Why the OPAI Strategy Beat Bitcoin by 5.6% in 7 Days—And What It Means for AI Investors

TL;DR

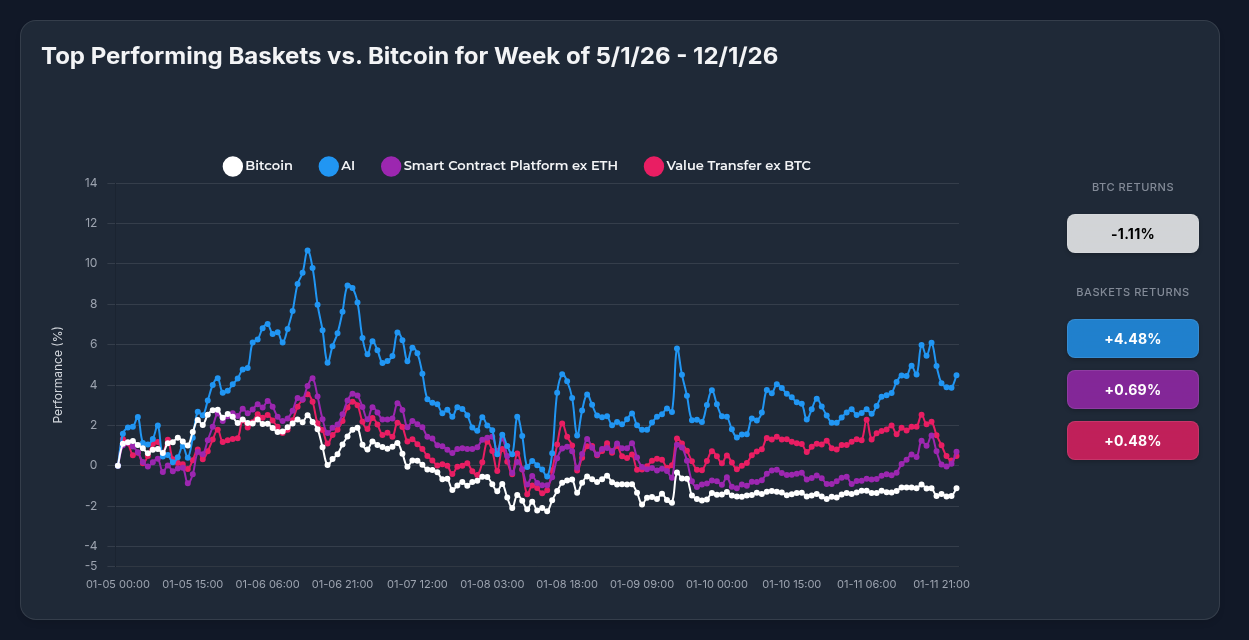

OPAI Strategy: +4.48% | Bitcoin: -1.11% | Outperformance: 5.59%

While Bitcoin struggled with ETF outflows and consolidation below $92k, Optima's AI Strategy delivered strong positive returns through strategic exposure to AI infrastructure tokens. The basket approach captured Render's explosive 30% rally while mitigating losses from underperformers—demonstrating the power of sector-focused diversification over broad market beta.

Performance Snapshot: 7 Days That Tell a Story

From January 5-12, 2026, the divergence between active crypto strategies and Bitcoin was striking:

- OPAI (AI Strategy): +4.48%

- Smart Contract Platform ex ETH: +0.69%

- Value Transfer ex BTC: +0.48%

- Bitcoin: -1.11%

All three Optima baskets outperformed BTC, but the AI Strategy led with a 5.59 percentage point advantage—a significant margin in just one week.

What Drove the Divergence?

Bitcoin's Headwinds

Bitcoin faced multiple challenges during this period:

- ETF Outflows: ~$398M in institutional redemptions signaling short-term risk-off sentiment

- Range-Bound Trading: Consolidating between $88k-$92k with no clear directional catalyst

- Fear Sentiment: Fear & Greed Index at 27-28 ("Fear" territory)

- Macro Uncertainty: Markets awaiting CPI data and $2.25B options expiry

The result: Bitcoin spent the week treading water, down slightly as traders waited for clarity.

