Value Transfer ex BTC Outperforms Bitcoin by 7.3% During Market Stress: Why Strategy Beats Solo Holds

Value Transfer ex BTC Outperforms Bitcoin by 7.3% During Market Stress: Why Strategy Beats Solo Holds

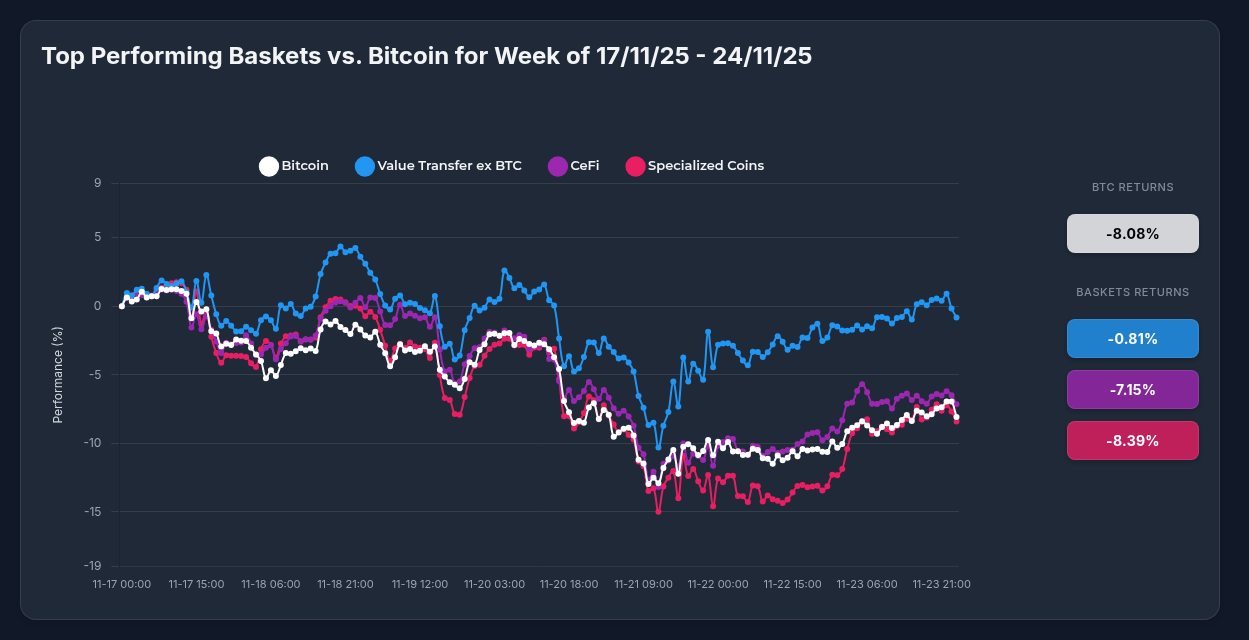

TL;DR: During last week's crypto market selloff, Optima's Value Transfer ex BTC strategy lost only -0.81% while Bitcoin plunged -8.08%—a 7.27-percentage-point outperformance. The secret? Strategic diversification that captured BCH's +11.44% surge while limiting exposure to LTC's -13.70% decline.

The Numbers That Matter

- Value Transfer ex BTC: -0.81%

- Bitcoin: -8.08%

- CeFi Strategy: -7.15%

- Specialized Coins: -8.39%

- Fear & Greed Index: 11/100 (Extreme Fear)

What Drove the Divergence?

Bitcoin's Perfect Storm: BTC tumbled from over $95,500 to around $87,000 amid:

- $903M in spot ETF outflows

- Rising US Treasury yields reducing risk appetite

- Widespread liquidations of leveraged long positions

- MSCI digital-asset warning triggering institutional caution

- Profit-taking by long-term holders at recent highs

Value Transfer Strategy's Resilience: While broader markets capitulated, OPVT's diversified approach captured critical sector rotation:

Star Performer - Bitcoin Cash (+11.44%):

- $500M institutional investment by mF International (4.5% of supply)

- Technical breakout above $520 resistance during market fear

- 2026 protocol upgrade announcements (2-min blocks, smart contracts)

- Exchange supply at lowest levels since mid-2021

Supporting Actor - Pi Network (+6.35%):

- MiCA regulatory compliance achieved

- EU market access confirmed

- Trading launch scheduled November 28, 2025

The Laggards:

- Litecoin: -13.70% (competitive pressure from faster L1s)

- Bittensor: -7.86% (technical profit-taking)

The Critical Insight: When Markets Panic, Diversification Protects

The November 19-21 market stress event revealed a fundamental truth: Bitcoin's status as "digital gold" doesn't prevent severe drawdowns during risk-off episodes. Meanwhile, strategic sector exposure allowed OPVT to benefit from capital rotation within crypto markets.

