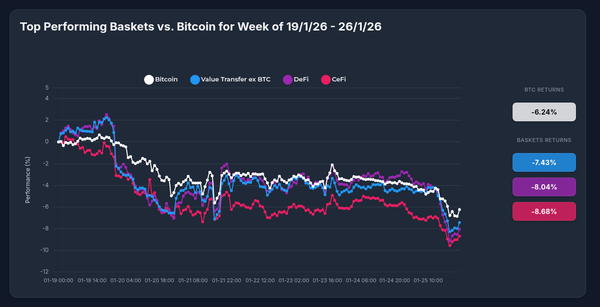

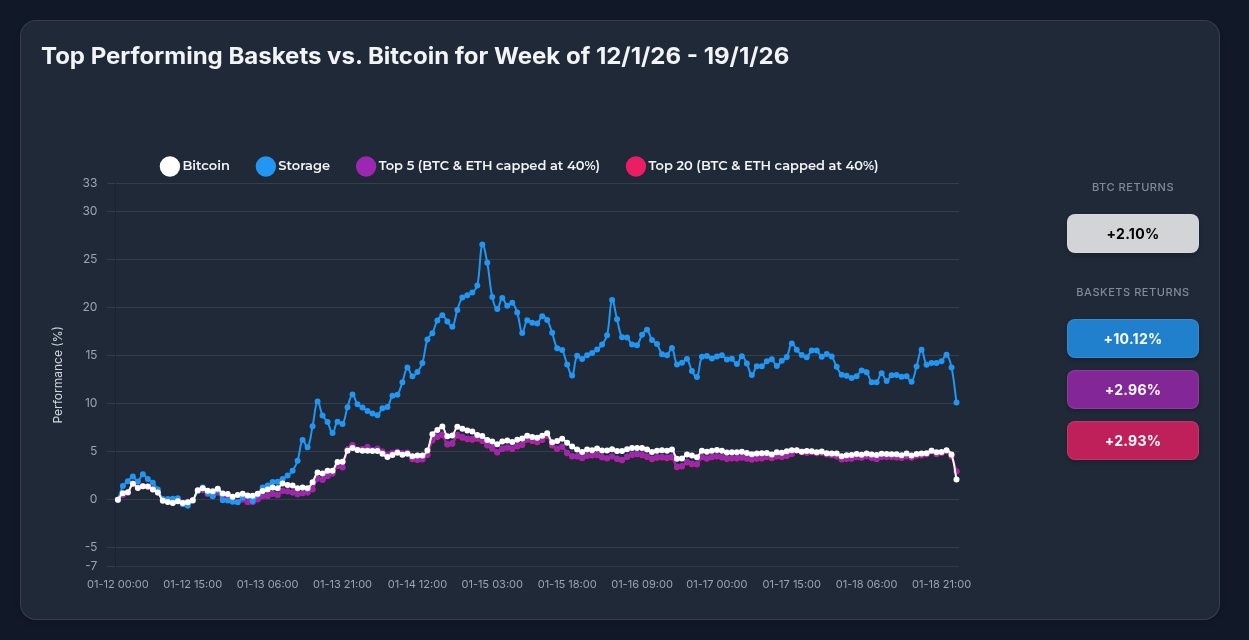

Storage Strategy Crushes Bitcoin: +10.12% vs +2.10% in 7 Days

tl;dr

Optima's Storage Strategy delivered +10.12% in 7 days vs Bitcoin's +2.10%—nearly 5x better performance. Diversified baskets (Top 5/Top 20) returned ~3%, proving strategic asset selection beats single-token exposure. While BTC faces death cross risks and $92k support tests, Optima strategies capture sector momentum with controlled volatility.