OPAI's Tailwinds

Meanwhile, the AI Strategy captured powerful sector-specific momentum:

1. Infrastructure Narrative Dominance

The market rewarded utility-focused AI infrastructure over general crypto exposure:

- Render (+30.34%): Decentralized GPU compute becoming the "Nvidia of crypto"—partnerships with OTOY, Blender, and Polygon driving adoption. A 21% single-day surge on Jan 6 reflected surging institutional interest.

- Bittensor (+7.36%): Expanding subnet ecosystem (128 specialized subnets) and Grayscale's GTAO Trust launch boosting credibility. Technical breakout targeting $300.

- Virtuals Protocol (+15.39%): Community speculation around developments creating high-volatility upside.

2. Diversification Mitigated Downside

While some tokens lagged (Beldex -6.82%, Internet Computer -3.64%), the basket structure absorbed these hits without derailing overall performance. This is the index advantage in action.

3. Sector Rotation Into AI

As global AI adoption accelerates, sophisticated capital is flowing into crypto projects with real-world utility and technological fundamentals—not just broad market beta. The AI sector is differentiating winners based on substance, not speculation.

The Strategic Advantage: Baskets vs. Bitcoin

Why Active Selection Matters

This 7-day period illustrates a critical investment principle: market regimes change. When Bitcoin consolidates or corrects, sector-focused strategies can capture alpha through:

- Narrative Alignment: Riding thematic waves (AI infrastructure) independent of Bitcoin's technicals

- Volatility Harvesting: Higher short-term volatility compensated with superior returns

- Reduced Correlation: Breaking free from Bitcoin's gravitational pull during specific market phases

The OPAI Basket Benefits Over Individual Holdings

1. Emotional Stability

Render surged 30%. Beldex dropped 7%. Individual holders faced gut-wrenching volatility. OPAI holders enjoyed smooth 4.48% gains.

2. Winner Capture Without Guesswork

Which AI token would you have picked? Render? Bittensor? Fetch.ai? The basket captured all the winners simultaneously while diluting losers.

3. Risk Dilution

Token-specific risks—Internet Computer's execution uncertainty, Beldex's regulatory concerns—don't tank your entire position. Diversification protects your AI thesis.

4. Disciplined Rebalancing

No emotional selling of winners or bagholding losers. The strategy maintains optimal exposure automatically.

5. Time Efficiency

Monitor one basket instead of 8+ individual tokens. Comprehensive AI exposure without the research overhead.

Baskets vs. Bitcoin: The Big Picture

Bitcoin remains the foundational crypto asset—but it's increasingly a macro bet on digital gold adoption rather than a technology growth play. During consolidation phases like this week, Bitcoin acts like a store of value awaiting catalysts.

Optima baskets, by contrast, are active technology investments capturing sector-specific innovation cycles. When AI infrastructure is hot, OPAI outperforms. When smart contract platforms rally, that basket leads. This is portfolio construction 2.0.

What's Next?

Bitcoin Outlook: Cautiously Neutral

- Near-Term: Range-bound $88k-$92k until CPI data or options expiry provides direction

- Mid-Term: Potential breakout toward $98k-$100k if institutional flows reverse

- Support: Mid-$80,000s remain critical; breaking below signals deeper correction

- Long-Term 2026 Target: $110k-$150k based on post-halving dynamics

OPAI Outlook: Cautiously Bullish

- Technical Setup: Infrastructure tokens (Render, Bittensor) showing strength with clear resistance levels ahead

- Fundamental Drivers: AI adoption trends, institutional interest (Grayscale GTAO), partnership expansion

- Key Levels: Render resistance $2.70-$3.00; Bittensor targeting $300

- Risk Factors: Elevated volatility requires active monitoring; performance dispersion may continue

The Bottom Line

This week demonstrated that "crypto" is no longer monolithic. Bitcoin's performance increasingly decouples from sector-specific innovation themes. Investors seeking pure exposure to transformative technologies—AI, smart contracts, decentralized infrastructure—need strategies beyond BTC holding.

The OPAI Strategy's 5.59% outperformance wasn't luck. It was:

- Strategic sector selection capturing the AI infrastructure narrative

- Diversification smoothing individual token volatility

- Active management delivering alpha when Bitcoin treaded water

For investors bullish on AI's intersection with crypto but unwilling to pick individual winners, the index approach offers the optimal risk-reward profile—proven again this week.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Past performance does not guarantee future results. Cryptocurrency investments carry significant risk.