Why Bitcoin ETF Outflows Don't Tell the Liquidity Story - January 2026

Why are Bitcoin ETFs bleeding capital while global liquidity conditions scream expansion?

TL;DR: Bitcoin ETF outflows totaled -$1.14 billion for the week ending January 26, 2026—but that's a liquidity sentiment story, not a liquidity reality story. US bank lending growth accelerated to +4.3% year-over-year (January 14), China injected 910 billion CNY in new loans in December, and the Eurozone hit record corporate lending levels. Crypto follows money supply expansion, and money supply is expanding. The disconnect? Institutional investors are trading narratives, not fundamentals.

The Headline: Bitcoin ETF Exodus

The numbers are stark. For the week of January 20-26, 2026, US spot Bitcoin ETFs recorded cumulative outflows of -$1.137 billion across five trading days, according to Amberdata. BlackRock's IBIT alone shed -$508.7 million. Grayscale's GBTC lost -$289.8 million.

On January 26, a brief reversal brought +$6.84 million in net inflows, snapping a five-day streak. But context matters: this followed weeks of hemorrhaging. Earlier in January, outflows hit -$486.1M (Jan 7), -$708.7M (Jan 21), and -$527.9M (Jan 22). CoinShares reported that through January 23, global digital asset products saw -$1.73 billion in weekly outflows.

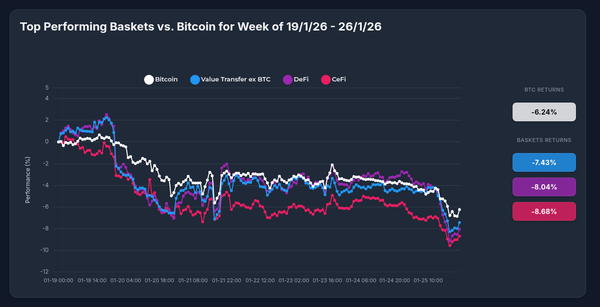

Bitcoin's price reflected the mood, dropping below $90,000 and testing $88,000 support levels. The narrative? Risk-off. Institutional retreat. Crypto winter fears.

But here's what the ETF flow headlines don't tell you.

What Actually Drives Crypto Prices: Liquidity Flows

At Optima Financial, we track one thing above all: where spendable money is being created. Not sentiment. Not Fed speeches. Not ETF marketing campaigns. Money creation.

There are two sources of new dollars, euros, or yuan entering the private sector:

- Government deficit spending: When governments spend more than they tax back, net financial assets flow into private hands.

- Bank credit creation: When banks issue loans, they create new deposit money via accounting entries—not constrained by reserves or deposits.

Central bank asset purchases (QE) or sales (QT)? Those change the composition of private sector assets (bonds vs. reserves), but they don't add spendable money the way deficit spending or bank loans do. This is why QE's impact on crypto has been overstated.

So what happened to these actual liquidity flows in late January 2026?

The Liquidity Reality: Expansion Across Three Continents

United States:

- Bank lending growth accelerated to +4.3% year-over-year for the week ending January 14, 2026—up from 3.7% in December.

- Private sector lending grew +3.6% YoY, driven by business loans (+5.2%, up from 3.9%) following a $5.3 billion weekly increase.

- The first three months of fiscal year 2026 (October-December 2025) produced a $601 billion cumulative deficit—injecting net financial assets into the private sector.

- Major banks reported robust Q4 2025 loan growth: Bank of America +8%, JPMorgan +9%, Wells Fargo +12% in commercial loans.

China:

- Chinese banks extended 910 billion CNY in new yuan loans in December 2025, sharply up from 390 billion in November and exceeding the 800 billion CNY market expectation.

- Full-year 2025 bank loan stock grew +6.2%, outpacing nominal GDP growth of 4%.

- Beijing announced a "more proactive fiscal policy" for 2026, maintaining elevated budget deficits and expanding consumption stimulus programs.

Eurozone:

- Loans to non-financial corporations reached a record €5.296 trillion in November 2025, growing +3.1% year-over-year—the fastest pace since June 2023.

- Total private sector loans stood at €5.282 billion in September 2025, projected to hit €5.36 billion by end-Q1 2026.

- The EU's 2026 budget commits €192.77 billion in appropriations, with targeted allocations for research, infrastructure, and defense.

This is not a contracting liquidity environment. This is coordinated expansion.

The Disconnect: Why Institutions Sold Anyway

So why did institutional investors pull $1.14 billion from Bitcoin ETFs while liquidity conditions improved?

Three factors:

- Narrative lag: Institutions trade stories, not balance sheets. The dominant January narrative was "Fed staying higher for longer" and "deficit concerns." Neither changes the fundamental reality that deficit spending = private sector surplus.

- Regulatory uncertainty front-running: While the GENIUS Act provides a stablecoin framework and market infrastructure bills are expected from Congress, the timing of implementation remains unclear. Institutions hate uncertainty more than they hate risk.

- Profit-taking after 2025 gains: Bitcoin hit an all-time high of $126,080 on October 6, 2025. At $89,041 (January 28, 2026), it's down -29% from that peak. Classic momentum reversal, not a liquidity reversal.

Meanwhile, the actual long-term institutional adoption story accelerated:

- 76% of companies now plan tokenized asset allocations, with some targeting 5%+ of portfolios.

- JPMorgan tokenized deposits and issued JPM Coin on public blockchains.

- Citi enabled 24/7 USD clearing.

- UBS is exploring crypto services for private clients.

Short-term ETF flows and long-term institutional infrastructure buildout are telling opposite stories. We trust the infrastructure.

What This Means for Crypto in 2026

Liquidity drives asset prices over time. Sentiment drives them over weeks.

January's ETF outflows reflect sentiment—specifically, institutions second-guessing crypto exposure as Bitcoin corrected from October highs and regulatory clarity remained incomplete.

But the liquidity fundamentals—government deficits, bank credit expansion, and fiscal stimulus across the US, EU, and China—remain constructive. That's the foundation crypto prices build on over quarters and years, not days.

Three things to watch:

- US bank lending trends: If private sector credit growth sustains above +4% YoY, that's new dollar creation flowing into the economy. Some portion finds its way to crypto.

- China's consumption stimulus execution: Beijing pledged "more proactive" fiscal policy. If that translates to sustained 900B+ CNY monthly loan injections, Chinese retail and institutional interest in digital assets will follow.

- Regulatory implementation timelines: The GENIUS Act and potential market infrastructure bills provide clarity. Once implementation dates are firm, institutional capital that fled in January will return.

The Takeaway

Bitcoin ETF outflows of -$1.14 billion in late January 2026 made headlines. But they don't change the macro picture.

Global liquidity—the actual creation of spendable money through government deficits and bank lending—is expanding. US bank lending growth accelerated to +4.3%. China injected 910 billion CNY in December loans. The Eurozone hit record corporate lending levels.

Crypto doesn't follow ETF marketing sentiment. It follows money supply. And money supply is growing.

Institutions will catch up. They always do—once the narrative catches up to the numbers.

— Optima Financial Chief Economist

January 28, 2026