Performance Comparison: Strategy vs Bitcoin

The numbers tell a clear story:

- OPSG Storage Strategy: +10.12%

- Top 5 Diversified Basket: +2.96%

- Top 20 Diversified Basket: +2.93%

- Bitcoin: +2.10%

Bitcoin delivered solid gains but faced significant headwinds—dropping 6% from its January 14 peak and struggling with bearish technical indicators. Meanwhile, Optima's Storage Strategy capitalized on explosive sector momentum, particularly Internet Computer's +24.20% surge, while diversified baskets provided steady, risk-adjusted returns with minimal drawdowns.

What's Driving the Divergence?

Bitcoin's Challenges

BTC currently trades around $92,731, caught between conflicting forces:

- Bearish signals: Death cross forming on weekly charts, trading below 365-day MA (~$101k), 150% spike in long-term holder selling

- Bullish support: $1.42B ETF inflows (largest since October), Fed liquidity injection of $55.36B, whale accumulation on Chinese exchanges

- Uncertain outlook: 43% probability of hitting $100k by month-end, but 21% chance of dropping to $85k

Storage Strategy's Catalysts

The Storage basket captured three powerful tailwinds:

- ICP Technological Leadership (+24.20%): World Computer Day anticipation, AI agent integrations (CaffeineAI), decentralized compute expansion drove 49.4% volume surge to $310.5M

- Filecoin Infrastructure Growth (+0.62%): Onchain Cloud mainnet launch, 20+ exbibytes storage capacity, leading 2026 crypto AI development rankings

- Sector Rotation: Capital flowing from generic crypto exposure into specialized decentralized storage infrastructure

Why Baskets Beat Individual Tokens

1. Asymmetric Risk Management

Bitcoin holders experienced binary outcomes: either catch the rally or endure the drawdown. Storage Strategy holders captured ICP's +24.20% surge while BitTorrent's -0.40% decline barely registered—delivering stable +10.12% with controlled volatility.

2. Automatic Winner Capture

No need to predict whether ICP, FIL, or BTT dominates. The basket automatically weights exposure to capture the sector's growth without concentration risk. Individual token holders face timing risks and emotional decision-making.

3. Volatility Smoothing

ICP peaked near +27% before retracing. Individual holders experienced extreme swings. Basket holders enjoyed ICP's upside while FIL's defensive characteristics and systematic rebalancing smoothed the ride.

4. Diversified Catalyst Exposure

Rather than betting on a single protocol, you benefit from:

- ICP's compute infrastructure and AI integration

- FIL's data storage and cross-chain bridges

- BTT's decentralized file sharing and staking yields

5. Consistent Performance Across Strategies

The Top 5 and Top 20 diversified baskets delivered nearly identical returns (+2.96% and +2.93%), demonstrating systematic risk management outperforms individual token selection—even beating Bitcoin with minimal drawdowns.

Market Context: Why Now?

Bitcoin faces a critical inflection point. Trading below its 365-day moving average with five bear market indicators active, BTC requires significant catalysts to break through $100k resistance. Meanwhile, institutional money ($1.42B ETF inflows) signals confidence but hasn't translated to price momentum.

Optima strategies exploit this environment by:

- Capturing sector-specific catalysts (storage infrastructure growth, AI integration)

- Avoiding BTC's macro headwinds (death cross formation, holder capitulation)

- Providing exposure to crypto upside with superior risk-adjusted returns

The Bottom Line

Bitcoin remains the foundational crypto asset, but Optima's strategic baskets demonstrate why diversification and active sector selection matter:

- Storage Strategy: 5x Bitcoin's returns (+10.12% vs +2.10%)

- Diversified Baskets: 40% better than BTC with lower volatility

- Risk Management: All strategies posted positive returns while BTC faces death cross risks

For investors seeking to "earn like the top 1%," the data is clear: systematic exposure to high-conviction sectors with automatic rebalancing beats trying to time Bitcoin's volatile swings.

As Bitcoin consolidates around $92k support with mixed technical signals, Optima strategies continue capturing upside through intelligent asset selection and risk management—making sophisticated investment approaches accessible to everyone.