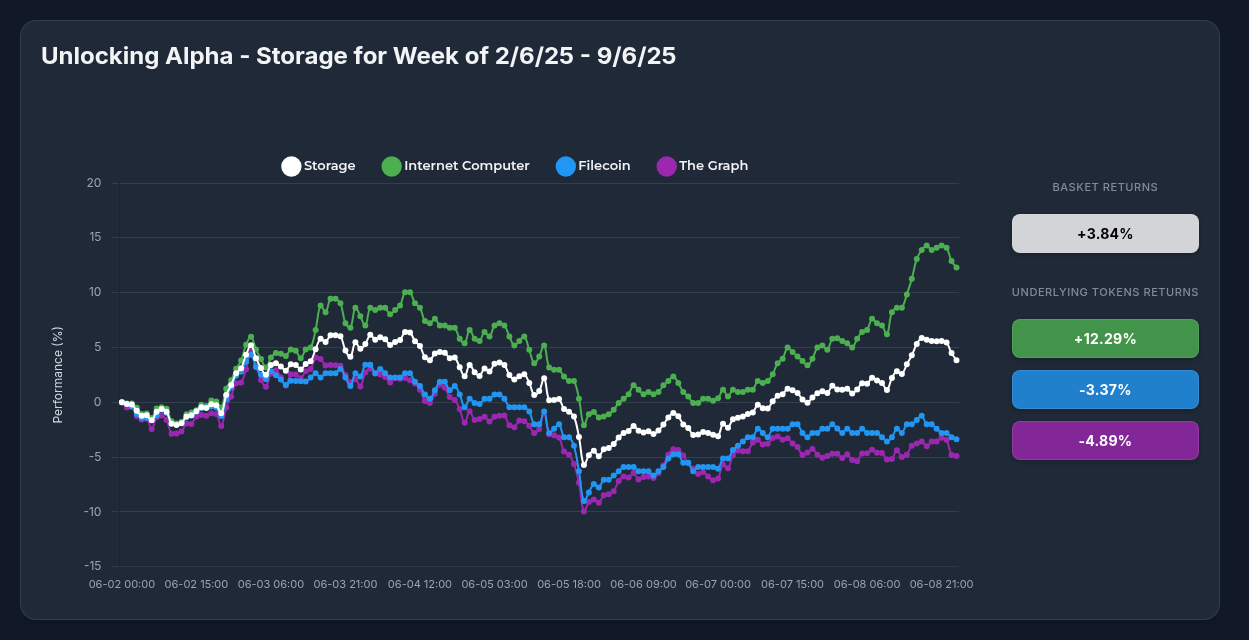

V-Shaped Recovery: How Optima's Storage Strategy Withstood Market Volatility with a 3.84% Gain

In an increasingly data-driven world, decentralized storage solutions continue to demonstrate resilience amid market fluctuations. Optima's Storage Strategy has proven this point over the past week, delivering a positive 3.84% return despite significant market turbulence.

Price Development Analysis: A Tale of Resilience

The OPSG Decentralized Storage Strategy displayed a textbook V-shaped recovery pattern from June 2nd to June 9th, 2025. This performance can be broken down into three distinct phases:

- Initial Consolidation (June 2-3): The strategy moved sideways between -2% to +3%, establishing a base for future movement.

- Mid-Period Correction (June 4-6): A sharp decline reaching a -10% trough tested investor resolve.

- Strong Recovery (June 7-9): A dramatic reversal with sustained upward momentum reaching +14% peak before settling at +3.84% for the week.

This V-shaped recovery demonstrates strong buying interest at lower levels and confidence in the long-term value proposition of decentralized storage solutions.

Key Performance Drivers

The strategy's performance was characterized by significant divergence among its constituent tokens:

Internet Computer (ICP): The Star Performer

With an impressive +12.28% return, ICP was the primary catalyst driving the strategy's positive performance. Several factors contributed to ICP's outperformance:

- The imminent release of CaffeineAI platform in approximately 20 days

- Potential token burn cycles generating buying pressure

- Technical breakout above key resistance levels

- Increased whale accumulation signaling institutional confidence

Storage Token: The Stabilizer

The Storage token provided stability to the portfolio with moderate volatility and a steady recovery pattern, acting as a defensive component during market downturns.

Underperforming Components

Two constituents dragged down overall returns:

- Filecoin (FIL): Despite recent technical infrastructure upgrades and cross-ecosystem collaboration with Ava Labs, FIL delivered a -3.37% return.

- The Graph (GRT): The biggest detractor at -4.89%, GRT failed to meaningfully participate in the late-period recovery despite positive developments in its Token API Beta and Subgraph Studio enhancements.

The Index Advantage: Why Diversification Matters

The past week's performance perfectly illustrates the benefits of holding Optima's Storage Strategy versus individual token investments:

- Risk Mitigation: Despite two components delivering negative returns, the strategy maintained overall profitability thanks to ICP's strong performance.

- Reduced Volatility: While individual tokens experienced dramatic swings (the strategy saw a ~24% peak-to-trough range), the diversified approach smoothed overall performance.

- Sector Exposure: Investors gained balanced exposure to the entire decentralized storage ecosystem without needing to pick winners.

- Simplified Management: The strategy's automatic rebalancing eliminates the need for constant portfolio adjustments.

- Fundamental Strength: Exposure to complementary technologies within the storage sector provides resilience against project-specific setbacks.

Looking Forward

The OPSG strategy presents a moderately bullish technical outlook. The successful navigation through a significant correction demonstrates the resilience of decentralized storage as a sector. With Internet Computer's exceptional performance acting as the primary positive driver, we're seeing selective strength rather than broad-based sector momentum.

For investors seeking exposure to blockchain infrastructure without the volatility of individual token selection, Optima's Storage Strategy continues to demonstrate its value proposition through balanced risk management and sector-wide participation.