Why Is Crypto Still Rising Despite Economic Headwinds?

TL;DR

Crypto remains bullish despite mixed signals. Government fiscal flows continue injecting liquidity into markets, while bank credit expansion remains modest but stable. Bitcoin hit new highs above $111K in mid-December before correcting, yet finished 2024 with 100%+ gains. The macro thesis: liquidity drives crypto prices, and liquidity remains positive—though slowing.

Crypto Market Update

- BTC Performance: Reached $111K ATH mid-December, currently trading around $92,736 (down 16% from peak but +100% for 2024)

- Institutional Flows: $4.7B net inflows into spot Bitcoin and Ether ETPs in December

- DEX Activity: Record $433B trading volume in December (up from $380B in November)

- Regulatory Optimism: Pro-crypto Trump administration fueling positive sentiment

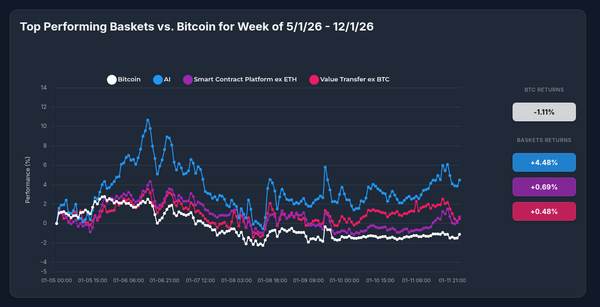

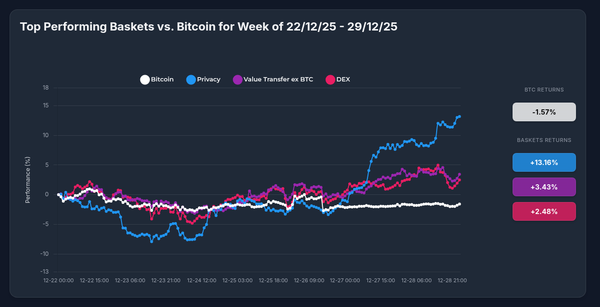

- Altcoin Divergence: Mixed performance - ETH and SOL down 10-21% in December, while TRX (+23%), SUI (+20%) outperformed

The Liquidity Picture

Government Fiscal Flows (Net Money Creation):

- U.S. FY2024 deficit: $1.8 trillion (6.4% of GDP)

- Interest payments surged 34% to $882B—now exceeding Medicare and defense spending

- FY2025 through August: Deficits up 4.32% vs prior year

- Federal spending up 6.07%, revenues up 6.83%

Bank Credit (Private Money Creation):

- U.S. credit card balances grew 2.9% nominal (flat inflation-adjusted)

- Overall consumer credit balances down 0.9% YoY

- Bank loan portfolios growing modestly: +1.6% to +5.5%

- Delinquencies rising to pre-pandemic highs

- Prime lending rate decreased from 7.75% to 7.50% (slight easing)

What This Means For Crypto

The crypto market benefits from two sources of new money: government deficit spending and bank credit creation. While bank credit expansion remains cautious (consumers paying down debt, rising delinquencies), government fiscal flows remain massive. The $1.8T+ annual deficit continues pumping liquidity into the system.

Key insight from recent Twitter discussions: Higher interest rates paradoxically increase liquidity through higher government interest payments to the private sector—now $882B annually. This money flows directly into asset markets, including crypto.

The Big Thesis: Stay Long, But Watch for Shifts

Crypto prices follow liquidity. As long as net fiscal flows (government spending minus taxes) remain positive and bank credit doesn't contract significantly, crypto maintains its upward bias. The recent correction from $111K to ~$93K is normal profit-taking after a 100%+ year.

What Could Change the Trend?

- Significant reduction in government deficit spending

- Major contraction in bank credit (recession signal)

- Sharp increase in taxes without offsetting spending increases

None of these are imminent. Government spending continues growing, and while credit growth is modest, it's not contracting.

Investor Takeaway

The macro environment remains supportive for crypto in early 2025. Government continues spending, institutional money flows into crypto ETPs, and regulatory tailwinds are building. Short-term volatility is expected, but the liquidity thesis suggests continued upward momentum over the medium term.

Not financial advice. This is macro analysis focused on liquidity trends and their historical correlation with crypto asset prices.