Traditional crypto investors holding only BTC faced:

- -8.08% losses with no offsetting gains

- Extreme volatility (60% implied volatility)

- Psychological pressure at Fear Index levels of 11/100

- No exposure to sector-specific catalysts

Why Strategy Investing Beats Individual Asset Selection

1. Volatility Dampening

OPVT's -0.81% decline vs individual holdings ranging from +11.44% to -13.70% demonstrates managed exposure. You avoid catastrophic single-asset risk without sacrificing upside capture.

2. Automatic Rebalancing

No manual intervention needed to capture BCH's institutional surge or limit LTC exposure. The strategy adjusts dynamically as market conditions evolve.

3. Sector Exposure Without Prediction

Impossible to predict BCH would outperform BTC by 19.5 percentage points this week. Strategy investing ensures you own the winners automatically.

4. Correlation Breakdown Benefits

During the recovery phase (Nov 22-24), OPVT showed low correlation with Bitcoin—generating alpha while BTC remained depressed at -8% levels.

5. Emotional Discipline

Portfolio-level perspective prevents panic selling during drawdowns. While BTC holders faced capitulation pressure at $87k, OPVT investors experienced minimal portfolio stress.

6. Capital Efficiency

One position provides exposure to:

- Institutional adoption (BCH)

- Regulatory progress (PI)

- Technical infrastructure (TAO)

- Established payment rails (LTC)

Major Catalysts Behind the Movement

Macro Environment:

- Treasury yield pressure reducing crypto risk appetite

- Institutional reallocation from broad crypto to specific narratives

- Post-ETF approval market maturation and consolidation

Sector-Specific Drivers:

- Value transfer tokens gaining institutional traction independent of BTC

- Protocol upgrades creating differentiated value propositions

- Regulatory clarity in key markets (MiCA compliance)

- Supply dynamics (exchange reserves at multi-year lows for BCH)

Technical Outlook: Cautiously Optimistic on Value Transfer

Market Position: Neutral with selective bullish bias toward Value Transfer ex BTC

While overall crypto sentiment remains bearish (Fear Index: 39.45), the divergent performance patterns reveal emerging opportunities:

Key Levels to Watch:

- BTC support: $82,000-87,000 (break below triggers further selling)

- BCH support: $520 (new institutional floor)

- LTC support: $80-85 (critical technical zone)

Risk Factors:

- Broader market capitulation could pressure all assets

- Macroeconomic deterioration may override sector dynamics

- 24-percentage-point spread between OPVT holdings signals sector stress

Opportunity Factors:

- Institutional capital seeking BTC alternatives with less correlation

- Value transfer narrative strengthening amid payments innovation

- Technical setups improving as weak hands shake out

The Bottom Line

This week's performance crystallizes a fundamental investing principle: you don't need to outperform on every asset—you need to outperform on the portfolio.

While Bitcoin investors endured an -8.08% decline with no relief, Value Transfer ex BTC holders:

- Limited losses to -0.81%

- Captured sector rotation benefits

- Avoided emotional decision-making

- Positioned for recovery with diversified catalysts

The 7.27-percentage-point outperformance isn't luck—it's the mathematical result of strategic diversification meeting market reality. When fear grips markets and Bitcoin sells off indiscriminately, having exposure to assets with independent catalysts isn't just smart—it's essential.

This is why Optima exists: to make institutional-grade portfolio construction accessible to everyone, allowing you to earn like the top 1% without needing to predict which individual assets will outperform.

Disclaimer: This analysis is for informational purposes and does not constitute financial advice. Cryptocurrency investments carry significant risk. Past performance does not guarantee future results.